Search Results

2015, March, 25, 20:30:00

U.S.: LAYING OFF

OPEC and lower global oil prices delivered a one-two punch to the drillers in North Dakota and Texas who brought the U.S. one of the biggest booms in the history of the global oil industry.

2015, January, 31, 15:55:00

U.S.: 90 RIGS DOWN

The US drilling rig count plunged 90 units—a majority of which were in Texas—to settle at 1,543 rigs working during the week ended Jan. 30, Baker Hughes Inc. reported.

2015, January, 6, 13:25:00

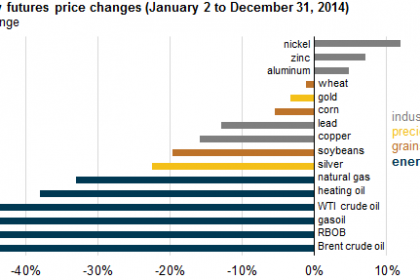

ENERGY PRICE DECLINES

Two benchmark crude oils, West Texas Intermediate (WTI) and Brent, make up about 67% of the weighting in the S&P GSCI energy index. Petroleum-based products (gasoline, heating oil, and gasoil) together comprise another 29% of the S&P GSCI energy index, and because prices for these products generally follow crude oil prices, the index tends to follow the major price movements in the crude oil market.

2014, December, 9, 21:00:00

SHALE GAS DECLINE

The recent confidence in shale gas was likely premature, according to several new reports published in the US. In particular a study from the University of Texas claims the US boom will tail off by 2020 and not keep going to 2040 as previous less thorough analyses have predicted.

2014, November, 29, 20:25:00

OIL PRICES: FURTHER DECLINES

Brent and West Texas Intermediate crudes fell to the lowest level in more than four years after OPEC failed to cut its output in response to a glut.

2014, November, 9, 13:45:00

OIL PRICES & U.S. JOBLESS

West Texas Intermediate and Brent oils increased after U.S. employment gains exceeded 200,000 for a ninth month and the jobless rate dropped to a six-year low, bolstering the fuel demand outlook.

2014, November, 4, 19:50:00

OIL PRICES DROPPED

West Texas Intermediate dropped to the lowest intraday level in three years as Saudi Arabia cut prices for crude exports to U.S. customers amid speculation that stockpiles increased. Brent extended losses in London.

2014, October, 17, 20:45:00

BRENT/WTI DIFFERENCE

The Brent-WTI spread, the difference between the front month futures price of North Sea Brent crude oil and that of West Texas Intermediate (WTI) crude oil, narrowed to $2.00 per barrel (bbl) as of October 15, after reaching a 2014 high of $14.95/bbl in January

2014, October, 11, 19:30:00

OIL PRICES DOWN

West Texas Intermediate extended its slump into a bear market amid speculation that rising global oil supplies will be more than enough to meet slowing demand. London’s Brent traded at the lowest price since December 2010.

2014, October, 8, 20:40:00

IVORY COAST NEED MONEY

Ivory Coast will seek investors in its available offshore oil acreage, including seven new ultra-deep water blocks in the Gulf of Guinea, at a promotional event in Texas next week, a senior oil ministry official said on Tuesday.

2014, October, 2, 20:00:00

EXXON FINDING IN RUSSIA

At another time or in a different place, the oil and gas field ExxonMobil has discovered in the Russian Arctic would have been a cause for jubilation at its Texas headquarters.

2014, September, 30, 20:31:00

OIL PRICES

West Texas Intermediate crude fell from the highest price in seven days as concern eased over the risk of a supply disruption in the Middle East. Brent declined in London.

2014, September, 25, 20:55:00

EIA: OIL $150/BARREL

Crude oil would cost at least $150 a barrel due to supply disruptions in the Middle East and North Africa were it not for rising production in North Dakota and Texas

2014, January, 31, 11:40:00

KOCH BROTHERS OIL & GAS

PRNEWSWIRE - Charles and David Koch of Kansas are the wealthiest individuals in America's oil and gas sector, with a combined net worth of US$83 billion, according to a Wealth-X Top 10 list that includes billionaires from Texas, New York and Oklahoma.