OIL MARKET BALANCE

MEOG - May 18, 2020 - As companies across the industry struggle to maintain stability through the coronavirus pandemic, Dr. Sultan Al Jaber, CEO of ADNOC Group and UAE minister of state said that despite the unpredictable future for oil and gas, there are reasons for cautious optimism in oil markets.

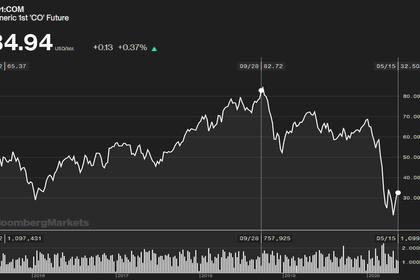

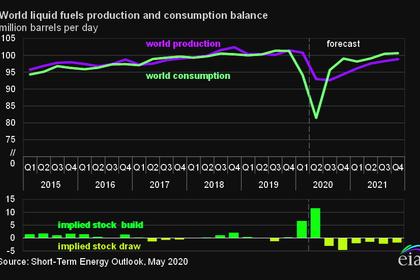

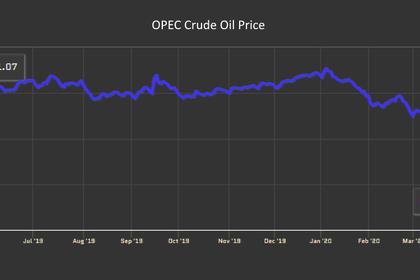

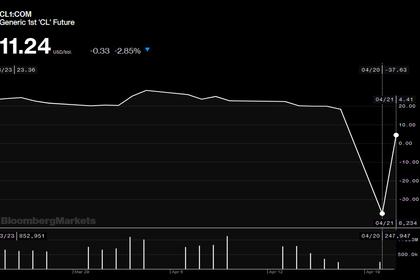

"When it comes to oil, there are signs that the market has tightened in recent weeks. The OPEC+ agreement, voluntary cuts outside OPEC-++, and production shut-ins are working together to start to rebalance the market. This will take time. As economies begin to open up, demand will follow, but the path to the next normal is not a straight line," he said.

In a "Virtual Majlis" with Helima Croft, managing director and global head of commodity strategy at RBC Capital Markets, he noted that companies are learning "something new every day and learning in real time," and noted that connectivity, crisis management, and continuing operations are key to success.

Since he took on his role at ADNOC in 2016, he has been a vocal advocate for industry digitalisation and led the transformation of ADNOC Group. "We are seeing the benefits of the steps we have taken on over the last four years. In fact, this crisis has highlighted just how forward-thinking our leadership's guidance has been in directing this transformation. As a result, ADNOC is now far stronger and better positioned to manage the current market dynamics," he said.

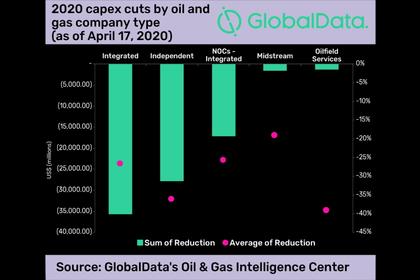

"Through our transformation, we have focused on what we can control and that is our costs. We've been laser-focused on being one of the lowest-cost producers in the world. And this has given us the flexibility and the resilience that we need at times like these. In this environment, we are continuing to work even harder to preserve our resources, and maximize our profitability."

-----

Earlier: