GLOBAL TRADING SYSTEM UPGRADE

IMF - January 17, 2020 - The Financial Sector in the 2020s: Building a More Inclusive System in the New Decade

By Kristalina Georgieva, Managing Director, IMF

Peterson Institute for International Economics, Washington, D.C.

As prepared for delivery

I. Introduction

Thank you, Adam, for welcoming me today. I am so pleased to deliver my first speech of 2020 at the Peterson Institute.

The year is only two weeks old, but already a series of events have highlighted the shared challenges we face.

In Australia, the brush fires blazing across the country are a reminder of the toll on life climate change exacts.

In the Middle East, conflict and growing tensions have put an entire region on edge.

On trade, an important agreement was announced this week, but much more work is ahead to heal the fractures between the world’s two largest economies. Beyond the US and China, the global trading system is in need of a significant upgrade.

If I had to identify a theme at the outset of the new decade it would be increasing uncertainty.

Uncertainty that geopolitical tensions will ease and peace will prevail. Uncertainty that a trade truce will translate into lasting peace and trade reform. Uncertainty that public policy can address the frustrations and growing unrest in many countries.

We know this uncertainty harms business confidence, investment, and growth.

But this is not the uncertainty millions of people think about every day. They think about the uncertainty of being able to pay a bill at the end of the month. The uncertainty of their families’ future health and well-being. The constant fear of falling behind.

So this morning I would like to focus on one particular driver of uncertainty — inequality —and share with you the results of our new research on the role of the financial sector in this area.

II. Rising Inequality and the Tools to Address it

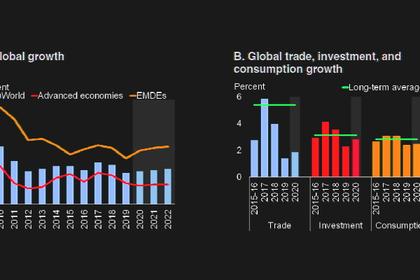

First, the good news. Income inequality between countries has declined sharply over the past two decades — led by the rise of key emerging markets in Asia. While there are certainly regions of concern, it is important to note this is the first decline in global inequality since the Industrial Revolution. [1]

However, the reality is that over the same period, within many countries, inequality has been on the rise. In the United Kingdom, for example, the top 10 percent now control nearly as much wealth as the bottom 50 percent. [2] This situation is mirrored across much of the OECD where income and wealth inequality have reached or are near record highs. [3]

In some ways, this troubling trend is reminiscent of the early part of the 20th century — when the twin forces of technology and integration led to the first Gilded Age, the Roaring Twenties, and, ultimately, financial disaster.

One issue which we did not face in the 1920s but which we face urgently today is climate change. It is often the poor and most vulnerable populations who bear the brunt of this unfolding existential challenge. The World Bank estimates that unless we alter the current climate path an additional 100 million people may be living in extreme poverty by 2030. [4]

So we have to learn the lessons of history while adapting them for our times. We know that excessive inequality hinders growth and hollows out a country’s foundations. It erodes trust within society and institutions. It can fuel populism and political upheaval.

To address inequality, many governments first turn to fiscal policies. These are, and will remain, critical tools.

But too often we overlook the financial sector, which can also have a profound and long-lasting positive or negative effect on inequality.

Our new staff research, launched today, shows how a well-functioning financial sector can create new opportunities for all in the decade ahead. But it also shows how a poorly managed financial sector can amplify inequality.

These findings present both a warning and a call to action.

If we act, and act together, we can avoid repeating the mistakes of the 1920s in the 2020s.

III. Three Dimensions of How the Financial Sector Impacts Inequality

There are three major dimensions to consider when it comes to the financial sector and inequality.

a) Financial Deepening

First, financial deepening — the size of the financial sector relative to a country’s entire economy.

We know that it has a significant effect on a country’s economic performance.

In China and India, for example, sustained financial sector growth throughout the 1990s paved the way for enormous economic gains in the 2000s. This in turn helped in lifting a billion people out of poverty. [5]

But that is not the full story.

Our new research shows there is a point at which financial deepening is associated with exacerbated inequality and less inclusive growth. [6]

Many factors drive inequality — corruption, regressive taxes, intergenerational wealth — but the connection between excessive financial deepening and inequality holds across countries. [7]

Why do we see this reversal in the impact of financial deepening on inequality? Our thinking is that while poorer individuals benefit in the early stages of deepening, over time, the growing size and complexity of the financial sector ends up primarily helping the wealthy.

The negative impact is especially visible where financial sectors are already very deep. Here, complicated financial instruments, influential lobbyists, and excessive compensation in the banking industry can lead to a system that serves itself as much as it serves others.

We do not have to go far for examples. The US has one of the most diversified economies in the world. And yet, in 2006, financial services firms comprised nearly 25 percent of the S&P 500 and generated almost 40 percent of all profits. This made the financial sector the single largest and most profitable sector of the entire S&P. [8]

What happened next — the Great Recession — brings me to the second dimension of how the financial sector impacts inequality: financial stability.

b) Financial Stability

Financial stability, and the economic damage inflicted from financial crises, was a defining issue of the last decade.

We know that on average a financial crisis leads to a permanent output loss of 10%. [9] This can change the entire direction of a country’s future and leave too many behind permanently.

Stability will remain a challenge in the decade ahead. In the 2020s, the financial sector will have to grapple with preventing the traditional type of crisis, and handle newer ones, including climate related shocks. Think of how stranded assets can trigger unexpected loss. Some estimates suggest the potential costs of devaluing these assets range from $4 trillion to $20 trillion. [10]

So we all have a vested interest in focusing our efforts on financial stability.

Our new research shows that inequality tends to increase before a financial crisis, signaling a strong link between inequality and financial stability. [11]

Why does this happen? One reason is that greater inequality can create political pressure for a quick fix that actually makes the problem worse.

Look at the US housing market in the 2000s. A drive to help more Americans own a home led to an overzealous mortgage industry enabled by lax lending regulations. On paper, many low-income individuals became wealthier, but their gains were outpaced by those at the top.

Then the housing bubble burst in 2007. The subsequent Global Financial Crisis (GFC) dealt a devasting blow to millions across the world and over the long-term worsened inequality.

Just one example. Today, as a result of the crisis, 1 in 4 young people in Europe are at-risk of living in poverty. [12]

For them, and many others, the crisis has never ended.

This connection between financial stability and inequality is not limited to the GFC or even the Great Depression. A survey of 17 advanced economies looked at every financial crisis between 1870 through 2013. The results confirm what our research shows: widening income inequality is consistently a strong predictor of a financial crisis and can be a lasting effect after one. [13]

As Mark Twain said, “History does not repeat itself, but it does often rhyme.”

What lessons do our historical rhymes teach us?

One is that financial services are primarily a good thing. Developing economies need more finance to give everyone a chance to succeed. Think of deeper domestic bond markets that finance a new business or investment opportunities that help people save for retirement.

It’s just that too much of a good thing can turn into a bad thing. Excessive financial deepening and financial crisis can fuel inequality.

So, we need to find the right balance between too much and too little.

This brings me to the third dimension of how the financial sector can impact inequality: financial inclusion.

c) Financial Inclusion

Financial inclusion simply means more people and companies having cheaper and easier access to financial services.

Research by IMF staff and others shows a strong association between increasing access to bank accounts and reducing income inequality.

The data also shows that while both men and women gain from inclusion, the largest reduction in income inequality comes when women are given increased access to finance. [14]

Interestingly, the relationship between access to finance and inequality is consistent across nations with different income levels.

For example, in Sweden, a country with one of the most even income distributions, the share of people having a bank account is the same for the rich and the poor.

By contrast, in Indonesia, a country with high income inequality, the richest 20 percent are about twice as likely to have a bank account compared to the poorest 20 percent.

Fintech is playing a major role all over the world by giving people access to banking services and delivering a chance for a better life. [15]

Think of Cambodia where mobile finance helped generate 2 million new borrowers over the past decade, representing nearly 20 percent of the adult population. Many of these borrowers never had a bank account before. [16]

While these changes may not immediately reduce income inequality, they create opportunity — and give people a chance to save, start a small business, and improve educational options for their children.

What does this mean for the broader economy? IMF staff research shows there is a 2-to-3 percentage point GDP growth difference over the long-term between financially inclusive countries and their less inclusive peers. [17]

So, we know that financial inclusion can be an economic game changer. It can help break down the barriers presented by gender, race, geography, and unequal starting positions in life.

…

In each of the dimensions I have raised — from deepening to stability to inclusion — there are trade-offs when it comes to the financial sector and inequality.

We want a financial sector that is robust, but not overly complex. We want financial inclusion to bring new opportunities and credit, but not create heavy debt burdens and put an entire system at risk.

So, what policies do we need to build a more inclusive system in the decade ahead?

IV. Policies to Build a More Inclusive System in the Next Decade – Safer, Stable, Smarter

There are three policy areas to match the three main ways the financial sector impacts inequality.

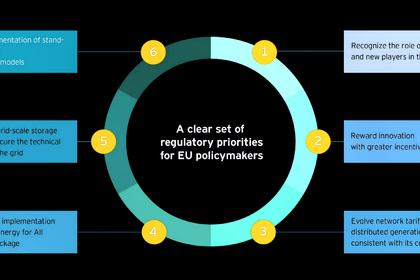

First, a safer system. There is no substitute for high-quality regulation and supervision. Financial deepening is a worthy goal for all economies, but like a city, a financial system should grow sustainably and intentionally.

Positive steps were taken to implement the regulatory reform agenda in the aftermath of the crisis. These efforts demonstrated that in an interconnected global economy strong financial sector reforms require strong international cooperation.

Today, banks have higher capital and liquidity requirements. Winding down troubled banks has become easier. Transparency and accountability have improved.

We are safer, but not safe enough . Rolling back these achievements — as has already begun in some places — would be a profound mistake.

Instead, countries should follow through on the reform agenda and complement it with new efforts. Safe growth of financial markets requires increasing financial literacy, so people fully understand what they are being offered and what it means for their family.

And this brings me to my second point, building a more stable system.

The private sector and banking industry have a critical role to play here.

That is certainly the case when it comes to climate and stability, an area where we will unveil new research in the spring. The financial sector can play a crucial role in moving the world to net zero carbon emissions and reach the targets of the Paris Agreement.

To get there, firms will need to better price climate change impacts in their loans. This is where thinking about the decade ahead as opposed to just the year ahead makes a difference. A longer-term horizon will crystallize the opportunities and risks. Last year climate change claimed its first bankruptcy of an S&P 500 company. [18] It is clear investors are looking for ways to adapt.

Stronger disclosure standards can help financial institutions see the full picture. If the price of a loan for an at-risk project increases, companies may simply decide the money for the project could be better spent elsewhere.

This is not the only area where more information can bring more stability.

Right now, many banks require excessively high levels of collateral for mortgages or business credit.

Not everyone owns a home, nor should they have to in order to start a business.

How can these risk assessments change?

Financial institutions could base more lending decisions on future cash flows. This would return the financial services industry to what it is supposed to be — an industry that serves people.

When banks better assess risk, they will likely increase lending to smaller firms. This is key for stability.

Our research shows that lending to small firms increases financial stability and reduces risk compared to lending to large firms. [19]

When risk is spread across hundreds of companies, instead of a few conglomerates, a more inclusive and healthier economy emerges.

And how can a healthier economy be put to best use?

This brings me to my third and final point,create a smarter system.

Broadening financial access to low-incomes households and small businesses is one of the most effective ways to reduce inequality.

But too much too fast can backfire.

Looking forward, the myriad of new fintech companies offering credit around the world presents a unique challenge. Governments can work with firms to unlock the full potential of fintech, while managing the risks.

That is the goal of the Bali Fintech Agenda launched by the IMF and World Bank in 2018. It provides key principles — including on promoting competition, enhancing consumer protection, and fighting money laundering. These principles can help guide policymakers, reduce risks for banks, and deliver new jobs.

In fact, a World Bank study which looked at 135,000 firms across 140 counties showed that lending to smaller firms is directly connected to improvements in income inequality. [20] That’s because these companies are often hiring people who need work the most.

A good example is M-Pesa. M-Pesa started as a peer-to-peer mobile payment service in Kenya at the beginning of the last decade.

Starting in 2020, the company will become a pan-African financial platform. There are still significant challenges ahead for M-Pesa, but the goal is right: bring millions of unbanked and underbanked online.

Of course, it did not happen overnight. It was the result of years of work by entrepreneurs, government officials, and, most importantly, citizens who were searching for new opportunities. It is a good model to learn from.

V. Conclusion

The last several decades have sent us a clear signal — increasing inequality is a problem that will only get worse if left unaddressed.

While fiscal policy remains a potent tool, we cannot overlook financial sector policies. If we do, we may find that the 2020s are all too similar to the 1920s.

However, if we learn the lessons of history, and adapt them for our time, we can build an even stronger system fit for the future.

So, let me end by borrowing a line from the man who captured the spirit of the 1920s in America better than any other writer, F. Scott Fitzgerald. He once wrote, “Action is character.”

Fitzgerald’s work was famously underappreciated in his own time, and his advice went unheeded.

Let us not make the same mistake twice.

Let us make the year ahead a year of action, and, in turn, the 2020s a decade of prosperity for all.

Thank you very much.

[1] Ana Revenga and Meagan Dooley, “ Is Inequality really on the rise?,” The Brookings Institution, May 28, 2019.

[2] Feargal McGuinness and Daniel Harari, 2019, “ Income Inequality in the UK,” House of Commons Library, Briefing Paper No. 7484.

[3] Carlotta Balestra and Richard Tonkin, “ Inequalities in household wealth across OECD countries: Evidence from the OECD Wealth Distribution Database,” OECD Statistics Working Papers 2018/01.

[4] Jean-Pierre Robin, “ Kristalina Georgieva: Global warming can add 100 million poor people by 2030,” The World Bank, September 14, 2017.

[5] Carolina Sanchez, “ From local to global: China’s role in global poverty reduction and the future of development,” The World Bank, December 7, 2017.

[6] Martin Čihák, Ratna Sahay, in collaboration with others, 2020, “Finance and Inequality,” IMF Staff Discussion Note, SDN/20/01.

[7] Id.

[8] IMF Staff Analysis.

[9] Valerie Cerra and Sweta C. Saxena, “ The Economic Scars of Crises and Recessions,” IMFBlog. March 21, 2018.

[10] Sarah Breeden, “ Avoiding the storm: Climate change and the financial system,” Bank of England, April 15, 2019.

[11] Martin Čihák, Ratna Sahay, in collaboration with others, 2020, “Finance and Inequality,” IMF Staff Discussion Note, SDN/20/01.

[12] Tingyun Chen, Jean-Jacques Hallaert, Alexander Pitt, Haonan Qu, Maximilien Queyranne, Alaina Rhee, Anna Shabunina, Jérôme Vandenbussche, and Irene Yackovlev, 2018, “ Inequality and Poverty Across Generations in the European Union,” IMF Staff Discussion Note, SDN/18/01.

[13] Pascal Paul, 2017, “ Historical Patterns of Inequality and Productivity around Financial Crises,” Federal Reserve Bank of San Francisco Working Paper 2017-23.

[14] Ratna Sahay, Martin Čihák, and other IMF Staff, 2018, “ Women in Finance: A Case for Closing Gaps,” IMF Staff Discussion Note, SDN/18/05.

[15] See Lael Brainard, “ FinTech and the Search for Full Stack Financial Inclusion ,” Board of Governors of the Federal Reserve System, October 17, 2018.

[16] Christine Lagarde, “ Belt and Road Initiative: Two Key Channels to Achieving Financial Connectivity,” International Monetary Fund, April 24, 2019.

[17] Ratna Sahay, Martin Čihák, Papa N’Diaye, Adolfo Barajas, Srobona Mitra, Annette Kyobe, Yen Nian Mooi, and Seyed Reza Yousefi, 2015, “ Financial Inclusion: Can It Meet Multiple Macroeconomic Goals?,” IMF Staff Discussion Note, SDN/15/17.

[18] See Mark Carney, “ A New Horizon,” Bank of England, March 21, 2019. Citing PG&E Corp. example.

[19] Martin Čihák, Ratna Sahay, in collaboration with others, 2020, “Finance and Inequality,” IMF Staff Discussion Note, SDN/20/01.

[20] Id. citing 2018 World Bank Enterprise Survey Data.

-----

Earlier: