Trends

2024, March, 5, 06:30:00

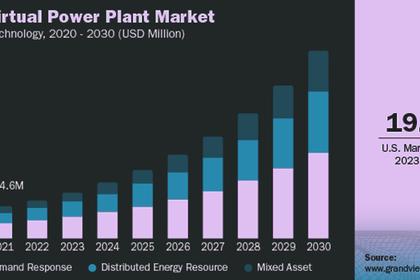

VIRTUAL POWER PLANT INVESTMENT $100 MLN

Google, long interested in clean energy and conservation, is spinning out its Google Nest Renew business and Sidewalk Infrastructure Partners (SIP) is combining it with OhmConnect to create a new company in which SIP will make an initial $100 million investment.

2024, March, 5, 06:25:00

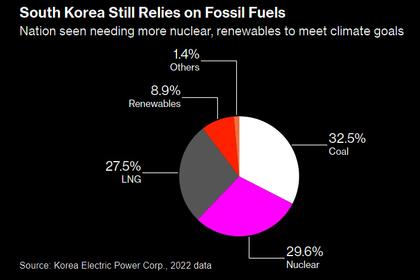

S.KOREA NUCLEAR DEVELOPMENT $3 BLN

South Korea has 25 nuclear power reactors with a total capacity of 24.7 GWe at the end of 2023. According to the state-run utility Korea Hydro & Nuclear Power, in 2022, these plants generated nearly 30% of all electricity, up from 23% in 2018.

2024, February, 28, 07:00:00

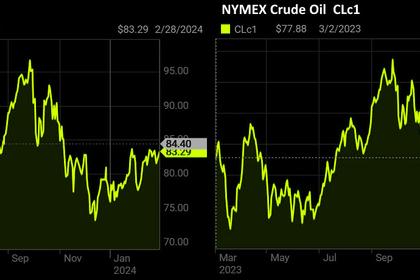

OIL PRICE: BRENT ABOVE $83, WTI ABOVE $78

Brent fell 30 cents, or 0.36%, to $83.35 a barrel, WTI dropped 28 cents to $78.59 a barrel.

2024, February, 28, 06:45:00

QATAR LNG WILL UP

Qatar’s push highlights the importance of gas for the country. Exports of the fuel are the country’s biggest revenue earner which has already made it one of the wealthiest countries and helped boost its global clout since it started shipments about two decades ago.

2024, February, 28, 06:40:00

DIGITAL ENERGY TRANSFORMATION

Digitalization in the energy sector entails automating business processes and workflows, resulting in increased efficiency and cost reduction.

2024, February, 26, 07:00:00

OIL PRICE: BRENT ABOVE $81, WTI ABOVE $76

Brent fell 35 cents, or 0.4%, to $81.27 a barrel, WTI declined 35 cents, or 0.5%, to $76.14 a barrel.

2024, February, 26, 06:45:00

CHINA'S COAL ELECTRICITY

China saw a robust increase in its peak power demand in 2021-2022 due to an increase in the prevalence of air conditioners amid exceptionally intense heat waves. This prompted an enhancement of more coal-based power generation capacity as a "costly and suboptimal solution,"

2024, February, 26, 06:35:00

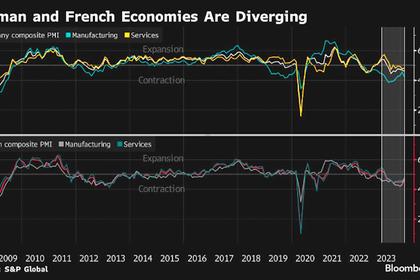

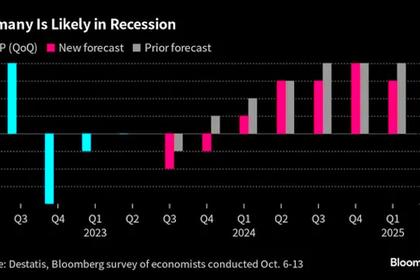

GERMANY'S RECESSION UP

The government on Wednesday slashed its growth forecast for this year to 0.2% from 1.3%, after a contraction in 2023.

2024, February, 21, 07:00:00

OIL PRICE: BRENT ABOVE $82, WTI ABOVE $77

Brent rose 30 cents or 0.36% to $82.64 a barrel, WTI were up 26 cents or 0.34% at $77.30.

2024, February, 21, 06:45:00

GERMANY IN RECESSION

While the outlook is weak, the bank said it expects no major deterioration in the labour market, which has insulated the economy so far, and Germany was not facing a broad-based, prolonged recession.

2024, February, 21, 06:40:00

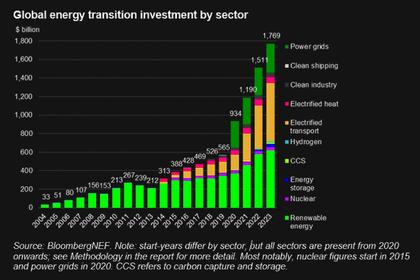

GLOBAL ENERGY INDUSTRY OPPORTUNITIES 2024

The year 2024 is projected to be a potential turning point for the power industry, as it could witness a significant shift towards renewable energy.

2024, February, 21, 06:35:00

GLOBAL ENERGY INDUSTRY DEVELOPMENT 2024

In 2024, Energy consumers have more questions about the state of the Energy Industry's current initiatives than answers. Some areas to focus on include decarbonization, technology implementation, energy storage, and emergency responses.

2024, February, 21, 06:25:00

S.KOREA NEED NUCLEAR POWER

Atomic power would need to account for 40% to 45% of electricity supply, from about 30% now, for Korea to zero out its emissions by mid-century,

2024, February, 21, 06:10:00

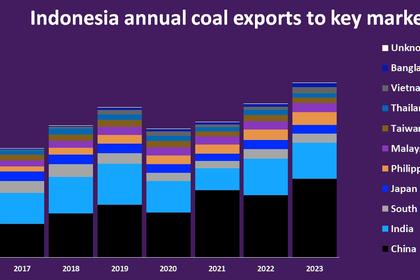

INDONESIAN COAL EXPORTS UP

For 2023 as a whole, Indonesian exports scaled a new high of 504.6 million tons, so if the blistering pace of exports seen so far this year is sustained, 2024 will mark a new high for Indonesian exports of the power fuel.

2024, February, 20, 07:00:00

OIL PRICE: BRENT ABOVE $83, WTI NEAR $80

Brent ticked down 11 cents to $83.45 a barrel, WTI rose 36 cents to $79.55 a barrel.