All publications by tag «OIL»

2018, January, 8, 19:00:00

U.S. RIGS DOWN 5 TO 924

U.S. Rig Count is down 5 rigs from last week to 924, with oil rigs down 5 to 742, gas rigs unchanged at 182, and miscellaneous rigs unchanged.

Canada Rig Count is up 38 rigs from last week to 174, with oil rigs up 36 to 98 and gas rigs up 2 to 76.

2018, January, 5, 23:55:00

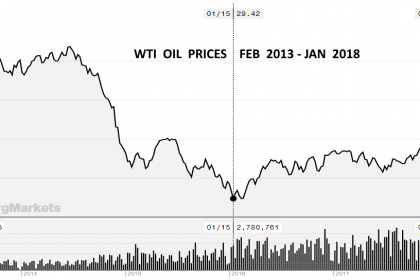

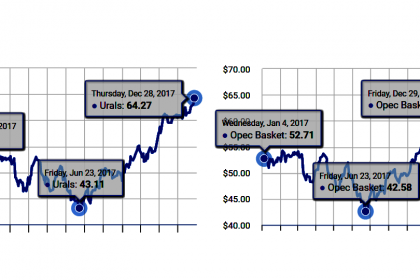

OIL PRICES: ABOVE $67

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $61.81 a barrel at 0750 GMT. That was 20 cents, or 0.3 percent, below their last close. WTI hit a $62.21 the previous day, which was its strongest since May, 2015. Brent crude futures LCOc1 were at $67.88 a barrel, 19 cents, or 0.3 percent, below their last settlement. Brent hit $68.27 the day before, also the highest since May, 2015.

2018, January, 5, 23:45:00

IRANIAN OIL EXPORTS 2017: 777 MB

IRNA - Iran exported some 777 million barrels of oil to Asian and European destinations in 2017, according to a report by the country's Ministry of Petroleum.

2018, January, 5, 23:40:00

IRAQI OIL TO CHINA

PLATTS - China's crude oil imports from Iraq in November surged 47.2% on year and 58.8% on month to hit a record high of 4.21 million mt or an average 1.03 million b/d, making the Persian Gulf producer its third-largest supplier, data from China's General Administration of Customs showed.

2018, January, 4, 12:30:00

OIL PRICES: ABOVE $68

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $62.16 a barrel at 0752 GMT, up 53 cents, or 0.9 percent, from their last close. They touched $62.21 shortly before, their highest level since May 2015. Brent crude futures LCOc1 - the international benchmark for oil prices - were at $68.23 a barrel, up 39 cents, or 0.9 percent, after revisiting a May 2015 high of $68.27 shortly before.

2018, January, 3, 16:05:00

OIL PRICES: ABOVE $66 YET

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.50 a barrel at 1017 GMT, up 13 cents from their last close, though still not far off the $60.74 reached on the previous day that was the highest since June 2015.

Brent crude futures LCOc1 - the international benchmark for oil prices - were at $66.74 a barrel, up 17 cents but still trailing Tuesday’s high of $67.29 that was the most since May 2015.

2018, January, 3, 15:55:00

RUSSIA - CHINA OIL FRIENDSHIP

BLOOMBERG - After a glut sparked the biggest price crash in a generation and starved Russia of oil revenues, the nation sought to boost market share in the world’s top importer. It’s now supplanted Saudi Arabia as the top exporter to China, even as the two producers lead efforts to shrink the global oversupply by curbing output. A pipeline that transports crude from the East Siberia-Pacific Ocean system has helped its mission to increase volumes.

2018, January, 3, 15:45:00

SAUDIS OIL TO JAPAN UP 19.3%

PLATTS - Japan's crude oil imports from Saudi Arabia rose 19.3% month on month to an average of 1.39 million b/d in November, preliminary data released Thursday by the Ministry of Economy, Trade and Industry showed.

2018, January, 3, 15:40:00

IRAQ'S OIL EXPORT UP TO 3.535 MBD

PLATTS - Federal crude oil exports from Iraq's southern Persian Gulf terminals edged up in December to reach a new record high, averaging 3.535 million b/d, up 33,000 b/d from in November, the latest data from the oil ministry showed.

2018, January, 3, 15:35:00

NORWAY'S OIL PROBLEMS

BLOOMBERG - Norway’s oil production has been halved since a 2000 peak. While natural-gas output has surged, total production is forecast to fall again in the middle of the next decade. A flurry of investment decisions at the end of last year hides a painful truth: after Statoil’s $6 billion Johan Castberg oil field starts production in the Barents in 2022, the project pipeline is scant.