Analysis

2023, May, 19, 06:20:00

ФНБ РОССИИ $154,96 МЛРД.

По состоянию на 1 мая 2023 г. объем ФНБ составил 12 475 588,3 млн рублей, что эквивалентно 154 958,3 млн долл. США.

2023, May, 5, 18:25:00

ЦЕНА URALS: $51.05

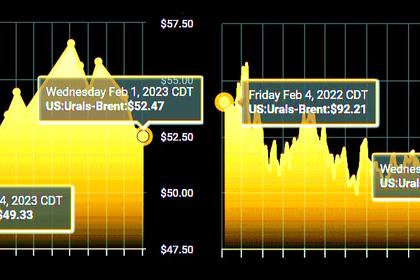

Средняя цена на нефть марки Urals в январе-апреле 2023 года сложилась в размере $51,05 за баррель, в январе-апреле 2022 года – $84,68 за баррель.

2023, May, 5, 18:10:00

ДОХОДЫ РОССИИ МИНУС 8,1 МЛРД. РУБ.

Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета прогнозируется в мае 2023 года в размере -8,1 млрд руб.

2023, April, 14, 07:10:00

ДОХОДЫ РОССИИ МИНУС 113,6 МЛРД. РУБ.

Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета прогнозируется в апреле 2023 года в размере -113,6 млрд руб.

2023, April, 14, 07:05:00

ФНБ РОССИИ $154,45 МЛРД.

По состоянию на 1 февраля 2023 г. объем ФНБ составил 11 906 061,4 млн рублей , что эквивалентно 154 451,1 млн долл. США.

2023, April, 7, 07:20:00

ЦЕНА URALS: $48.92

Средняя цена на нефть марки Urals в январе-марте 2023 года сложилась в размере $48,92 за баррель, в январе-марте 2022 года — $88,95 за баррель.

2023, March, 24, 07:10:00

ЗАПАСЫ ГАЗПРОМА ВЫРОСЛИ

Прирост запасов природного газа в ходе геологоразведки в 2022 году составил 529,2 млрд куб. м. Таким образом, уже восемнадцатый год подряд прирост запасов превышает объемы добычи (в 2022 году она составила 412,6 млрд куб. м газа).

2023, March, 15, 07:15:00

РОССИЯ - ОТВЕТСТВЕННЫЙ ПОСТАВЩИК ЭНЕРГОРЕСУРСОВ

Энергетический сектор по-прежнему сталкивается с новыми вызовами, и нынешняя геополитическая ситуация негативно сказывается на мировых энергетических рынках.

2023, March, 3, 12:15:00

ЦЕНА URALS: $49.52

Средняя цена на нефть марки Urals в январе-феврале 2023 года сложилась в размере $49,52 за баррель, в январе-феврале 2022 года – $88,89 за баррель.

2023, February, 17, 11:00:00

ЦЕНА URALS: $50.51

Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2023 года составила $50,51 за баррель, или $368,7 за тонну.

2023, February, 8, 12:25:00

ФНБ РОССИИ $155,3 МЛРД.

По состоянию на 1 февраля 2023 г. объем ФНБ составил 10 807 595,0 млн рублей , что эквивалентно 155 297,8 млн долл. США.

2023, February, 6, 12:50:00

ДОХОДЫ РОССИИ МИНУС 108,0 МЛРД. РУБ.

Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета прогнозируется в феврале 2023 года в размере -108,0 млрд руб.

2023, February, 3, 11:50:00

ОПЕК+: МИНУС 2 МБД

Делегаты встречи подтвердили свою приверженность плану сокращения добычи нефти на 2 млн баррелей в сутки, согласованному по итогам заседания 5 октября 2022 года.

2023, February, 3, 11:25:00

ЦЕНА URALS: $49.48

Средняя цена на нефть марки Urals в январе 2023 года сложилась в размере $49,48 за баррель, что в 1,7 раз ниже, чем в январе 2022 года ($85,64 за баррель).

2023, January, 20, 10:50:00

ФНБ РОССИИ $148,4 МЛРД.

По состоянию на 1 января 2023 г. объем ФНБ составил 10 434 580,8 млн рублей, что эквивалентно 148 350,2 млн долл. США.