All publications by tag «OIL»

2017, July, 31, 14:40:00

OIL PRICE: ABOVE $52

U.S. West Texas Intermediate (WTI) futures briefly jumped over $50 per barrel on Monday and were at $49.97 per barrel at 0654 GMT, still up 25 cents, or 0.5 percent from their last close. That means that virtually the entire WTI curve has moved over $50 per barrel.

Brent crude futures were at $52.85 per barrel, up 33 cents or 0.6 percent. Prices hit $52.90 per barrel earlier in the day, their highest since May 25.

2017, July, 31, 14:00:00

U.S. RIGS UP 8 TO 958

U.S. Rig Count is up 495 rigs from last year's count of 463, with oil rigs up 392, gas rigs up 106, and miscellaneous rigs down 3 to 0.

Canadian Rig Count is up 101 rigs from last year's count of 119, with oil rigs up 69, gas rigs up 33, and miscellaneous rigs down 1 to 0.

2017, July, 28, 10:05:00

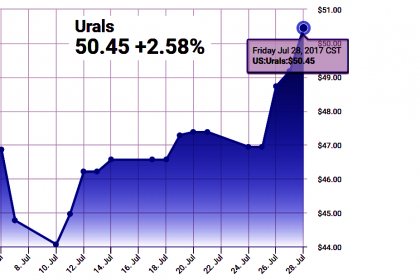

OIL PRICE: ABOVE $51

Brent crude futures were down 8 cents, or 0.2 percent, at $51.41 per barrel at 0651 GMT.

U.S. West Texas Intermediate (WTI) crude futures were down 10 cents, or 0.2 percent, at $48.94 per barrel.

2017, July, 28, 10:00:00

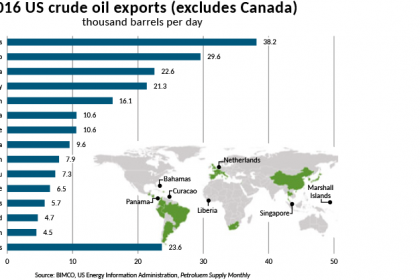

U.S. - CHINA OIL RECORD

China's import of US crude oil crossed 1 million mt for the first time in June, an eight-fold rise year on year, as elevated Dubai prices prompted both state and independent refiners to use it as an opportunity to diversify supplies, a trend that could add to the headache of OPEC suppliers.

2017, July, 28, 09:55:00

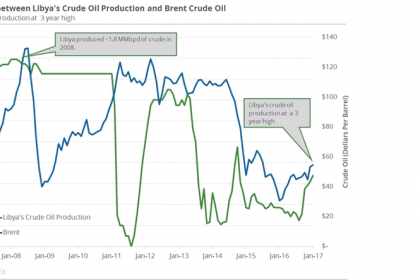

LIBYA'S OIL UP TO 1.069 MBD

Libya's oil production is 1.069 million b/d, and the country hopes to grow its output to as much as 1.25 million b/d this year, a source close to production said Monday.

2017, July, 28, 09:40:00

STATOIL NET INCOME $1.4 BLN

“Our solid financial results and strong cash flow are driven by good operational performance with high production efficiency and continued cost improvements. At oil prices around 50 dollars per barrel, we have generated 4 billion dollars in free cash flow, and reduced our net debt ratio by 8.1 percentage points since the start of the year. We expect to deliver around 5% production growth this year, and at the same time realise an additional one billion dollars in efficiencies,” says Eldar Sætre, President and CEO of Statoil ASA.

2017, July, 26, 14:55:00

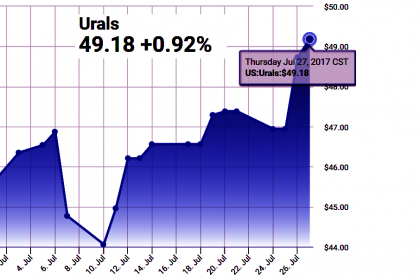

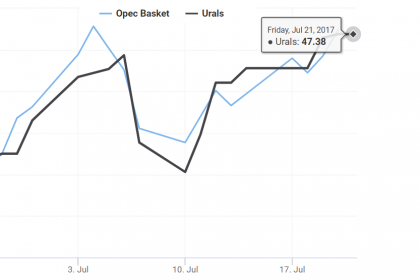

OIL PRICES: ABOVE $50

Brent crude futures LCOc1 rose 30 cents to $50.50 a barrel by 0959 GMT, after rallying more than 3 percent on Tuesday.

U.S. West Texas Intermediate futures CLc1 climbed 40 cents to $48.29 a barrel.

2017, July, 26, 14:40:00

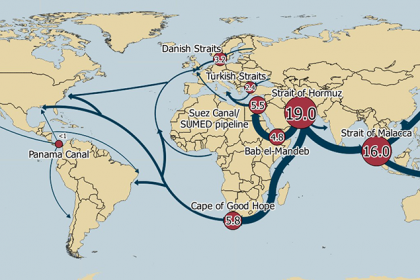

WORLD OIL CHOKEPOINTS

EIA - World chokepoints for maritime transit of oil are a critical part of global energy security. About 61% of the world's petroleum and other liquids production moved on maritime routes in 2015. The Strait of Hormuz and the Strait of Malacca are the world's most important strategic chokepoints by volume of oil transit.

2017, July, 24, 14:00:00

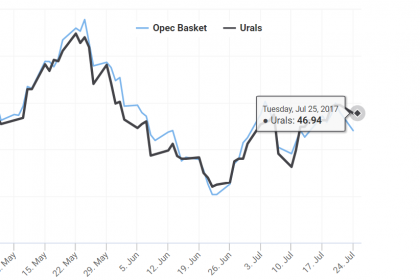

OIL PRICES: ABOVE $48 AGAIN

Brent September crude futures fell 18 cents on the day to $47.88 a barrel by 0850 GMT. The price fell 2.5 percent on Friday after a consultancy forecast a rise in OPEC production for July.

NYMEX crude for September delivery fell 20 cents to $45.57 a barrel.

2017, July, 24, 13:55:00

OIL OUTPUT CONSENSUS

With prices still languishing below the $55-$60/b that some ministers have said they are targeting, some market watchers say OPEC and its non-OPEC partners have no choice but to deepen cuts to make up for output gains from exempt Nigeria and Libya, as well as sliding compliance from other members.