Investments

2022, September, 5, 13:55:00

ESG & ENERGY INVESTMENT

The growing emphasis on ESG is a key component in the upstream oil and gas industry.

2022, September, 2, 12:25:00

BRITAIN'S NUCLEAR INVESTMENT $0.8 BLN

This is part of the GBP1.7 billion of new direct government funding to develop a large-scale nuclear project announced in October.

2022, August, 9, 14:15:00

U.S. CLIMATE INVESTMENT $430 BLN

The legislation is aimed at reducing carbon emissions and shifting consumers to green energy,

2022, August, 8, 12:25:00

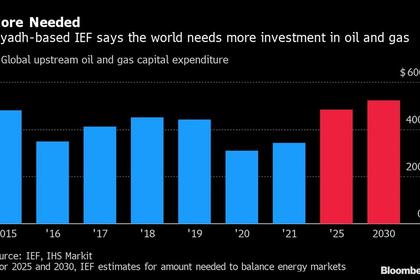

OIL NEED INVESTMENT $12 TLN

Al-Ghais noted that oil investments have not yet returned to pre-pandemic levels. He said it is difficult to forecast oil markets due to the current global economic conditions.

2022, August, 3, 12:15:00

SAUDI'S INVESTMENT MARKETING $3.2 TLN

Saudi Arabia would be looking to secure investments in untapped business sectors, including green hydrogen, renewable energy, and information technology.

2022, July, 26, 10:30:00

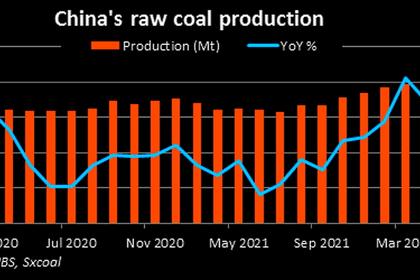

CHINA'S COAL PRODUCTION GROWTH

The company boosted coal production by 6.2% to 300 million tons and increased sales to 390 million tons.

2022, July, 15, 11:30:00

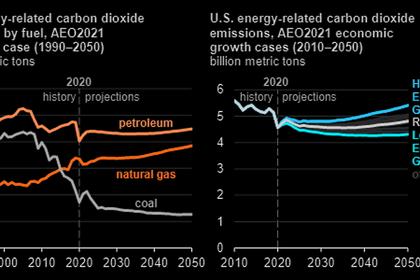

U.S. CARBON EMISSIONS PROGRAM $2.6 BLN

The two programs – the Carbon Capture Demonstration Projects Program and the Carbon Dioxide Transport/Front-End Engineering Design (FEED) Program – are funded by a more than $2.6 billion investment from President Biden’s Bipartisan Infrastructure Law.

2022, July, 7, 10:50:00

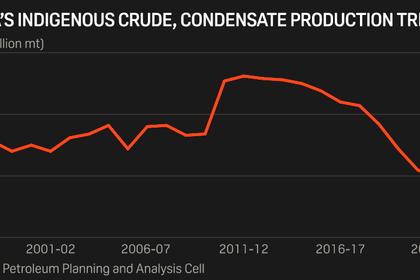

INDIA NEED OIL INVESTMENT

The oil ministry said June 29 that India would allow operators to sell locally-produced crude in the domestic market without restrictions from Oct. 1, but restrictions on exporting locally-produced crude would remain.

2022, June, 28, 11:35:00

U.S. SMR FOR ROMANIA

Romanian company Nuclearelectrica and NuScale will cooperate with the US Trade and Development Agency (USTDA) on a series of engineering and design activities and studies, as well further technical analyses of the Doicești site, a former thermal power plant site which has been identified as a potential location for the SMR plant.

2022, June, 21, 14:20:00

SAUDI ARABIA, EGYPT INVESTMENT $7.7 BLN

The agreements cover a range of sectors, including renewable energy, green hydrogen, pharmaceuticals and e-commerce

2022, June, 15, 14:10:00

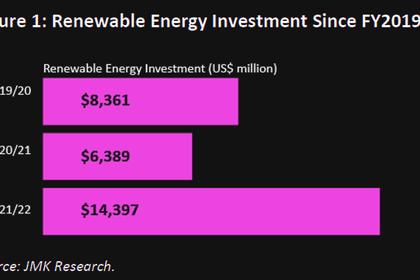

INDIA'S RENEWABLES INVESTMENT UP TO $14.4 BLN

Investment in electricity generation in India has rebounded from its slump during the COVID-19 pandemic, with 15.5 gigawatts (GW) of renewable energy capacity – representing an investment of a record US$14.4 billion – added in the past financial year.

2022, June, 14, 11:10:00

INDIAN HYDROGEN INVESTMENT $5 BLN

The purchase would be yet another shot in the arm for Adani, who has been seeking global investors and has committed to spend as much as $70 billion by 2030 across the green-energy value chain.

2022, June, 7, 11:10:00

U.S. HYDROGEN DEVELOPMENT $8 BLN

H2Hubs will create networks of hydrogen producers, consumers, and local connective infrastructure to accelerate the use of hydrogen as a clean energy carrier.

2022, June, 7, 11:05:00

U.S. NUCLEAR DEVELOPMENT $1.7 BLN

The request includes $1.7 billion for the Office of Nuclear Energy (NE) and is one of the highest asks ever for NE.

2022, June, 1, 10:15:00

INDIA OIL GAS INVESTMENT $4 BLN

India imported 84% of its oil needs and 54% of its gas needs in 2020. After coal (44%), oil represented 44% of the country’s total consumption in 2020, against 6% for natural gas.