All publications by tag «»

2017, July, 31, 14:30:00

ВВП РОССИИ: БОЛЬШЕ НА 2,7%

Минэкономразвития России скорректировало оценку темпа роста ВВП за май до 3,5% г/г. В июне 2017 года рост ВВП, по оценке, составил 2,9% г/г, темп роста ВВП во 2 кв. 2017 г. оценивается в 2,7% г/г.

2017, July, 31, 14:25:00

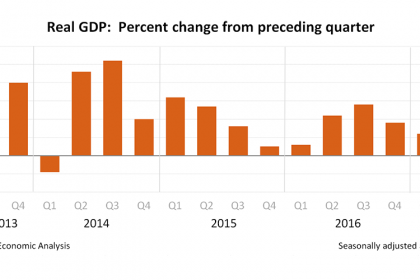

U.S. GDP UP 2.6%

Real gross domestic product increased at an annual rate of 2.6 percent in the second quarter of 2017 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 1.2 percent (revised).

2017, July, 31, 14:20:00

РОССИЯ - УКРАИНА: $3 МЛРД.

Суд обязал Украину выплатить Российской Федерации номинальную стоимость облигаций в сумме 3 млрд. долл. США, в 2013 году приобретенных за счет средств ФНБ, сумму неосуществлённого купонного платежа в размере 75 млн. долл. США и штрафные проценты, начисляемые на эти суммы. Проценты на сумму основного долга по облигациям подлежат оплате по ставке 8% годовых, проценты на сумму невыплаченного купона – по ставке «3-месячный ЛИБОР в долларах США плюс 2 процента годовых». Выплаты штрафных процентов рассчитываются с 21 декабря 2015 г. и производятся по дату полного исполнения обязательств. Таким образом, каждый день просрочки будет стоить государственному бюджету Украины (украинским налогоплательщикам) более 673 тыс. долл. США.

2017, July, 31, 14:15:00

EXXON EARNINGS $3.35 BLN

Exxon Mobil Corporation announced estimated second quarter 2017 earnings of $3.4 billion, or $0.78 per diluted share, compared with $1.7 billion a year earlier, as oil and gas realizations increased and refining margins improved.

2017, July, 31, 14:10:00

CHEVRON EARNINGS $1.45 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $1.5 billion ($0.77 per share – diluted) for second quarter 2017, compared with a loss of $1.5 billion ($0.78 per share – diluted) in the second quarter of 2016. Included in the quarter were impairments and other non-cash charges totaling $430 million, partially offset by gains on asset sales of $160 million. Foreign currency effects increased earnings in the 2017 second quarter by $3 million, compared with an increase of $279 million a year earlier.

2017, July, 31, 14:05:00

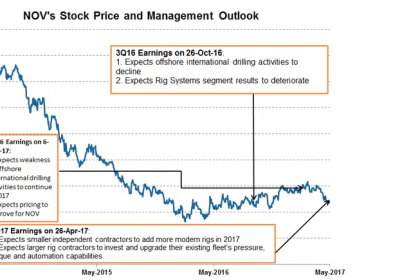

NOV VARCO NET LOSS $75 MLN

National Oilwell Varco, Inc. (NYSE: NOV) reported a second quarter 2017 net loss of $75 million, or $0.20 per share. Excluding other items, net loss for the quarter was $54 million, or $0.14 per share. Other items totaled $30 million, pretax, and primarily consisted of charges related to severance and facility closures.

2017, July, 31, 14:00:00

U.S. RIGS UP 8 TO 958

U.S. Rig Count is up 495 rigs from last year's count of 463, with oil rigs up 392, gas rigs up 106, and miscellaneous rigs down 3 to 0.

Canadian Rig Count is up 101 rigs from last year's count of 119, with oil rigs up 69, gas rigs up 33, and miscellaneous rigs down 1 to 0.

2017, July, 29, 09:31:00

WEATHERFORD NET LOSS $171 MLN

Weatherford International plc (NYSE: WFT) reported a net loss of $171 million, or a loss of $0.17 per share, and a non-GAAP net loss of $282 million before charges and credits ($0.28 non-GAAP loss per share) on revenues of $1.36 billion for the second quarter of 2017.

2017, July, 28, 10:05:00

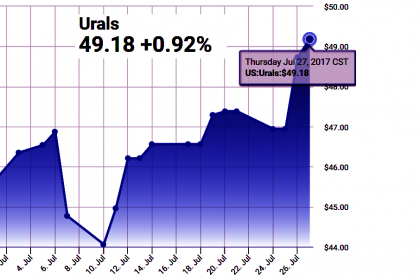

OIL PRICE: ABOVE $51

Brent crude futures were down 8 cents, or 0.2 percent, at $51.41 per barrel at 0651 GMT.

U.S. West Texas Intermediate (WTI) crude futures were down 10 cents, or 0.2 percent, at $48.94 per barrel.

2017, July, 28, 10:00:00

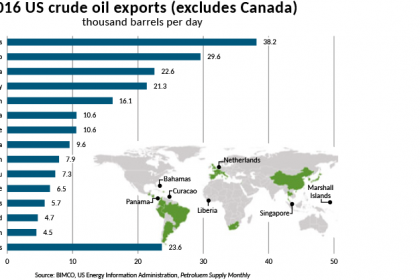

U.S. - CHINA OIL RECORD

China's import of US crude oil crossed 1 million mt for the first time in June, an eight-fold rise year on year, as elevated Dubai prices prompted both state and independent refiners to use it as an opportunity to diversify supplies, a trend that could add to the headache of OPEC suppliers.