All publications by tag «»

2019, November, 20, 10:42:00

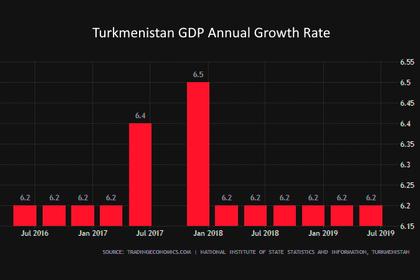

TURKMENISTAN GDP GROWTH 6.3%

Turkmenistan's economic growth continues to be driven by both the hydrocarbon and nonhydrocarbon sectors. External balances remain in surplus, buoyed by exchange controls in line with import substitution and export promotion objectives.

2019, November, 20, 10:40:00

KAZAKHSTAN GDP GROWTH 4.1-3.8%

Kazakhstan's GDP grew by 4.3 percent in the first three quarters of 2019

2019, November, 20, 10:35:00

MOZAMBIQUE GDP GROWTH 5.5%

Mozambique's GDP growth is projected to reach 5½ percent in 2020

2019, November, 20, 10:30:00

CONOCO WILL RETURN $50 BLN

ConocoPhillips has been one of the better-performing energy stocks, having dropped 8% this year, compared with a key industry index, the SPDR S&P Oil & Gas Exploration & Production ETF (XOP.P), which has sunk about 22%.

2019, November, 18, 13:30:00

OIL PRICE: ABOVE $63

Brent were up 11 cents, or 0.2%, to $63.41 a barrel, WTI were 21 cents, or 0.4%, higher at $57.93 a barrel

2019, November, 18, 13:25:00

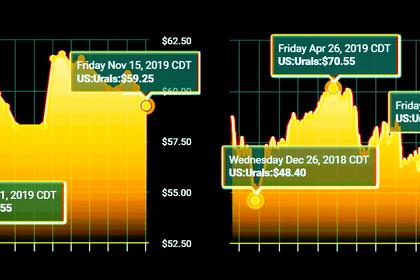

ЦЕНА URALS: $61,33

Средняя цена на нефть Urals за период мониторинга с 15 октября по 14 ноября 2019 года составила $61,33 за баррель

2019, November, 18, 13:20:00

RUSSIA'S GAS FOR EUROPE: RISK

Putin said Ukraine still had work to do to align its gas regulatory landscape with that of Europe, questioning whether Kiev would be able to achieve this in time.

"That is not up to us," he said. "Therefore, the risk of termination of transit exists."

2019, November, 18, 13:15:00

SAUDI ARAMCO VALUATION $1.7 TLN

Crown Prince Mohammed bin Salman had been seeking a valuation for the world's biggest oil and gas company of $2 trillion. Saudi Arabia's government currently owns all of Saudi Aramco's 200 billion shares outstanding.

2019, November, 18, 13:10:00

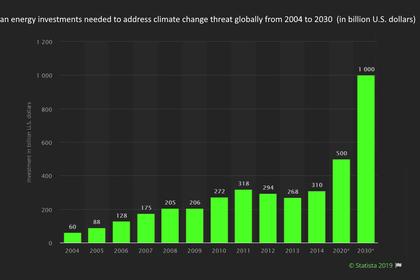

EUROPEAN INVESTMENT BANK: $1.1 TLN FOR CLIMATE

Brent was down 43 cents at $61.85 a barrel , WTI slipped 22 cents to $56.55 a barrel.

2019, November, 18, 13:05:00

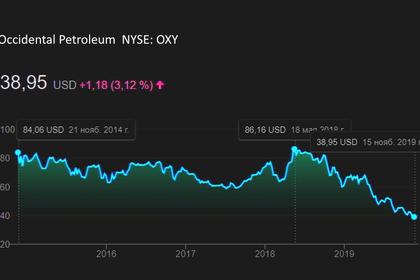

OCCIDENTAL WILL SELL $15 BLN

"We are highly confident that the actions we already have in progress will allow us to exceed the upper end of our original $10 to $15 billion divestiture goal by the middle of 2020," said President and Chief Executive Officer Vicki Hollub. "Closing the Midland Basin Joint Venture and completing the sale of additional non-core assets are the latest examples of Occidental’s progress towards further strengthening our balance sheet."