Analysis

2015, May, 28, 19:00:00

RUSSIA & OPEC STRATEGY

OPEC, which controls a third of the global oil market, and Russia, which produces another 12 percent, are unlikely to reverse their output strategy.

2015, May, 24, 19:55:00

RUSSIA & TURKEY STREAM

Russian energy company Gazprom has made it clear that it intends to move forward with the construction of the Turkish Stream natural gas pipeline as quickly as possible, whether or not the project can overcome political obstacles in Europe.

2015, May, 20, 18:45:00

OIL PRICES MOVES

The dollar was a contributing factor to oil’s crash between June and January as it rose 16 per cent against a basket of other currencies. However, the 60 per cent decline in crude from about $115 to $45 a barrel over the same period illustrates how crude was largely trading on its own fundamentals, as the US shale boom contributed to oversupply.

2015, May, 4, 12:10:00

RUSSIA&TURKEY STREAM

Last December Moscow took Europe by surprise with an announcement that South Stream, a 63 billion cubic metre (bcm) pipeline designed to bring Russian natural gas to southern Europe across the Black Sea would be scrapped and replaced with a pipeline of similar capacity that would cross Turkey and stop at its border with Greece.

2015, April, 30, 18:55:00

EU VS GAZPROM

Russian natural gas accounts for roughly a third of all foreign supplied natural gas coming into Europe. Russia’s biggest partner is Germany. In that state, Russia’s presence is on the upswing.

2015, April, 24, 22:45:00

OIL MARKET REBALANCING

Global oil demand is set to rise by 1 million or even 1.5 million barrels per day (bpd) in 2015, according to a range of forecasters.

2015, April, 24, 22:15:00

RUSSIA HAS A FIVE YEARS

Russia has a five year window, at best, to successfully enter the global LNG markets and even that window is closing fast. That sentiment was the major takeaway from the recent Russian LNG Congress in Moscow.

2015, April, 24, 22:10:00

RUSSIA GAS WEAKENS

Turkey's relationship with Russia is changing significantly. A domestic economic crisis, low energy prices and European energy diversification efforts have weakened Russia.

2015, April, 16, 19:55:00

RUSSIAN GAS STRATEGY

On December 1 2014, during his official visit to Turkey, Russian President Vladimir Putin announced the suspension of South Stream, blaming the EU for its “unconstructive” position. In fact, the realization of pipeline had become untenable as a result of various legal, political and financial issues, such as the EU’s Third Energy Package, the Ukraine crisis and the ensuing sanctions over companies involved in South Stream (Stroytransgaz and Gazprombank).

2015, April, 14, 19:35:00

EU GAS OPPORTUNITIES

Russia is the main supplier of crude oil and natural gas to the EU, and although diversifying away from Russian gas is not unrealistic in the medium term, several technical and political obstacles must be overcome.

2015, April, 7, 20:55:00

U.S. SEISMIC SHIFTS

A barrel of crude oil costs under $50, having more than halved in price since June. This means wells are pumping out smaller profits, if not losses. When oil prices plunge and billions of dollars are at stake, oil companies tend to respond quickly to curb production. The number of active rigs has fallen 50 percent since October, according to Baker Hughes, the oilfield services company. This has led to layoffs, tighter budgets and fewer orders for equipment, all which hurt growth.

2015, April, 7, 20:50:00

U.S. CUTTING JOBS

With crude oil prices dropping near $40 a barrel in March, area industry leaders are reacting to the deflated market prices by cutting jobs and ramping down production.

2015, April, 7, 20:40:00

U.S.: 100 RIGS WILL FALL

U.S. companies remain nervous about oil prices. Spending has been cut as prices fail to rebound significantly, and further price drops could quickly lead to more shrinkage in the rig count.

2015, April, 4, 14:00:00

RUSSIA & EUROPE GAS

Currently the project is moving forward, as Moscow and Ankara have signed the MoU, approved the new pipeline route and agreed upon the 10.25% gas discount for Turkey. On the EU side there are many questions, including the one on infrastructure that would have to be in place to transport gas from the Turkish-Greek border, envisaged as the new pipeline’s gas delivery point.

2015, April, 4, 13:20:00

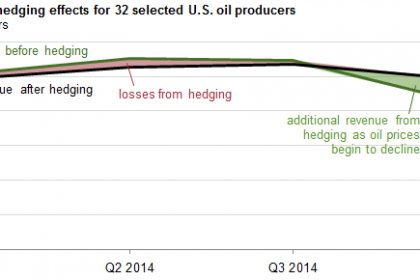

HEDGING HELPS

The decline in crude oil prices since last summer has had a direct impact on oil producers' sales revenue, but hedging strategies have lessened the effects of lower prices on some producers' total revenue. Oil producers who adopt hedging strategies can reduce their price risk and generate smoother financial outcomes in unstable markets. A common hedging practice is to sell futures and swaps to lock in desired prices for future production, a practice that can shield producers' revenue from decreasing prices.