News

2018, November, 14, 12:10:00

NATURAL GAS: THE SECOND

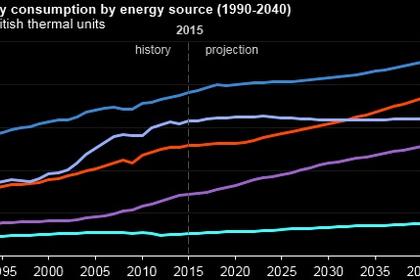

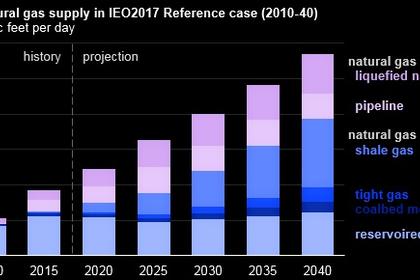

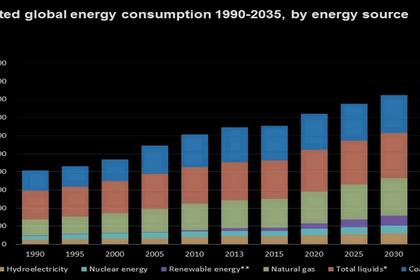

REUTERS - Global gas demand would increase by 1.6 percent a year to 2040 and would be 45 percent higher by then than today,

2018, November, 14, 12:05:00

CHINA: THE WORLD'S TOP

REUTERS - China has overtaken Japan to become the world’s top importer of natural gas, as Beijing’s crackdown on pollution boosts its demand for the more environmentally friendly fuel, while the restart of nuclear reactors in Japan reduces its LNG imports.

2018, November, 14, 12:00:00

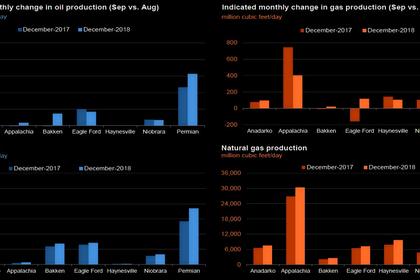

U.S. PRODUCTION: OIL + 113 TBD, GAS + 1,038 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 113,000 b/d month-over-month in December from 7,831 to 7,944 thousand barrels/day , gas production to increase 1,038 million cubic feet/day from 74,041 to 75,079 million cubic feet/day .

2018, November, 14, 11:55:00

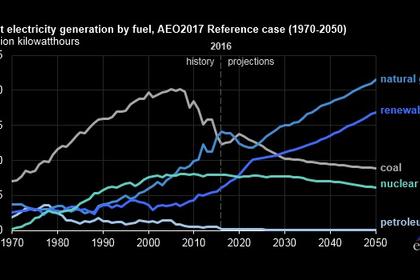

NUCLEAR NEEDS INVESTMENT

WNN - world electricity generation increases from 25,679 TWh in 2017 to 30,253 TWh in 2025 and to 40,443 TWh in 2040. Global nuclear generation increases from 2637 TWh in 2017 to 3726 TWh in 2040, when it will account for around 9% of total electricity production, down from the current level of about 10.5%. Fossil fuels remain the major source for electricity generation under this scenario, but their share falls from around two-thirds today to under 50% by 2040.

2018, November, 14, 11:50:00

NUCLEAR POWER CHANGING

WNN - The search for solutions to climate change must include discussion of nuclear power, Scott Foster, director of the Sustainable Energy Division of UNECE, told

2018, November, 14, 11:45:00

U.S. NUCLEAR CAPEX DOWN 40.8%

WNN - in 2017 the average total generating cost - which includes capital, fuel and operating costs - for nuclear energy was USD33.50 per megawatt-hour (MWh).

2018, November, 14, 11:40:00

LUKOIL PRODUCTION 2.3 MBD

LUKOIL - For the first nine months of 2018 LUKOIL Group's average hydrocarbon production excluding West Qurna-2 project was 2,301 thousand boe per day, which is 3.7% higher year-on-year.

2018, November, 14, 11:35:00

BHGE, GE MAXIMIZES VALUE

GE - Baker Hughes, a GE company and General Electric Company Announce a Series of Long-Term Agreements to Maximize Value for Both BHGE and GE

2018, November, 14, 11:30:00

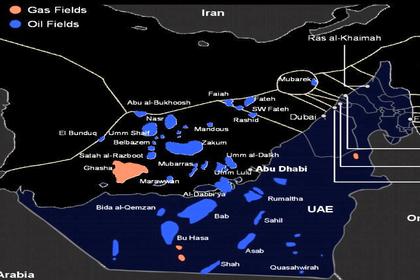

ADNOC & SAUDI ARAMCO COOPERATION

ADNOC - The Abu Dhabi National Oil Company (ADNOC) signed a framework agreement with Saudi Aramco (Aramco), to explore potential opportunities for collaboration in the natural gas and Liquefied Natural Gas (LNG) sectors.

2018, November, 14, 11:25:00

ENI, ADNOC CONCESSION

ADNOC - ADNOC signs First Hail, Ghasha and Dalma Ultra-Sour Gas Concession with Italy’s Eni

2018, November, 14, 11:20:00

ENI SELLS IN EGYPT

ENI - Eni sells to Mubadala Petroleum a 20% stake in the Nour North Sinai Offshore concession in Egypt

2018, November, 12, 12:30:00

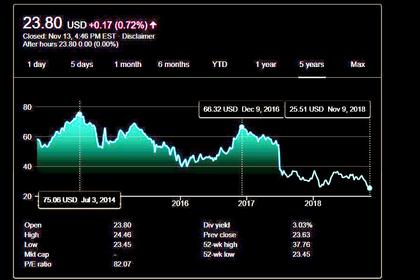

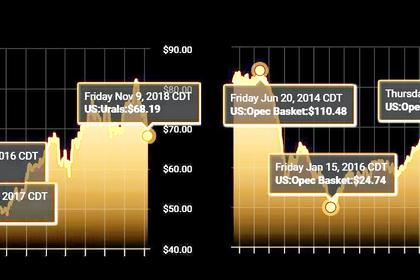

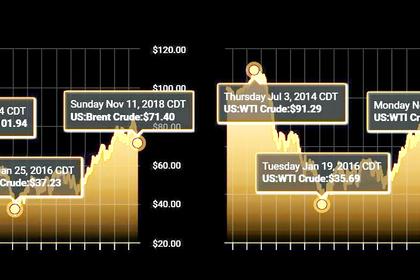

OIL PRICE: NEAR $71

REUTERS - Front-month Brent crude futures LCOc1, a benchmark for global oil prices, were at $71.59 per barrel at 0749 GMT, up 2 percent from their last close. U.S. West Texas Intermediate (WTI) crude futures rose 1.6 percent to $61.15 per barrel.

2018, November, 12, 12:25:00

CONFORMITY LEVEL 104%

OPEC - In advance of the scheduled meetings in December 2018, the JMMC directed the JTC to continue closely monitoring oil market conditions and further refine the scenario analysis based on updated data, with regard to options on new 2019 production adjustments, which may require new strategies to balance the market.

2018, November, 12, 12:15:00

SAUDIS CUTS OIL

PLATTS - Saudi Arabia expects to cut its oil exports next month but emerging signs of a crude glut in the US are not an indication that the global oil market is currently oversupplied, the kingdom's energy minister Khalid al-Falih said Sunday, attributing a two-week slide in oil prices to trader overreaction.

2018, November, 12, 12:10:00

OIL PRICES WILL UP

CNBC - "In the 2020's we are going to have a clear physical shortage of oil because nobody is allowed to fully invest in future oil production," Michele Della Vigna, Head of EMEA Natural Resources Research at Goldman Sachs told CNBC Friday.