ENERGY TRANSITION INVESTMENT $4.5 TLN

IRENA - THE POST-COVID RECOVERY An agenda for resilience, development and equality

EXECUTIVE SUMMARY

The energy sector, always at the centre of the global economy, plays a crucial role amid the coronavirus (COVID-19) crisis. Response measures, including widespread lockdowns, have disrupted production and supply chains, shrunk demand for goods and services, depressed commodity prices and caused a massive economic contraction around the world. Alongside the health crisis, hundreds of millions of people have lost their jobs or seen their livelihoods threatened.

Renewable energy, while suffering along with the whole global economy, has proven to be more resilient than other parts of the sector. With energy demand for transport and industrial uses plunging, fossil fuels have been hit hard. Oil prices have fallen sharply, raising concerns about volatility and long-term viability even as fossil fuels begin to show signs of recovery, at least in the short-term. Meanwhile, electricity systems with high shares of renewables continue to operate effectively.

When incorporated into stimulus and recovery plans, the energy transition can represent a far-sighted investment. The crisis has further unveiled inadequacies of the current system, both in terms of reliance on fossil fuels and massive gaps in energy access, which in turn affect healthcare, water supply, information and communication technologies and other vital services. An investment package focused on the energy transition can help to overcome the economic slump and create much-needed jobs, both for the short-term and beyond.

The International Renewable Energy Agency (IRENA), as the lead intergovernmental organisation for the global energy transition, supports countries in their pursuit of a sustainable energy future. The Global Renewables Outlook released by IRENA in April 2020 provides a comprehensive long-term strategy, which the present report adapts to the current situation and the decade until 2030. Governments have a profound opportunity to set in motion a lasting shift in the global energy mix and allow the world to reap the multiple benefits of a cleaner energy system. Drawing on IRENA's extensive knowledge and expertise on the technological, macroeconomic, and policy aspects of the energy transition, the present report offers decision-making advice at this critical time.

Linking the short-term recovery to medium and long-term strategies is paramount to achieving the Sustainable Development Goals (SDGs) and the Paris Agreement on Climate Change. The catalogue of post-COVID recovery measures outlined here aligns closely with the United Nations-backed 2030 Agenda for Sustainable Development and represents a crucial phase in the timely reduction of CO2 emissions to avert catastrophic climate change. It instigates a fundamental shift in how we produce and consume energy, thereby delivering the long-term global energy transformation.

Policy measures and investments for stimulus and recovery can drive a wider structural shift, fostering national and regional energy transition strategies as a decisive step in building resilient economies and societies. The energy sector must be viewed as an integral part of the broader economy to fully understand the impact of the transition, and ensure it is timely and just.

Energy transition investment can boost the economy over the 2021-23 recovery phase and create a wide range of jobs. Stimulus measures can accelerate positive ongoing tends. In 2019, renewables and other transition-related technologies attracted investments worth USD 824 billion. In the 2021-2023-recovery phase, the analysis conducted in this report shows that such investments should more than double to nearly USD 2 trillion and then continue to grow to an annual average of USD 4.5 trillion in the decade to 2030. Government funds can leverage private investments by a factor of 3-4 and should be used strategically to nudge investment decisions and financing in the right direction.

Institutional investment and green bonds will be vital, along with dedicated credit, investment and funding programmes. For now, the pandemic appears to have sharpened investor interest in sustainable assets. Institutional investors may opt to focus more on renewables in the recovery and beyond. By aligning their investment portfolios to a climate-safe future, investors can also be better prepared to anticipate new regulatory demand and evolving fiduciary standards.

Socio-economic benefits would already accrue in the first three years of recovery programmes, while simultaneously accelerating the energy transition. If the required investment is mobilised and nimble recovery policies are put in place, the transition would boost GDP by 1% more, on average over three years, than current plans.

Each million dollars invested in renewables or energy flexibility would create at least 25 jobs, while each million invested in efficiency would create about 10 jobs. With the added investment stimulus under IRENA’s Transforming Energy Scenario, energy transition-related technologies would add 5.5 million more jobs by 2023 than would be possible under the less ambitious Planned Energy Scenario. Renewables would account for 2.46 million of these additional jobs, energy efficiency for 2.91 million, and grids and energy system flexibility for 0.12 million. These gains far outweigh the loss of 1.07 million jobs in the fossil fuel and nuclear sectors.

