Analysis

2022, August, 8, 11:45:00

U.S. RIGS DOWN 3 TO 764

U.S. Rig Count is down 3 from last week to 764, Canada Rig Count is down 1 from last week to 203.

2022, August, 4, 11:00:00

OIL PRICE: BRENT ABOVE $96, WTI ABOVE $90

Brent rose 10 cents, or 0.1%, at $96.88 a barrel, WTI was up 21 cents, a 0.2% gain, at $90.87.

2022, August, 4, 10:55:00

OPEC OIL PRICE: $104.86

The price of OPEC basket of thirteen crudes stood at $104.86 a barrel

2022, August, 4, 10:40:00

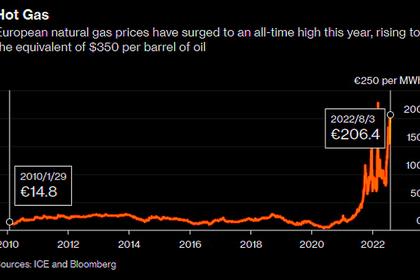

EUROPE WILL PAY MORE

Energy consumer prices are rising at an annual rate of nearly 40 per cent in the eurozone and 57 per cent in the UK, reflecting the surge in wholesale gas and oil prices after Russia’s invasion of Ukraine. That is drastically eating into households’ disposable income.

2022, August, 4, 10:35:00

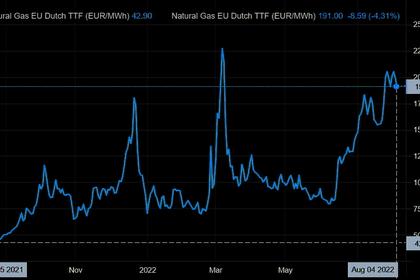

GERMAN ENERGY IS EXPENSIVE

The incentive to reduce gas consumption is huge after Putin reduced supplies to Germany via the Nord Steam 1 pipeline. The Dutch TTF gas contract, a European benchmark, is trading above 205 euros ($209) per megawatt hour, 10 times its average in the decade through 2020 and equivalent to about $350 per barrel of oil.

2022, August, 4, 10:30:00

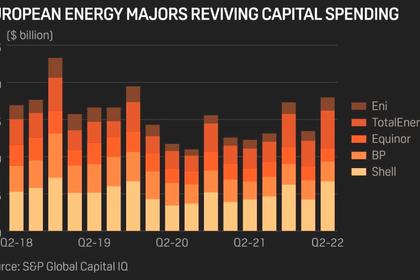

EUROPE NEED OIL GAS INVESTMENT

TotalEnergies said it would boost spending on short-cycle projects this year to help ease Europe's growing energy supply crunch. It expects its full-year capital spending to hit $16 billion in 2022 as it hopes to increase its sources of European natural gas and produce more LNG in the coming months.

2022, August, 4, 10:15:00

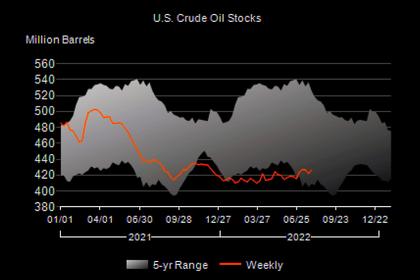

U.S. OIL INVENTORIES UP BY 4.5 MB TO 426.6 MB

U.S. commercial crude oil inventories increased by 4.5 million barrels to 426.6 million barrels.

2022, August, 3, 12:45:00

OIL PRICE: BRENT ABOVE $99, WTI ABOVE $93

Brent were down $1.34, or 1.3%, at $99.20 a barrel, WTI fell $1.28, or 1.4%, to $93.14 a barrel.

2022, August, 3, 12:40:00

OPEC OIL PRICE: $106.80

The price of OPEC basket of thirteen crudes stood at $106.80 a barrel

2022, August, 3, 12:25:00

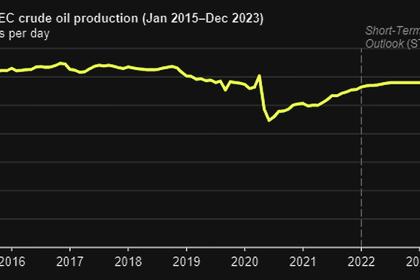

OPEC+ PRODUCTION IS STABLE

The Joint Technical Committee of OPEC+, which includes Russia, trimmed its forecast for a surplus in the oil market this year by 200,000 barrels per day to 800,000 bpd

2022, August, 3, 12:20:00

RUSSIAN DIESEL FOR EUROPE UP

The region imported almost 700,000 barrels a day of the fuel from Russia last month, higher than the previous month and a 22 per cent increase compared with July last year

2022, August, 2, 12:40:00

OIL PRICE: BRENT NEAR $100, WTI ABOVE $93

Brent was down $1.40, or 1.4%, to $98.63 a barrel, WTI fell $1.00, or 1.1%, to $92.89.

2022, August, 2, 12:35:00

OPEC OIL PRICE: $110.9

The price of OPEC basket of thirteen crudes stood at $110.90 a barrel

2022, August, 2, 12:30:00

ЦЕНА URALS: $83,27

Средняя цена на нефть марки Urals в январе-июле 2022 года сложилась в размере $83,27 за баррель, в январе-июле 2021 года – $64,68 за баррель.

2022, August, 2, 12:25:00

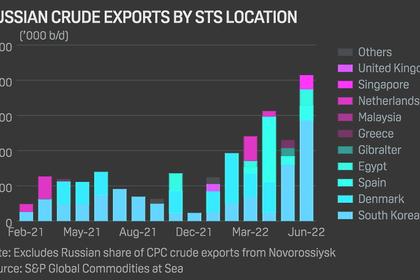

RUSSIAN OIL EXPORTS UP

The boom in STS activity involving Russian crude came as Moscow's seaborne oil exports defied Western sanctions to hit post-pandemic highs of 4 million b/d in April 2022.