Analysis

2016, May, 30, 18:10:00

MAJORS DEBT UP TO $383 BLN

The aggregate net debt of the 15 largest North American and European oil groups rose to $383bn at the end of March, up $97bn from 12 months ago.

2016, May, 30, 18:05:00

NIGERIAN OIL DOWN 50%

Nigeria's crude oil and condensate production has fallen almost 50% from the start of the year to around 1.1 million b/d.

2016, May, 30, 18:00:00

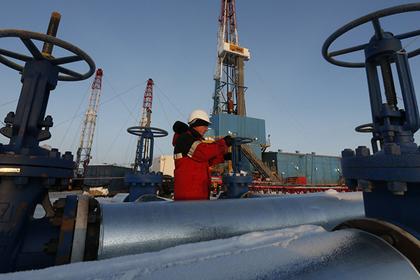

U.S. RIGS UNCHANGED

U.S. Rig Count is unchanged from last week at 404, with oil rigs down 2 to 316, gas rigs up 2 to 87, and miscellaneous rigs unchanged at 1.

Canadian Rig Count is down 1 rig from last week to 43, with oil rigs down 2 to 14, gas rigs up 1 to 28, and miscellaneous rigs unchanged at 1.

2016, May, 26, 21:00:00

OIL RESERVES LESS

With most companies indicating continued reductions in E&D budgets absent a meaningful increase in crude oil prices, proved reserves additions will likely continue to decline.

2016, May, 23, 21:00:00

OIL PRICES DOWN TO $48

Brent futures LCOc1 were down 18 cents at $48.54 a barrel as of 0421 GMT, after ending the previous session 9 cents down.

U.S. crude futures CLc1 fell 26 cents to $48.15 a barrel, having settled down 41 cents in the previous session.

2016, May, 23, 20:55:00

АСЕАН: РАСТУЩИЙ РЫНОК

Министр энергетики отметил, что страны АСЕАН являются одними из наиболее быстро растущих в мире по темпам роста объемов потребления энергии.

«Сегодня в этом регионе потребляется вдвое меньше энергии, чем в среднем по миру, при этом с 1990 г. энергопотребление выросло в 2,5 раза», - отметил Александр Новак.

По его словам, эта тенденция открывает для России «окно возможностей», связанных с поставками энергоресурсов, технологий и оборудования.

2016, May, 23, 20:50:00

RUSSIA & CHINA OIL RECORD

China's crude oil imports from Russia surged 52.4 percent in April from a year earlier to reach a record 1.17 million barrels per day (bpd), customs data showed on Monday, ahead of the previous record of 1.13 million bpd in December.

2016, May, 23, 20:45:00

JAPAN'S INVESTMENT DOWN BY 40%

International Energy Agency (IEA) Executive Director Fatih Birol said last month that global upstream investment fell by 24 percent in 2015 and is set to fall by 18 percent in 2016.

2016, May, 23, 20:40:00

JAPAN PAY LESS

The average price of LNG shipments into the country was about $6.32 per million British thermal units in April, the least since August 2005, according to Bloomberg calculations based on preliminary data from the Ministry of Finance. Prices are expected to rebound in coming months as crude values have surged, according to Junzo Tamamizu, managing partner at Clavis Energy Partners LLC.

2016, May, 23, 20:30:00

KCA DEUTAG LOSS $29 MLN

The KCA Deutag Way is the combination of worldwide standards, tried and tested policies and procedures, pragmatic work guidelines and core behaviours that help us live and work by our values. It governs how we behave as colleagues and as a company. It ensures we operate safely, succeed globally and our customers enjoy a world class service.

2016, May, 22, 15:20:00

SAUDI NEED MORE MONEY

Saudi Arabia’s debt plans come as falling oil prices encourage other Gulf countries, including Abu Dhabi and Oman, to turn to capital markets for funding, setting a new record for borrowing by Middle Eastern governments so far in 2016. This week, Qatar said it was looking to tap dollar bond markets for the first time in five years.

2016, May, 22, 15:05:00

U.S. OIL DEMAND UP, PRODUCTION DOWN

Crude oil production fell 7.8 percent from April 2015 to average 8.9 million barrels per day in April, the lowest output level in 20 months. Natural gas liquids (NGL) production, a co-product of natural gas production, rose from prior year. NGL production in April averaged 3.3 million barrels per day, 0.7 percent higher than last year. This was the highest April output level on record.

2016, May, 22, 15:00:00

U.S. RIGS DOWN 2

U.S. Rig Count is down 2 rigs from last week to 404, with oil rigs unchanged at 318, gas rigs down 2 to 85, and miscellaneous rigs unchanged at 1.

Canadian Rig Count is up 1 rig from last week to 44, with oil rigs unchanged at 16, gas rigs up 1 to 27, and miscellaneous rigs unchanged at 1.

2016, May, 19, 20:55:00

OIL PRICES UP TO $48

The Brent crude contract for July on London's ICE was up $1.14 to $48.97/bbl. The August contract gained $1.29 to $49.43/bbl. The June gas oil contract gained $11.50 to $430.25/tonne.

2016, May, 19, 20:50:00

U.S. ENERGY DEBT: $370 BLN

"[Oil’s recent rise] is not enough," said Dicker. "You can’t find the financing to keep the lights on at $50 oil. Most of these guys won’t be able to keep the lights on at $65 or $70 oil."