The transition would achieve net job gains in all regions of the world, including those where fossil-fuel jobs are now concentrated. This creates meaningful options to switch from fossil-fuel employment and provides new opportunities for both skilled and unskilled workers from other industries. Such benefits hinge on leveraging and enhancing local industrial capacities, strengthening supply chains, putting in place adequate education and training programmes, and adopting suitable labour market policies. Forward-looking industrial policies can create green industries, in both developed and developing countries.

Investments starting now can put renewable power generation on track to grow five times faster than current plans would indicate. Such ramping up requires substantial upfront spending, as well re-evaluating the cost-effectiveness of existing assets.

To start with, retiring the least competitive 500 gigawatts (GW) of coal-fired power capacity and replacing it with utility-scale solar PV and onshore wind could reduce annual system-wide generation costs by USD 23 billion and yield a far larger stimulus, according to IRENA's latest cost analysis.

Recovery measures over the next three years can either trigger a decisive shift toward resilient energy systems or ensure an enduring lock-in with unsustainable practices. A holistic policy approach – rooted in the climate-safe energy development, yet also focused on short-term imperatives – would reap multiple benefits and help set the stage for a just transition.

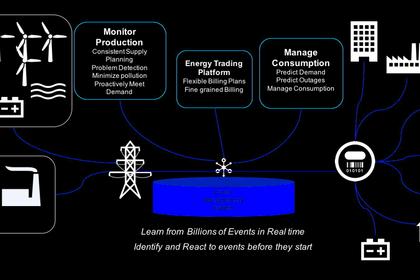

Renewable power projects – including existing utility-scale plants and those under construction, distributed generation investments and renewables-ready network infrastructure – must be safeguarded. Alongside renewable power generation, measures could stimulate supply industries (e.g. battery factories), enabling infrastructure (smart grids, grid reinforcements, EV charging, district heating and cooling, hydrogen), energy efficiency and increased electrification of end uses.

Energy investments undertaken as a short-term response to the pandemic's effects can support increasingly ambitious longer-term targets for renewables and efficiency in all sectors, as well as reinforce enhanced climate pledges. Current Nationally Determined Contributions (NDCs) under the Paris Agreement – as far as they set renewable power targets – lag compared to already-apparent market trends. If renewable power continues growing at the same rates as seen in 2015-18, the cumulative global targets now in place for 2030 could be met as soon as 2022. Market progress and renewable-based recovery aims could be reflected in updated NDCs.

Short-term measures can also drive the energy transition in end uses like heat and transport that account for a large share of total energy demand. The post-COVID stimulus package could encompass renewable-based heating and cooling systems combined with energy efficiency measures in buildings; electromobility based on renewable power sources; and transport fuels based on bioenergy or green hydrogen.

Increased electrification of end-use infrastructure, including via electric vehicle (EV) charging and electrolysis for hydrogen production, is another requirement for a decarbonised energy system.

Investment decisions must go hand-in-hand with policies to ensure that industrial and other economic capabilities are aligned with recovery and transition objectives.

Careful policy attention is needed to ramp up existing manufacturing capacity, building supply chains, and expanding the available pool of skilled labour in parallel with boosting investment.

To foster a just transition, labour and social protection policies must be tailored to the specific needs of each region and country. Labour-market interventions can include employment services (matching jobs with qualified applicants; facilitating on- and off-job training; and providing safety nets), along with relocation grants and other measures to facilitate labour mobility where necessary. Programmes could also support the retention of fossil-fuel workers whose skills can be reoriented for the energy transition. Social equity considerations, in particular gender aspects, must be integrated into policy and programme design, in order to fully tap societal potential and to ensure that no one is left behind.

To ultimately succeed, the Agenda for Resilience, Development and Equality calls for full adherence to the principles of sustainability and human solidarity. Economic stimulus plans should be consistent with the 2030 Agenda on the SDGs, the Paris Agreement on Climate Change, and plans for their implementation such as those outlined in the Addis Ababa Action Agenda on financing for development. Short-term and longer-term opportunities can be sequenced, aiming to cascade investment flows into key areas. Beyond renewables and decarbonisation, investments in the energy system in the wake of the COVID-19 pandemic can pave the way for equitable, inclusive and resilient economies.

-----

Earlier: