Analysis

2022, October, 31, 11:35:00

U.S. RIGS DOWN 3 TO 768

U.S. Rig Count is down 3 from last week to 768, Canada Rig Count is up 2 from last week to 212.

2022, October, 28, 12:05:00

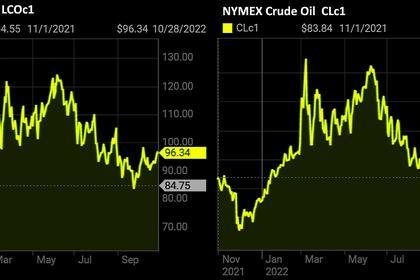

OIL PRICE: BRENT BELOW $97, WTI ABOVE $88

Brent dropped $1.02, or 1.1%, to $95.94 a barrel, WTI were down $1.24, or 1.4%, at $87.84 a barrel.

2022, October, 28, 12:00:00

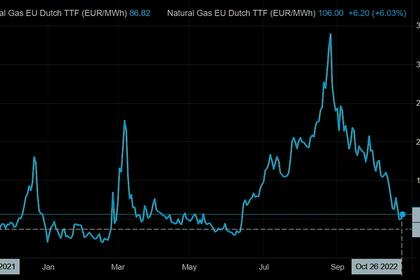

EUROPEAN GAS PRICE UPDOWN

Dutch front-month gas, Europe’s benchmark, rose 3.4% to €111 per megawatt-hour at 8:57 a.m. in Amsterdam, paring some of the weekly decline.

2022, October, 28, 11:55:00

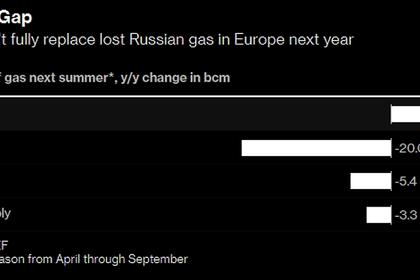

EUROPEAN GAS DEFICIT

While US fuel now makes up 40% of Europe’s liquefied natural gas imports, it will only offset a fraction of the deficit from Russia next summer,

2022, October, 28, 11:50:00

EUROPEAN GAS SHORTAGE

Lower Russian supplies sent European gas prices to all-time highs in late August though prices have come down sharply as storage sites across the EU were filled to close to capacity.

2022, October, 28, 11:35:00

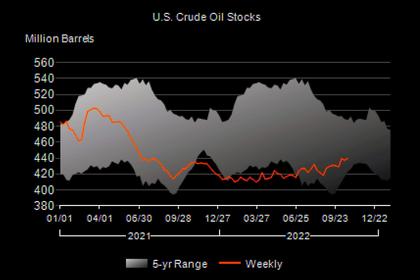

U.S. OIL INVENTORIES UP BY 2.6 MB TO 439.9 MB

U.S. commercial crude oil inventories increased by 2.6 million barrels to 439.9 million barrels.

2022, October, 27, 15:30:00

OIL PRICE: BRENT BELOW $97, WTI BELOW $89

Brent rose 56 cents, or 0.6%, to $96.25 a barrel, WTI gained 41 cents, or 0.5%, to $88.32.

2022, October, 27, 15:20:00

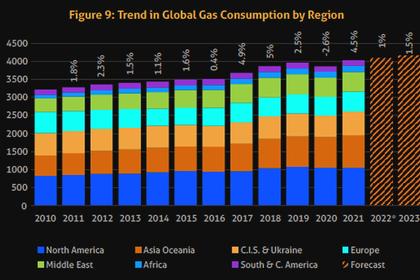

GLOBAL GAS CONSUMPTION WILL UP

Further in 2023, consumption is forecasted to increase by up to 1.1% driven by China, South and South East Asia and the Middle East.

2022, October, 26, 10:45:00

OIL PRICE: BRENT BELOW $93, WTI BELOW $85

Brent fell $1.03, or 1.1%, to $92.49 a barrel, WTI were down 75 cents, or 0.9%, to $84.57.

2022, October, 26, 10:40:00

EUROPEAN GAS PRICE CAP

The other cap in the mix is one to limit the price of gas used in electricity generation, which is backed by a vociferous group of member states.

2022, October, 25, 14:55:00

OIL PRICE: BRENT NEAR $92, WTI BELOW $84

Brent fell by $1.30 to $91.96 per barrel, WTI fell by $1.24 to $83.34 per barrel.

2022, October, 25, 14:50:00

GLOBAL ENERGY SECURITY

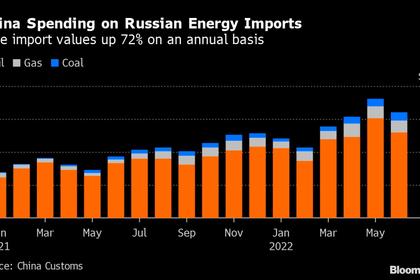

China's crude imports from Russia have continued to stay elevated through 2022, averaging at 1.71 million b/d over January-August, up 7.3% year on year, according to customs data.

2022, October, 25, 14:45:00

GLOBAL ENERGY RESILIENCE

Lesson one is that energy security and energy transition must be in balance to sustain energy systems that are also affordable.

2022, October, 25, 14:40:00

EUROPEAN GAS LIMITS

Caps on gas prices top the political agenda in Europe as governments seek to rein in an unprecedented energy crisis triggered by a cut of gas shipments by Russia, the continent’s former biggest supplier.

2022, October, 25, 14:35:00

RUSSIAN LNG, COAL FOR CHINA

Coking coal imports from Russia jumped to 2.5 million tons in September, from about 900,000 tons in the same month last year and 1.9 million tons in August, according to Chinese customs data.