Analysis

2024, April, 26, 07:00:00

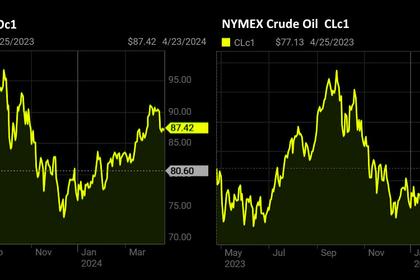

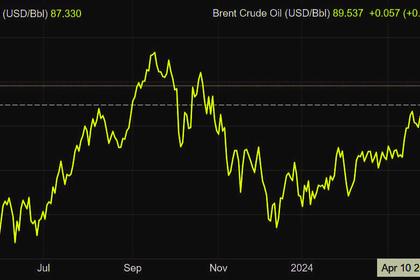

OIL PRICE: BRENT ABOVE $89, WTI ABOVE $83

Brent gained 31 cents, or 0.4%, to $89.32 a barrel, WTI rose by 23 cents, or 0.3%, to $83.80 a barrel.

2024, April, 26, 06:40:00

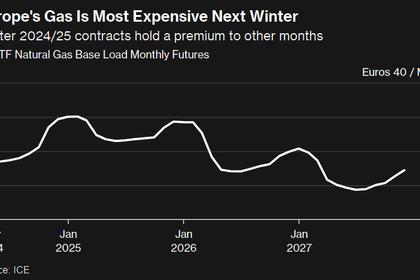

EUROPEAN ENERGY UNCERTAINTY

Worries include uncertainty over remaining Russian flows through Ukraine and rebounding gas demand in Asia. A colder-than-normal winter spurring consumption at home is also seen as more likely after two consecutive mild ones.

2024, April, 26, 06:35:00

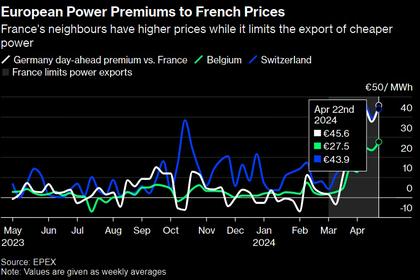

EUROPEAN ELECTRICITY PRICES UP

The capacity for transmitting electricity to Belgium, Germany, Switzerland and Italy has been reduced since early March, according to French power-grid operator RTE. That’s depriving those nations of exports of cheaper French nuclear power and boosting wholesale prices across the region.

2024, April, 26, 06:30:00

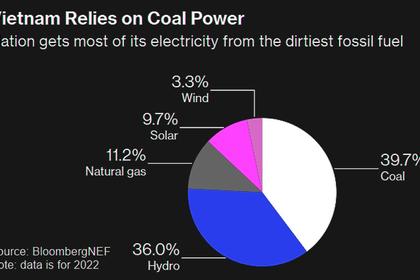

VIETNAM NEED COAL

Vietnam, which gets most of its power from coal, is rushing to avoid a repeat of last year, when a shortage of the mineral, blistering hot weather and drought forced it to cut electricity to northern industrial parks that house many multinational companies.

2024, April, 23, 07:00:00

OIL PRICE: BRENT ABOVE $87, WTI ABOVE $82

Brent traded 27 cents higher at $87.27 a barrel, WTI gained 26 cents to $82.16 a barrel.

2024, April, 23, 06:35:00

FINANCIAL STRATEGIES: STAYING RESILIENT IN RECESSIONARY TIMES

In times of economic downturn, it's imperative to equip yourself with the right financial strategies to not just survive, but thrive. By implementing smart financial practices, you can position yourself to weather the storm and emerge stronger than ever. Let's explore key tactics to navigate through a recession and ensure financial stability.

2024, April, 17, 07:00:00

OIL PRICE: BRENT ABOVE $89, WTI ABOVE $84

Brent slipped 56 cents, or 0.62%, to $89.46 a barrel, WTI fell 63 cents, or 0.74%, to $84.73 a barrel.

2024, April, 17, 06:55:00

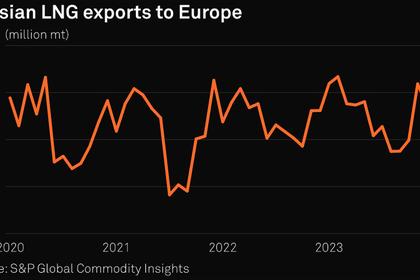

EUROPE NEED RUSSIAN LNG

"If Europe is still importing LNG from Russia, it is because there is a need," a France-based gas trader said. "With our other main suppliers, such as Norway, operating at maximum capacity, it will be hard to completely stop the flow of Russian LNG. We are still not completely out of the crisis."

2024, April, 17, 06:50:00

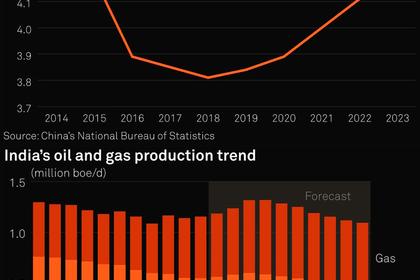

CHINA, INDIA OIL & GAS PRODUCTION UP

India's overall oil and gas output rose 1.3% on the year to 1.15 million boe/d in 2023. China's upstream story sounds relatively more promising at this stage.

2024, April, 17, 06:40:00

POSSIBILITIES FOR GRID INVESTMENT

As solar and storage costs continue to decrease, at what point will having stand-alone power for customers of all types be a reality? What about microgrids that can use fuel cells and emerging green or even blue hydrogen technologies.

2024, April, 17, 06:35:00

ENERGY TECHNOLOGIES & CONSUMERS

Factors in the Energy Utility Grid’s growth involve two facets of the Energy Industry, technology and energy consumer populations. Technology developments successfully applied to the Energy Utility Grid to expand efficiency, reliability, and stability include AI, SMART Grid platforms, and DERs.

2024, April, 12, 07:00:00

OIL PRICE: BRENT ABOVE $90, WTI ABOVE $85

Brent climbed 51 cents, or 0.57%, to $90.25 a barrel, WTI rose 61 cents, or 0.72%, to $85.63.

2024, April, 12, 06:50:00

RUSSIAN OIL PRICE ABOVE $80

While Urals has been above $60 almost all year, this month’s surge to well above $70 will stretch the credibility of those attestations for traders wanting to keep using western services.

2024, April, 12, 06:45:00

OIL PRICE COULD BE $100

Last week, OPEC+ said it would maintain its voluntary cuts until July. The cartel is expected to decide on its continued production cuts beyond then at its next full ministerial meeting scheduled for June 1.

2024, April, 12, 06:40:00

WTI OIL PRICE ABOVE $86

#WTICrude OilPrice holds a two day declines and trades on high $84s/bbl price print after the API Report publications for the week stated that US oil stocks added 3.03m barrels last week, subtotalling towards the 3rd consecutive weekly addition prior to the EIA Report.