Oil&Gas

2018, February, 16, 23:10:00

TRANSCANADA NET INCOME $3.0 BLN

TRANSCANADA - TransCanada Corporation (TSX:TRP) (NYSE:TRP) (TransCanada or the Company) announced net income attributable to common shares for fourth quarter 2017 of $861 million or $0.98 per share compared to a net loss of $358 million or $0.43 per share for the same period in 2016. For the year ended December 31, 2017, net income attributable to common shares was $3.0 billion or $3.44 per share compared to net income of $124 million or $0.16 per share in 2016.

2018, February, 14, 10:05:00

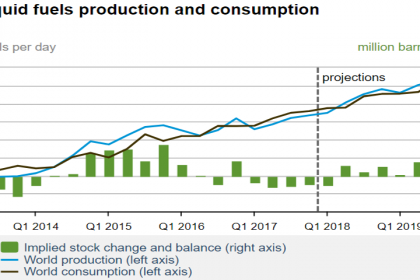

IEA: OIL DEMAND GROWTH 1.6 MBD

IEA - Our demand growth estimate for 2017 remains strong at 1.6 mb/d, reinforced by November data for the US. For 2018, the more positive global economic picture published by the International Monetary Fund is a key factor in raising our growth outlook to 1.4 mb/d. It was thought that the significant increase in the dollar price of crude oil since the middle of 2017 would dampen growth, and this might be the case to some extent, but the impact of higher prices has been partly offset in some countries by currency appreciations.

2018, February, 12, 07:15:00

UAE - INDIA'S CONCESSION: $600 MLN

REUTERS - A consortium led by India’s Oil and Natural Gas Corp (ONGC) (ONGC.NS) has become the first group to win a stake in Abu Dhabi National Oil Co’s (ADNOC) 40-year offshore oil concession, a deal set to help the UAE expand its foothold in Asia.

2018, February, 12, 07:10:00

NORWAY DEFENDS OIL

REUTERS - “The Ministry maintains that the Norwegian rules on reimbursement of exploration costs and interest on carry forward of losses ... do not constitute state aid under Article 61 of the EEA Agreement, and are therefore in compliance with the EEA (European Economic Area) law,” the ministry said in a letter.

2018, February, 12, 07:05:00

LEBANON OFFSHORE DRILLING

NOVATEK - Total and Eni signed exploration and production agreements (Agreements) with the Government of Lebanon to explore and produce hydrocarbons on the offshore blocks 4 and 9 in the Eastern part of the Mediterranean Sea. NOVATEK’s participating interest in the Agreements is 20%, Total and Eni both hold 40% stakes, with Total appointed as the Operator.

2018, February, 12, 07:00:00

U.S. RIGS UP +29 TO 975

BAKER HUGHES A GE - U.S. Rig Count is up 29 rigs from last week to 975, with oil rigs up 26 to 791, gas rigs up 3 to 184, and miscellaneous rigs unchanged.

Canada Rig Count is down 17 rigs from last week to 325, with oil rigs down 13 to 221 and gas rigs down 4 to 104.

2018, February, 9, 10:35:00

WORLDWIDE RIG COUNT UP 96 TO 2,271

BAKER HUGHES A GE - The worldwide rig count for February 2018 was 2,271, up 96 from the 2,175 counted in January 2018, and up 244 from the 2,027 counted in February 2017.

2018, February, 9, 10:30:00

EXXON'S RESERVES 21.2 BLN

EXXONMOBIL said it added 2.7 billion oil-equivalent barrels of proved oil and gas reserves in 2017, replacing 183 percent of production. ExxonMobil's proved reserves totaled 21.2 billion oil-equivalent barrels at year-end 2017. Liquids represented 57 percent of the reserves, up from 53 percent in 2016. ExxonMobil’s reserves life at current production rates is 14 years.

2018, February, 7, 08:15:00

GAZPROM'S ANNUAL INVESTMENT: $17.5 BLN

REUTERS - Gazprom expects its average annual investment until 2035 to be capped at 1 trillion rubles ($17.5 billion).

2018, February, 7, 08:10:00

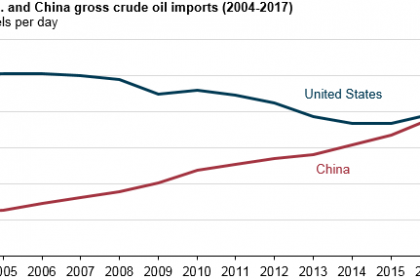

CHINA: THE WORLD'S LARGEST

EIA - China surpassed the United States in annual gross crude oil imports in 2017, importing 8.4 million barrels per day (b/d) compared with 7.9 million b/d for the United States. China had become the world’s largest net importer (imports minus exports) of total petroleum and other liquid fuels in 2013. New refinery capacity and strategic inventory stockpiling combined with declining domestic oil production were the major factors contributing to the recent increase in China’s crude oil imports.

2018, February, 7, 07:55:00

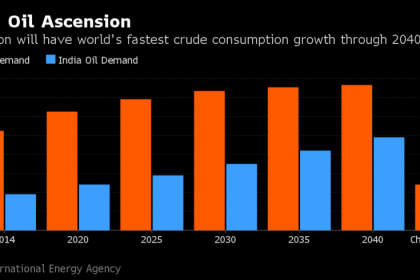

INTEGRATED INDIAN OIL

PLATTS - "The integrated entity will have the capacity to neutralize the impact of volatility in global crude oil prices," said oil minister Dharmendra Pradhan. "The integrated entity will have the advantage of having enhanced capacity to bear higher risks and take higher investment decisions."

2018, February, 7, 07:45:00

NORWAY DIVESTS OIL

BLOOMBERG - Norway’s $1.1 trillion wealth fund shocked the world last year when it announced a plan to divest all its oil and gas stocks, worth $35 billion at the time.

2018, February, 7, 07:30:00

BP PROFIT $3.4 BLN

BP - “2017 was one of the strongest years in BP’s recent history. We delivered operationally and financially, with very strong earnings in the Downstream, Upstream production up 12%, and our finances rebalanced. And we did all this while maintaining safe and reliable operations.

“We enter the second year of our five-year plan with real momentum, increasingly confident that we can continue to deliver growth across our business, improving cash flows and returns for shareholders out to 2021 and beyond.

“At the same time, we are embracing the energy transition, seeking new opportunities in a changing, lower-carbon world.”

2018, February, 7, 07:25:00

NOV VARCO NET LOSS $237 MLN

NOV - National Oilwell Varco, Inc. (NYSE: NOV) reported a fourth quarter 2017 net loss of $14 million, or $0.04 per share. Revenues for the fourth quarter were $1.97 billion, an increase of seven percent compared to the third quarter and an increase of 16 percent from the fourth quarter of 2016. Operating loss for the fourth quarter was $111 million, or 5.6 percent of sales. Adjusted EBITDA (operating profit excluding depreciation, amortization, and other items) for the fourth quarter was $197 million, or 10.0 percent of sales, an increase of $30 million from the third quarter. Other items were $133 million, pre-tax, and primarily consisted of charges for inventory write-downs, facility closures and severance. Cash flow from operations for the fourth quarter was $321 million.

2018, February, 7, 07:20:00

SOUTH AFRICA'S EXPLORATION

TOTAL - Total has signed an agreement to sell a 25% interest in the Exploration Block 11B/12B, offshore South Africa, to Qatar Petroleum. The transaction remains subject to regulatory approval.