All publications by tag «»

2016, November, 8, 18:50:00

ROSNEFT & BGC DEAL: $1.1 BLN

Rosneft and Beijing Gas Group Company Limited (hereinafter, "Beijing Gas") signed a Purchase and Sale Agreement and a Shareholder and Operating Agreement for the sale of a 20% stake in Verkhnechonskneftegaz (a Rosneft subsidiary) to the Chinese company, an Agreement on the Area of Mutual Interest in respect of the adjoining license areas and an Agreement on the cooperation in the gas business. The transaction execution agreement was signed in the presence of the Prime Minister of the Russian Government Dmitry Medvedev and Premier of the State Council of the People's Republic of China Li Keqiang by Rosneft Chief Executive Officer Igor Sechin and Beijing Gas Group Chairwoman of the Management Board Li Yalan.

2016, November, 8, 18:45:00

СОТРУДНИЧЕСТВО РОССИИ И ЯПОНИИ

Министр энергетики Российской Федерации Александр Новак и Министр экономики, торговли и промышленности Японии Хиросигэ Сэко провели первое заседание Российско-Японского Консультационного энергетического совета.

2016, November, 8, 18:40:00

TOTAL & CNPC: IRANIAN DEAL

Iran wants $200bn of investment in its energy industry over the next five years in order to raise production. Until now the country has been struggling to persuade overseas energy companies to commit amid wrangling over the contract terms offered by Tehran.

2016, November, 8, 18:35:00

DEMAND WILL UP AGAIN

OPEC raised its outlook for oil use in 2018, 2019 and 2020, when it sees demand reaching 98.3 million barrels a day, or 900,000 more than the group projected in its previous annual outlook.

2016, November, 8, 18:30:00

BOTTOM IS GOING

Oil producers would love to see higher prices, but OPEC so far has been unable to cut output.

In September, OPEC agreed to have a committee look at potentially cutting production to 32.5 million to 33 million barrels a day, shaving off 700,000 barrels a day — some 2 percent of overall production.

2016, November, 7, 19:00:00

OIL PRICE: ABOVE $46

Brent crude futures LCOc1 were trading at $46.29 per barrel at 0705 GMT, up 71 cents, or 1.56 percent, from their previous close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 730 cents, or 1.66 percent, at $44.80 a barrel.

2016, November, 7, 18:55:00

OPEC CAN'T CUT

OPEC, which pumps about 40 percent of the world’s oil, meets on Nov. 30 in Vienna to try to implement its first cuts in eight years after agreeing to trim output in Algiers at the end of September. Two years ago Saudi Arabia faced an impasse, Al-Naimi said, commenting on OPEC’s decision to pump without limits.

2016, November, 7, 18:50:00

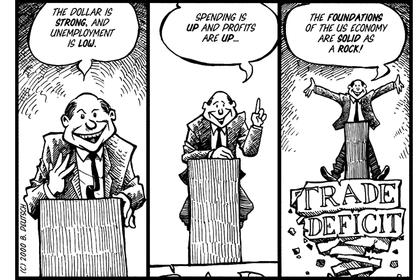

U.S. DEFICIT $36.4 BLN

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $36.4 billion in September, down $4.0 billion from $40.5 billion in August, revised. September exports were $189.2 billion, $1.0 billion more than August exports. September imports were $225.6 billion, $3.0 billion less than August imports.

2016, November, 7, 18:45:00

CHINA'S SHALE GAS UP

Sinopec Ltd. reported that Fuling shale gas field in southwestern China produced a cumulative 3.76 billion cu m of gas from January to September. The 107% increase in production was accompanied by additional processing capacity of 5.5-6.5 bcm, the company said. In 2014, Sinopec announced plans to bring production capacity to 10 bcm/year by 2017.

2016, November, 7, 18:40:00

MEXICO'S POTENTIAL: $415 BLN

After a decade of volatile GDP growth and steadily increasing gas and power demand, Mexico continues to progress toward an unbundling of the monopolies Pemex and CFE once held over its gas and power sectors. According to a recent study by Wood Mackenzie, these reforms have created the potential for approximately US$415 billion in investment over the next two decades as the country builds pipelines, develops a renewables market to meet clean energy targets, and sets the stage for M&A.