Oil&Gas

2019, May, 15, 11:35:00

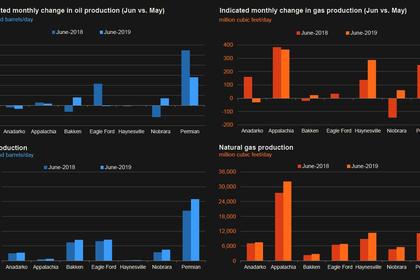

U.S. PRODUCTION: OIL + 83 TBD, GAS + 943 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 83,000 b/d month-over-month in June from 8,412 to 8,495 thousand barrels/day, gas production to increase 943 million cubic feet/day from 79,720 to 80,663 million cubic feet/day .

2019, May, 15, 11:20:00

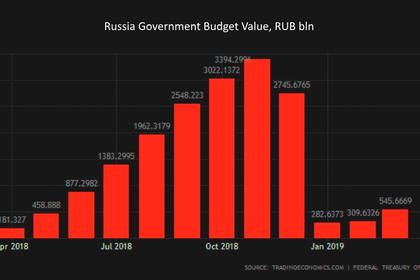

ДОХОДЫ РОССИИ +314,4 МЛРД.РУБ.

МИНФИН РОССИИ - Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета, связанный с превышением фактически сложившейся цены на нефть над базовым уровнем, прогнозируется в мае 2019 года в размере +314,4 млрд руб.

2019, May, 15, 11:10:00

ROSNEFT'S NET INCOME +61.7%

ROSNEFT - Net income growth of 61.7% YoY to RUB 131 bln

2019, May, 15, 11:05:00

ROSNEFT'S PRODUCTION 5.9 MBD

Hydrocarbon production in Q1 2019 amounted to 5.90 mmboed (71.7 mmtoe), exceeding Q1 2018 level by 3.4%. Average daily hydrocarbon production decreased by 0.6% QoQ due to the Company’s compliance with its obligations under the OPEC+ Agreement.

2019, May, 15, 11:00:00

LUKOIL'S PRODUCTION +4.1%

In the first quarter of 2019 LUKOIL Group's average hydrocarbon production excluding the West Qurna-2 project was 2,379 thousand boe per day, which is 4.1% higher year-on-year and 0.3% higher quarter-on-quarter. The increase was mainly driven by the development of gas projects in Uzbekistan.

2019, May, 13, 12:35:00

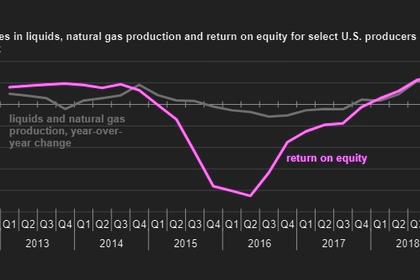

U.S. OIL PROFITABILITY $28 BLN

Net income for 43 U.S. oil producers totaled $28 billion in 2018, a five-year high. Based on net income, 2018 was the most profitable year for these U.S. oil producers since 2013, despite crude oil prices that were lower in 2018 than in 2013 on an annual average basis.

2019, May, 13, 11:55:00

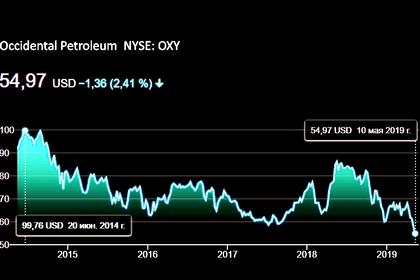

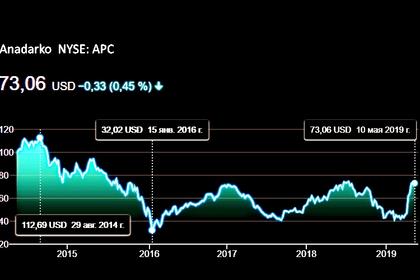

OCCIDENTAL, ANADARKO DEAL: $57 BLN

Occidental ("Occidental" or "the Company") (NYSE: OXY) ) today entered into a definitive agreement whereby Occidental will acquire Anadarko Petroleum Corporation ("Anadarko") (NYSE: APC) for $59.00 in cash and 0.2934 shares of Occidental common stock per share of Anadarko common stock, in a transaction valued at $57 billion, including the assumption of Anadarko's debt.

2019, May, 13, 11:50:00

CHEVRON, ANADARKO: NO COUNTERPROPOSAL

Chevron Corporation (NYSE: CVX) announced that, under the terms of its previously announced Merger Agreement with Anadarko Petroleum Corporation (NYSE: APC), it will not make a counterproposal and will allow the four-day match period to expire. Accordingly, Chevron anticipates that Anadarko will terminate the Merger Agreement.

2019, May, 13, 11:45:00

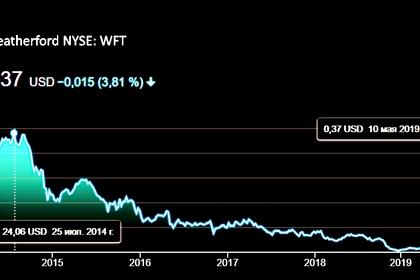

WEATHERFORD'S BANKRUPTCY

Oilfield services provider Weatherford International Plc, burdened by a heavy debt load and years of losses, said on Friday it would file for Chapter 11 bankruptcy protection.

2019, May, 13, 11:40:00

U.S. RIGS DOWN 2 TO 988

BHGE - U.S. Rig Count is down 2 rigs from last week to 988, with oil rigs down 2 to 805, gas rigs unchanged at 183, and miscellaneous rigs unchanged at 0. Canada Rig Count is up 2 rigs from last week to 63, with oil rigs up 5 to 22 and gas rigs down 3 to 41.

2019, May, 8, 11:35:00

6 UNDERVALUED ENERGY STOCKS

Investors with a long-term horizons could give a look to Energy Industry. According a Value Line Report on Petroleum Industry, Oil Price above $50 a barrel provide some assurance that existing dividend will be maintained.

2019, May, 8, 11:20:00

OCCIDENTAL SALES $8.8 BLN

Occidental Petroleum Corp agreed to sell Anadarko's Algeria, Ghana, Mozambique and South Africa assets to Total SA for $8.8 billion.

2019, May, 8, 10:55:00

WORLDWIDE RIG COUNT DOWN 73 TO 2,140

BHGE - The worldwide rig count for April 2019 was 2,140, down 73 from the 2,213 counted in March 2019, and up 53 from the 2,087 counted in April 2018.

2019, May, 6, 11:45:00

SHELL CCS EARNINGS $5.3 BLN

CCS earnings attributable to shareholders excluding identified items were $5.3 billion, reflecting lower realised chemicals and refining margins, decreased realised oil prices and lower tax credits, partly offset by stronger contributions from trading as well as increased realised LNG and gas prices compared with the first quarter 2018. In addition, there was a negative impact of $43 million related to the implementation of IFRS 16.

2019, May, 6, 11:35:00

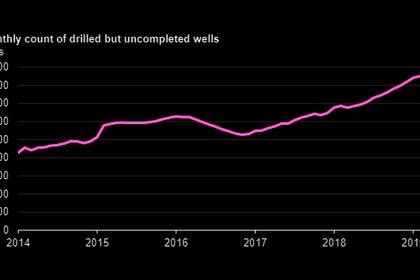

U.S. UNCOMPLETED WELLS UP

The number of drilled but uncompleted wells in seven key oil and natural gas production regions in the United States has increased over the last two years, reaching a high of 8,504 wells in February 2019,