Oil

2019, March, 22, 10:15:00

SAUDI'S OIL WILL DOWN

Saudi Arabia will supply its clients with significantly less oil than they requested in April, extending deeper-than-agreed oil production cuts into a second month, a Saudi official familiar with the policy said.

2019, March, 22, 10:10:00

BRITAIN NEED INVESTMENT $265 BLN

Oil & Gas UK estimates exploration and production companies would have to spend about $265 billion between 2019-35 to realize industry’s expectations outlined in Vision 2035 on the UK Continental Shelf (UKCS).

2019, March, 22, 09:55:00

PETROCHINA NET PROFIT UP 130.7%

PetroChina Company Limited (“the Company”, HKSE: 0857; NYSE: PTR; SSE: 601857) announced that the Company’s high-quality development is starting to achieve good results, with net profit increasing substantially by 130.7% year-on-year in 2018.

2019, March, 22, 09:50:00

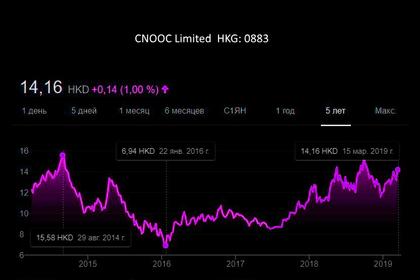

CNOOC NET PROFIT UP 113.5%

Net profit increased significantly and financial status remained healthy

All-in cost of US$30.39/boe, down 6.6% YoY; Net profit of RMB 52.69 billion, up 113.5% YoY; Final dividend of HK$0.40 per share (tax inclusive)

2019, March, 20, 11:35:00

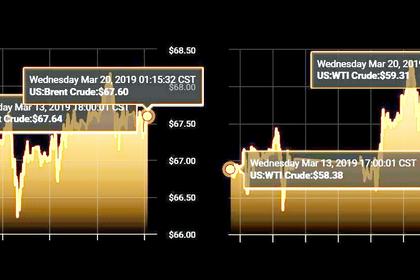

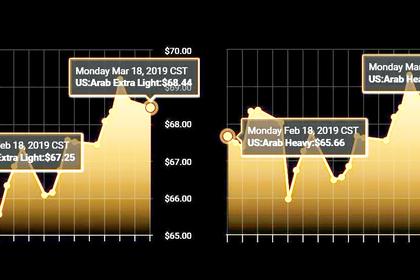

OIL PRICE: ABOVE $67 AGAIN

Oil prices edged up on Wednesday, supported by ongoing supply cuts led by producer club OPEC and U.S. sanctions against Iran and Venezuela,

2019, March, 20, 11:30:00

РОССИЯ ВЫПОЛНИТ 100%

Обсудить с компаниями эффективность сделки Минэнерго планирует во втором квартале этого года. И только затем у России появится взвешенное мнение о судьбе сделки, которое, в том числе, будет продиктовано ситуацией на мировом рынке, подчеркнул Александр Новак. По его словам, 100%-ого исполнения сделки Россия планирует достигнуть к концу марта - началу апреля этого года.

2019, March, 20, 11:15:00

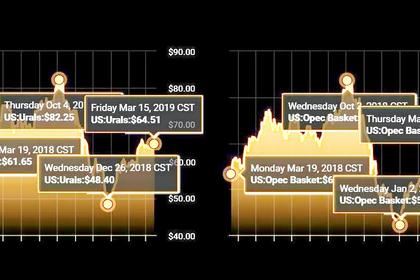

ЦЕНА URALS: $ 65,06525

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 февраля года по 14 марта 2019 года составила $ 65,06525 за баррель, или $ 475 за тонну. Согласно расчетам Минфина России экспортная пошлина на нефть в РФ с 1 апреля 2019 года повысится на $ 6,2 и составит $ 97,4 за тонну.

2019, March, 20, 11:05:00

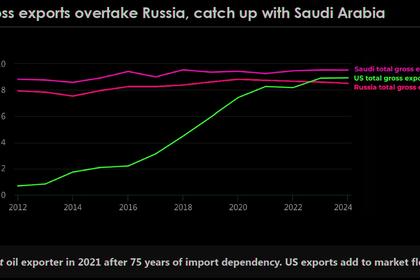

U.S. OIL WILL UP

IEA - The United States will drive global oil supply growth over the next five years thanks to the remarkable strength of its shale industry, triggering a rapid transformation of world oil markets

2019, March, 20, 11:00:00

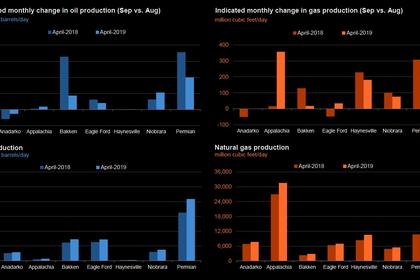

U.S. PRODUCTION: OIL + 85 TBD, GAS + 883 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 85,000 b/d month-over-month in April from 8,507 to 8,592 thousand barrels/day , gas production to increase 883 million cubic feet/day from 78,137 to 79,020 million cubic feet/day .

2019, March, 20, 10:55:00

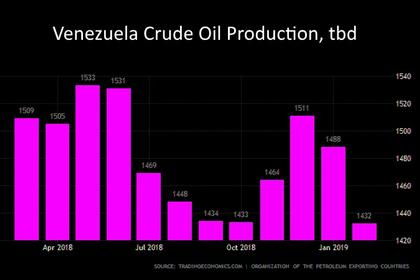

VENEZUELA'S OIL PRODUCTION 1.2 MBD

IEA - Until recently, Venezuela’s oil production had stabilised at around 1.2 mb/d. During the past week, industry operations were seriously disrupted and ongoing losses on a significant scale could present a challenge to the market.

2019, March, 18, 13:30:00

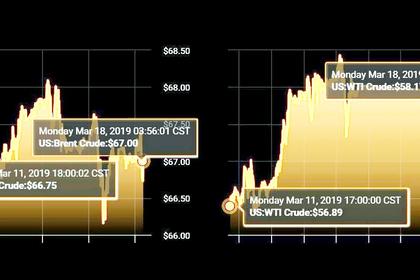

OIL PRICE: NEAR $67 YET

Oil prices were mixed on Monday, weighed by concerns that an economic downturn may dent fuel consumption, but supported by supply cuts led by producer group OPEC and U.S. sanctions against Iran and Venezuela.

2019, March, 18, 13:25:00

СПЛОЧЕННОСТЬ, РЕШИМОСТЬ, СТАБИЛЬНОСТЬ

«Уверен, что благодаря нашей сплоченности и решимости мы сможем добиться успеха в деле поддержания долгосрочной стабильности на рынке в интересах экономических агентов на всём протяжении нефтяной производственной цепи»,

2019, March, 18, 13:20:00

OPEC+ WILL CUT

Saudi Arabia’s energy minister said on Monday that he was confident that OPEC and its non-OPEC partners will reach full conformity with cuts, and even exceed it, in weeks to come.

2019, March, 18, 13:15:00

OPEC+ JOB NOT ENOUGH

Saudi Arabia said on Sunday OPEC’s job in rebalancing the oil market was far from done as global inventories were still rising despite harsh U.S. sanctions on Iran and Venezuela, signaling it may need to expand output cuts into the second half of 2019.

2019, March, 18, 13:10:00

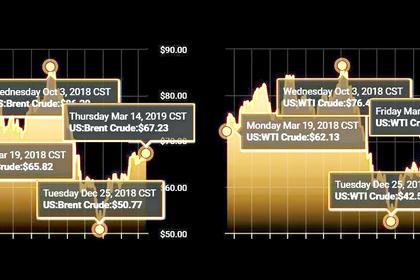

BRENT OIL: UNDERVALUED

In the context of supply and demand balance,the current price of BRENT oil is undervalued.Neither OPEC nor the IEA has considerably brought down their forecasts for global oil demand in the current year.