FINANCING THE ENERGY TRANSITION $131 TLN

IRENA - June 30, 2021 - World Energy Transitions Outlook

Executive summary

Financing the energy transition

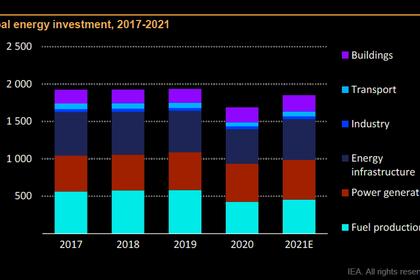

USD 131 trillion will need to flow into an energy system over the period to 2050 that prioritises technology avenues compatible with a 1.5°C Pathway. While the annual funding requirement averaging at USD 4.4 trillion is large, it represents 20% of the Gross Fixed Capital Formation in 2019, equivalent to about 5% of global Gross Domestic Product (GDP). Between now and 2050, over 80% of the USD 131 trillion total must be invested in energy-transition technologies, including efficiency, renewables, end-use electrification, power grids, flexibility, hydrogen, and innovations designed to help emerging and niche solutions become economically viable.

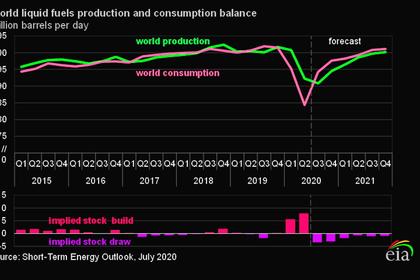

Current government strategies already envisage significant investment in energy amounting to USD 98 trillion by 2050. Collectively referred to in this Outlook as the Planned Energy Scenario (PES), they imply a near doubling of annual energy investment, which in 2019 amounted to USD 2.1 trillion. Substantial funds will flow towards modernisation of ailing infrastructure and meeting growing energy demand. But the breakdown of financing for technology under the 1.5°C Scenario differs greatly from current plans: USD 24 trillion of planned investments will have to be redirected from fossil fuels to energy transition technologies between now and 2050.

Funding structures in the 1.5°C Scenario are markedly different in terms of capital sources (public and private) and types of capital (equity and debt). In 2019, USD 1.6 trillion in energy assets were financed by private sources, accounting for 80% of total energy sector investment. That share would grow dramatically under the 1.5°C Scenario. The share of debt capital has to increase from 44% in 2019 to 57% in 2050, almost 20% more than under the PES (see Figure S.6). Energy transition technologies should find it increasingly easy to obtain affordable longterm debt financing, while “brown” assets will progressively be avoided by private financiers and therefore forced to rely on equity financing from retained earnings and new equity issues. Capitalintensive, more decentralised projects will influence investors’ risk perception, which in turn may need targeted policy and capital market interventions.

Public funding will need to grow almost two-fold to catalyse private finance and ensure just and inclusive unfolding of the energy transition. Public financing plays a crucial role in facilitating the energy transition, as markets alone are not likely to move rapidly enough. In 2019, the public sector provided some USD 450 billion in the form of public equity and lending by development finance institutions. In the 1.5°C Scenario, these investments will grow to some USD 780 billion. Public debt financing will be an important facilitator for other lenders, especially in developing markets with high real or perceived risks. In some instances, this may include grants to reduce the cost of financing. Public funds are also needed to create an enabling environment for the transition and ensure that it occurs fast enough and with optimal socio-economic outcomes.

Measures to eliminate market distortions that favour fossil fuels, coupled with incentives for energy transition solutions, will facilitate the necessary changes in funding structures. This will involve phasing out fossil fuel subsidies and changing fiscal systems to reflect the negative environmental, health and social costs of the fossil fuel-based energy system. Monetary and fiscal policies, including carbon pricing policies, will enhance the competitiveness of transition-related solutions. Such interventions should be accompanied by a careful assessment of the social and equity dimensions to ensure that the situation of low-income populations is not worsened but improved.

Executive summary full version

-----

Earlier: