Analysis

2021, January, 18, 13:00:00

CHINA OIL THROUGHPUT UP

On a metric tons basis, the December throughput went up 2.8% from November and 2.1% from a year ago to 60 million mt.

2021, January, 18, 12:55:00

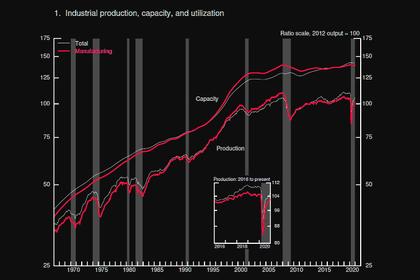

U.S. INDUSTRIAL PRODUCTION UP 1.6%

U.S. industrial production advanced 1.6 percent in December, with gains of 0.9 percent for manufacturing, 1.6 percent for mining, and 6.2 percent for utilities.

2021, January, 18, 12:45:00

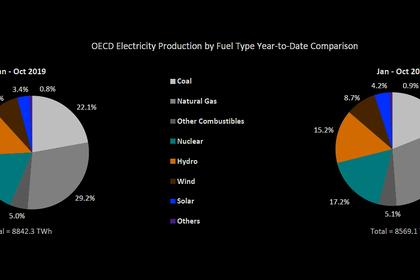

OECD RENEWABLE ELECTRICITY UP 12%

Renewable electricity production was 262.8 TWh, up by 12.4% compared to October 2019 and by8.7 % compared to September 2020.

2021, January, 18, 12:30:00

NOVATEK PRODUCTION +3%

In 2020, NOVATEK’s hydrocarbon production totaled 608.2 million barrels of oil equivalent (boe),

2021, January, 18, 12:25:00

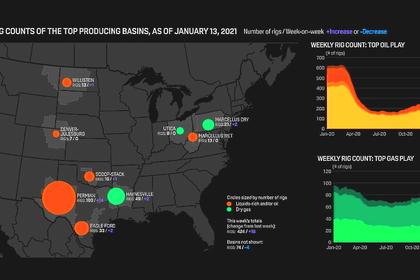

U.S. RIGS UP 13 TO 373

U.S. Rig Count is up 13 from last week to 373, Canada Rig Count is up 44 from last week to 161.

2021, January, 15, 12:05:00

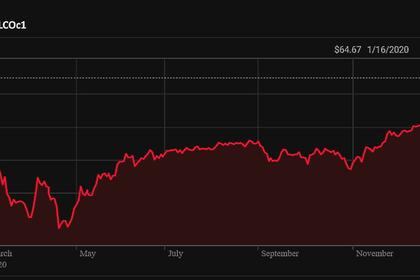

OIL PRICE: BELOW $56 ANEW

Brent was down 71 cents, or 1.2%, at $55.71 a barrel. WTI was 46 cents, or 0.9%, lower at $53.11 a barrel.

2021, January, 15, 12:00:00

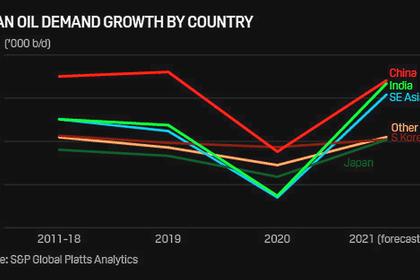

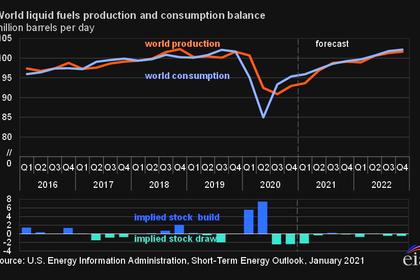

GLOBAL OIL DEMAND WILL UP BY 5.9 MBD

For 2021, global oil demand is forecast to increase by 5.9 mb/d y-o-y to average 95.9 mb/d.

2021, January, 15, 11:50:00

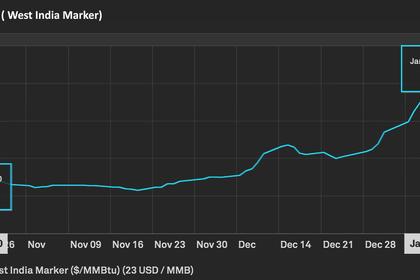

LNG PRICES UP ANEW

Spot LNG prices LNG-AS have nearly tripled since early November as freezing temperatures across North Asia boosted demand and depleted inventories. Since July, prices are up a dizzying 1,000%.

2021, January, 15, 11:45:00

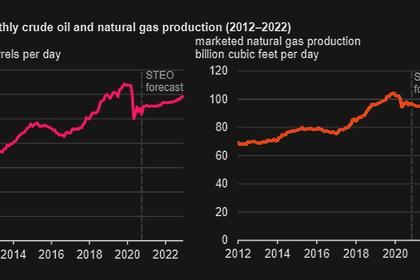

U.S. OIL GAS PRODUCTION UPDOWN

U.S. crude oil production will average 11.1 million b/d in 2021, down 0.2 million b/d from 2020 as result of a decline in drilling activity related to low oil prices.

2021, January, 15, 11:40:00

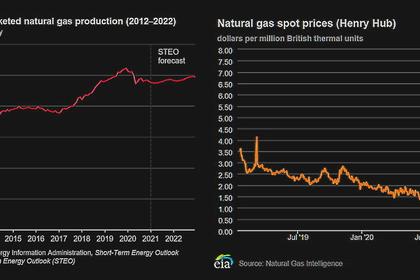

U.S. GAS PRODUCTION UPDOWN

U.S. marketed gas production for 2021 will fall 2% and average 96.2 billion cubic feet per day (Bcf/d).

2021, January, 15, 11:35:00

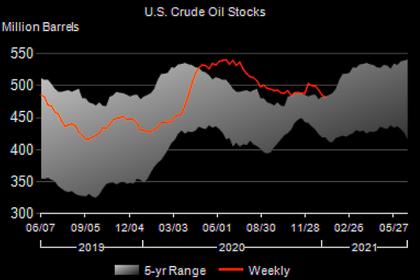

U.S. OIL INVENTORIES DOWN 3.2 MB TO 482.2 MB

U.S. commercial crude oil inventories decreased by 3.2 million barrels to 482.2 million barrels.

2021, January, 15, 11:25:00

INDIA'S INDEXES DOWN

The blue-chip NSE Nifty 50 index fell 0.5% to 14,529 and the benchmark S&P BSE Sensex was down 0.4% at 49,600.11 by 0411 GMT.

2021, January, 15, 11:20:00

ENERGY LANDSCAPE IS CHANGING

Assuming human behavior holds steady, a big transition to electricity will send demand skyrocketing. Making matters worse, this will all be happening as we transition away from easily scaled fossil fuel sources to more finicky renewables.

2021, January, 15, 11:15:00

GRID DIGITALIZATION: BENEFITS AND CHALLENGES IN 2021

The modern grid, also known as the smart grid, is interconnected and automated, with many technologies involved, including artificial intelligence (AI), edge computing, and the Internet of Things (IoT).

2021, January, 14, 14:25:00

OIL PRICE: BELOW $56

Brent fell 36 cents to $55.70 a barrel. WTI dropped 26 cents to $52.65.