Analysis

2017, April, 27, 20:00:00

TOTAL NET INCOME $2.8 BLN

"Supported by the OPEC/non-OPEC agreement, Brent prices remained volatile in the context of high inventories and averaged 54 $/b this quarter. In this environment, Total's adjusted net income increased by 56% to $2.6 billion in the first quarter 2017, in line with the strong recent quarterly results of 2016, due to good operational performance and a steadily decreasing breakeven. Excluding acquisitions and asset sales, the Group generated $1.7 billion of cash flow after investments, mainly due to a 63% increase in operating cash flow before working capital changes from the Exploration & Production segment and investment discipline."

2017, April, 27, 19:05:00

OIL PRICES: ABOVE $51 AGAIN

U.S. West Texas Intermediate (WTI) crude oil futures were trading at $49.37 per barrel at 0644 GMT, down 25 cents, or 0.5 percent from their last close. WTI has lost around 8.5 percent in value from its April peak.

Brent crude futures, the international benchmark for oil prices, were at $51.63 per barrel, down 19 cents, or 0.37 percent. Brent is almost 9 percent below its April peak.

2017, April, 27, 18:50:00

OIL PRICES FORECAST: $55 - $60

The World Bank is holding steady its crude oil price forecast for this year at $55 per barrel, increasing to an average of $60 per barrel in 2018. Rising oil prices, supported by production cutbacks by Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC states, will allow markets to gradually rebalance. These oil price forecasts are subject to downside risks should the rebound in the U.S. shale oil industry be greater than expected.

2017, April, 27, 18:45:00

OIL PRICE: $40

“If OPEC and the coalition don’t extend the agreement to continue cuts, that price floor will go,” he said. “Without it, prices would fall, and there’s nothing to stop oil going below $40 a barrel.”

2017, April, 27, 18:40:00

NORWAY'S OIL PRODUCTION UP 63 TBD

Preliminary production figures for March 2017 show an average daily production of 2 145 000 barrels of oil, NGL and condensate, which is an increase of 63 000 barrels per day (approx. 3 percent) compared to February.

2017, April, 25, 21:58:00

HALLIBURTON NET LOSS $32 MLN

Halliburton Company (NYSE:HAL) announced a loss from continuing operations of $32 million, or $0.04 per diluted share, for the first quarter of 2017.

2017, April, 25, 18:50:00

OIL PRICE: ABOVE $51

The June crude oil contract on the New York Mercantile Exchange dropped 39¢ on Apr. 24 to close at $49.23/bbl. The July contract decreased 39¢ to $49.58/bbl.

The natural gas price for May fell 3.5¢ to a rounded $3.07/MMbtu. The Henry Hub cash gas price was $2.98, down 6¢.

The Brent crude contract for June on London’s ICE fell 36¢ to settle at $51.60/bbl. The July contract was down 31¢ to $52.13/bbl. The May gas oil contract declined $1.75 to $465.75/tonne.

OPEC’s basket of crudes closed Apr. 24 at $49.64/bbl, down 35¢.

2017, April, 25, 18:30:00

U.S. RIGS UP 10

U.S. Rig Count is up 426 rigs from last year's count of 431, with oil rigs up 345, gas rigs up 79, and miscellaneous rigs up 2.

Canadian Rig Count is up 59 rigs from last year's count of 40, with oil rigs up 21, gas rigs up 39, and miscellaneous rigs down 1.

2017, April, 22, 12:05:00

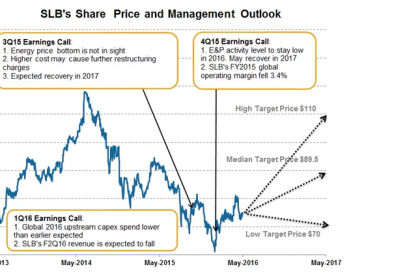

SCHLUMBERGER NET INCOME $279 MLN

Schlumberger Announces First-Quarter 2017 Results:

- Revenue of $6.9 billion decreased 3% sequentially

- GAAP EPS, including Cameron integration charges of $0.05 per share, was $0.20

- EPS, excluding Cameron integration charges, was $0.25

- Cash flow from operations was $656 million

- Quarterly cash dividend of $0.50 per share was approved

2017, April, 21, 20:45:00

ЭНЕРГЕТИЧЕСКИЕ РЕКОРДЫ РОССИИ

«Топливно-энергетический комплекс (для нас это важный сектор) демонстрировал уверенный рост и даже рекорды: во-первых, по добыче и экспорту нефти, причём за счёт месторождений, для которых были приняты специальные режимы; во-вторых, по добыче угля; в-третьих, по экспорту газа. В-четвёртых, очень хорошие показатели были достигнуты по генерации электроэнергии атомными электростанциями», - отметил Председатель Правительства РФ.

2017, April, 21, 20:40:00

U.S. PETROLEUM DELIVERIES UP 0.2%

Total petroleum deliveries in March moved up 0.2 percent from March 2016 to average nearly 19.7 million barrels per day. These were the highest March deliveries in nine years, since 2008. For the first quarter of 2017, total domestic petroleum deliveries, a measure of U.S. petroleum demand, were up 0.4 percent compared with the first quarter of 2016 to average 19.5 million barrels per day. These were the highest first quarter deliveries since 2008. According to the U.S. Bureau of Labor Statistics (BLS) April 7, 2017 report, the U.S. added 98,000 jobs in March. In addition, the unemployment rate (4.5 percent) and the number of unemployed persons (7.2 million) were down from prior month and the prior year.

2017, April, 20, 19:35:00

OIL PRICE: STILL ABOVE $54

Brent crude futures were at $53.34 per barrel at 0715 GMT (3:15 a.m. ET), up 41 cents, or 0.77 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures were up 32 cents, or 0.63 percent, to $50.76 a barrel.

2017, April, 19, 18:00:00

OIL PRICE: STILL ABOVE $54

The crude oil contract for May delivery on the New York Mercantile Exchange fell 53¢ on Apr. 17 to close at $52.65/bbl. The June contract lost 49¢ to $53.11/bbl.

The natural gas price for May declined 6.4¢ to a rounded $3.16/MMbtu. The Henry Hub cash gas price closed Apr. 17 at $3.06/MMbtu, up 8¢.

The Brent crude contract for June on London’s ICE also declined 53¢, settling at $55.36/bbl. The July contract was down 49¢ to $55.88/bbl. The gas oil contract for May lost 25¢ at $497.75/tonne.

The average price for OPEC’s basket of benchmark crudes on Apr. 17 was $52.94/bbl, down 43¢.

2017, April, 14, 18:40:00

IEA: OIL MARKET BALANCE

It can be argued confidently that the market is already very close to balance, and as more data becomes available this will become clearer.

2017, April, 14, 18:30:00

U.S. RIGS UP 8

U.S. Rig Count is up 407 rigs from last year's count of 440, with oil rigs up 332, gas rigs up 73, and miscellaneous rigs up 2.

Canadian Rig Count is up 78 rigs from last year's count of 40, with oil rigs up 30 and gas rigs up 48.