All publications by tag «DEBT»

2019, February, 6, 10:25:00

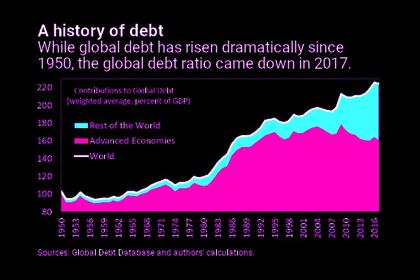

IMF: GLOBAL DEBT

IMF - Global debt has reached an all-time high of $184 trillion in nominal terms, the equivalent of 225 percent of GDP in 2017. On average, the world’s debt now exceeds $86,000 in per capita terms, which is more than 2½ times the average income per-capita.

2018, August, 29, 10:20:00

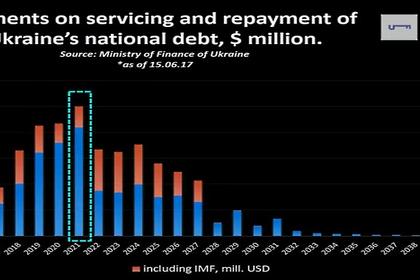

UKRAINE'S DEBT WILL UP

UNIAN - "If we don't pay, this will mean inflation, uncontrolled price rises for everything, depreciation of the national currency, halt of industrial production, and so on... And that's why we are adopting a strategy to manage the debt so as to protect people from any negative consequences as much as possible. We spend UAH 130 billion annually on debt servicing alone," Groysman said.

2018, July, 27, 12:50:00

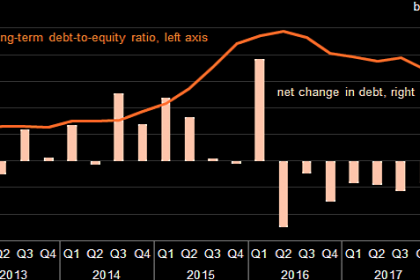

U.S. OIL INVESTMENT UP, DEBT DOWN

EIA - Capital expenditures for these 46 companies totaled almost $19 billion in the first quarter of 2018, a year-over-year increase of nearly $2 billion (10%). Most of these companies have announced that they expect to increase full-year 2018 capital expenditures from 2017 levels.

2018, May, 30, 13:55:00

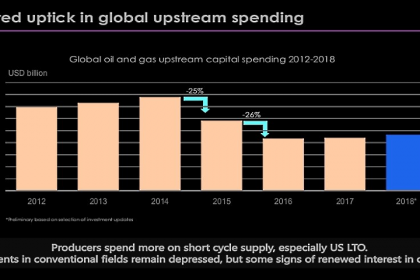

GLOBAL INVESTMENT UP, DEBT DOWN

EIA - Financial Review of the Global Oil and Natural Gas Industry: 2017

- Brent crude oil daily average prices were $54.75 per barrel in 2017—21% higher than 2016 levels

- Excluding proved reserve acquisitions, upstream costs incurred increased from 2016 levels but remained lower than 2008–15 levels

- Proved reserves additions in 2017 approached the highest levels in the 2008–17 period

- Finding plus lifting costs fell to $29 dollars per barrel of oil equivalent in 2017, the lowest level in the 2008–17 period

- The energy companies reduced debt in 2017, the first year in the 2008–17 period

- Refiners with global refining assets reduced distillation capacity for the eighth consecutive year

2016, August, 24, 18:55:00

MAJORS DEBT'S RECORD

Exxon Mobil Corp.Royal Dutch Shell PLC, BP PLC and Chevron Corp. hold a combined net debt of $184 billion -- more than double their debt levels in 2014, when oil prices began a steep descent that eventually bottomed out at $27 a barrel earlier this year. Crude prices have rebounded since, but still hover near $50 a barrel.

2016, August, 5, 18:35:00

MAJORS DEBT: $138 BLN

Debt levels are currently rising at an annual rate of 11.5 percent, more than double the 5.1 percent witnessed between 2009 and 2014.

2016, May, 30, 18:10:00

MAJORS DEBT UP TO $383 BLN

The aggregate net debt of the 15 largest North American and European oil groups rose to $383bn at the end of March, up $97bn from 12 months ago.

2016, May, 19, 20:50:00

U.S. ENERGY DEBT: $370 BLN

"[Oil’s recent rise] is not enough," said Dicker. "You can’t find the financing to keep the lights on at $50 oil. Most of these guys won’t be able to keep the lights on at $65 or $70 oil."

2016, January, 10, 17:55:00

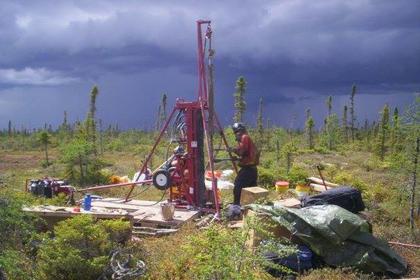

OIL SERVICE'S CAP

Even if E&P clients are able to negotiate more favorable terms for their debt, the industry’s overextended balance sheets will put a cap on activity — even if oil prices rise. On the producer side, companies will most likely de-lever before they drill should some extra cash come in the door. For OFS, building all the new equipment such as walking rigs and big frac spreads to meet strong client demand has some players in this sector significantly over-levered.

2015, July, 13, 19:30:00

US DEBT: THE GREATEST

“It’s a serious problem not just for the United States but for the whole world economy. Debt exceeds gross domestic product there.”