Trends

2017, July, 17, 14:10:00

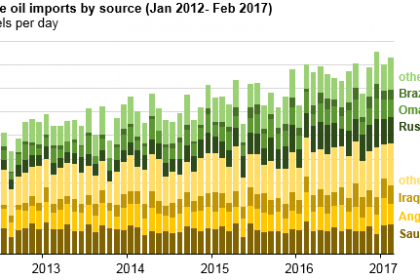

CHINA'S ENERGY DEMAND UP

CHINA will accelerate expanding oil and gas distribution in the next decade to ensure energy security and help boost industry, its top economic and energy planners said.

2017, July, 17, 14:05:00

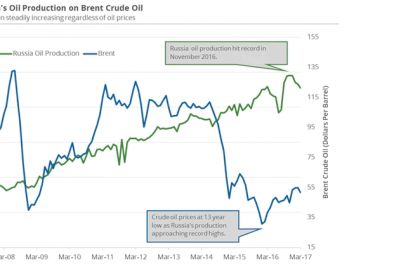

U.S. & RUSSIA: LIMITED IMPACT

The U.S. shale boom—which reshaped world markets for crude oil and natural gas before Mr. Trump took office—has only limited impact on Russia’s standing as a major energy provider to Europe and Asia.

2017, July, 17, 14:00:00

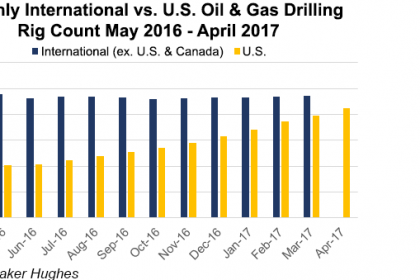

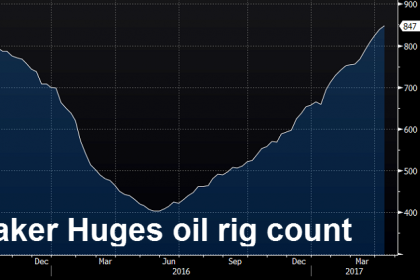

U.S. DRILLING UP 62%

API announced that estimated total wells drilled and completed in the second quarter of 2017 increased 62 percent compared to the second quarter of 2016. This includes a 41 percent increase in estimated development gas well completions and a dramatic 81 percent increase in total estimated oil well completions from year-ago levels. Total estimated oil well completions also increased 19 percent from the first quarter of 2017. Growing well completion figures could lead to an increase in U.S. oil production, which rose 62 percent from 2010 to 2016, and U.S. natural gas production which, also increased 26 percent during the same time.

2017, July, 17, 13:55:00

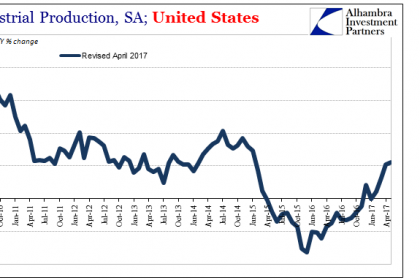

U.S. FRB: INDUSTRIAL PRODUCTION UP 0.4%

Industrial production rose 0.4 percent in June for its fifth consecutive monthly increase. Manufacturing output moved up 0.2 percent; although factory output has gone up and down in recent months, its level in June was little different from February. The index for mining posted a gain of 1.6 percent in June, just slightly below its pace in May. The index for utilities, however, remained unchanged. For the second quarter as a whole, industrial production advanced at an annual rate of 4.7 percent, primarily as a result of strong increases for mining and utilities. Manufacturing output rose at an annual rate of 1.4 percent, a slightly slower increase than in the first quarter. At 105.2 percent of its 2012 average, total industrial production in June was 2.0 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in June to 76.6 percent, a rate that is 3.3 percentage points below its long-run (1972–2016) average.

2017, July, 17, 13:50:00

IMF NEED RUSSIA

Directors underscored that accelerated structural reforms and broader trade relations can help promote a diversified export mix. They also urged the authorities to strengthen property rights, advance privatization, improve governance, and invest in innovation and infrastructure to build the foundations for higher potential growth.

2017, July, 17, 13:40:00

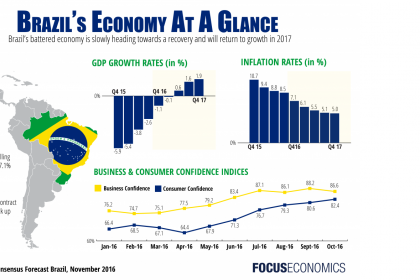

IMF WANT BRAZIL

Directors observed that the financial sector has remained sound despite the severe stresses. To make the system more robust, they encouraged actions to further strengthen financial safety nets through enhanced monitoring and an improved crisis management framework. Directors underscored the need for continued vigilance and close monitoring of the health of the corporate sector and its impact on the banking system.

2017, July, 17, 13:35:00

IMF HAS EGYPT

The approval by the IMF Executive Board of the First Review of the program shows the IMF’s strong support for Egypt in these efforts.

2017, July, 17, 13:30:00

U.S. RIGS UNCHANGED

U.S. Rig Count is up 505 rigs from last year's count of 447, with oil rigs up 408, gas rigs up 98, and miscellaneous rigs down 1 to 0.

Canadian Rig Count is up 96 rigs from last year's count of 95, with oil rigs up 62, gas rigs up 35, and miscellaneous rigs down 1 to 0.

2017, July, 14, 09:55:00

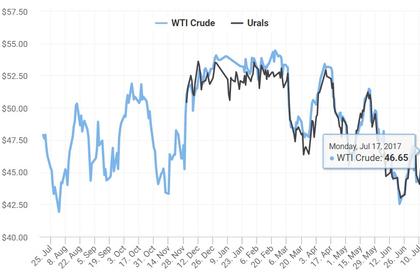

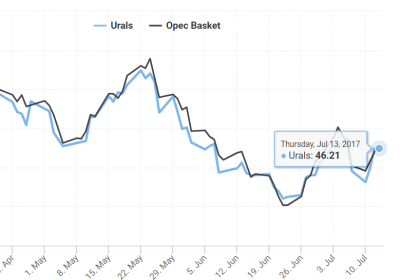

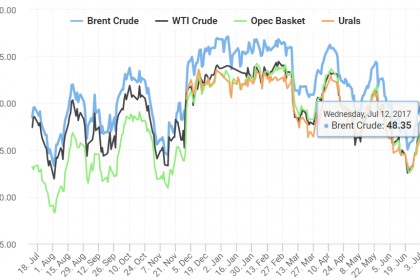

OIL PRICES: ABOVE $48 ANEW

Brent crude futures LCOc1, the international benchmark for oil prices, were down 7 cents, or 0.1 percent, at $48.35 per barrel at 0443 GMT (12:43 a.m. ET), but up 3.5 percent for the week.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $45.97 per barrel, down 11 cents, or 0.2 percent, but up around 4 percent over the week.

2017, July, 14, 09:50:00

СТАБИЛИЗАЦИЯ РЫНКА

«На наш взгляд, текущая ситуация, при которой все страны выполняют соглашение на уровне 100% и выше, способствует стабилизации нефтяных рынков. Мы видим положительный эффект от данной инициативы и считаем, что продление дает позитивный сигнал участникам рынка», - сказал Александр Новак.

2017, July, 14, 09:45:00

EIA OIL PRICES FORECASTS: $51 - $52

EIA now forecasts Brent crude oil spot prices to average $51 per barrel (b) in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are expected to be $2/b lower than Brent prices in 2017 and 2018.

2017, July, 14, 09:40:00

BP: EXCELLENCE, SUSTAINABILITY, COLLABORATION

I think there are three areas where we should focus our efforts.

The first is excellence in our operations, or as this session’s title puts it, leadership in responsible operations.

The second, is sustainability in our products - fully realising the benefits of both natural gas and renewables as well as our Downstream product range.

And the third is collaboration, or simply working together, in our partnerships - the kind of working together that makes new things happen and drives real change.

2017, July, 14, 09:35:00

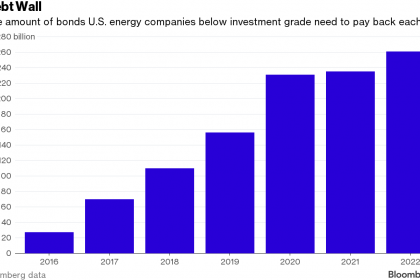

U.S. OIL DEBT

From 2012 through the end of 2015, debt was a significant source of capital for the producers included in the analysis, with the addition of a cumulative $55.3 billion in net debt. Since the beginning of 2016, however, these producers have reduced debt by $1.4 billion. The combination of higher equity and lower debt has resulted in the long-term debt-to-equity ratio, a measure of financial leverage, declining from 88% to 80% for the group of companies as a whole between the first quarter of 2016 and the first quarter of 2017.

2017, July, 14, 09:30:00

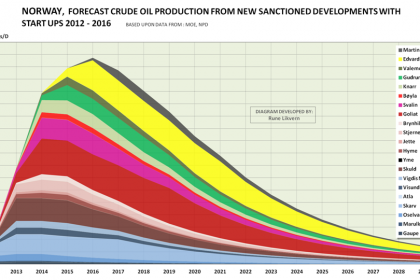

NORWAY'S PRODUCTION DOWN 116 TBD

Preliminary production figures for June 2017 show an average daily production of 1 884 000 barrels of oil, NGL and condensate, which is a decrease of 116 000 barrels per day compared to May.

2017, July, 12, 14:35:00

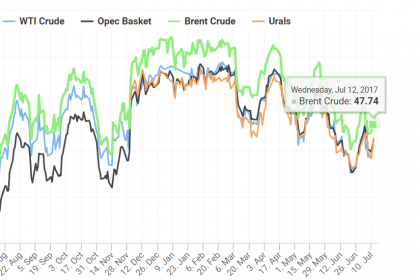

OIL PRICES: ABOVE $48

Oil prices rose more than 1 percent on Wednesday, extending gains from the previous day as the U.S. government cut its crude production outlook for next year and as fuel inventories plunged.

Brent crude futures were up 60 cents, or 1.3 percent, at $48.12 per barrel by 0657 GMT, while U.S. West Texas Intermediate (WTI) crude futures were at $45.72 per barrel, up 68 cents, or 1.5 percent.