All publications by tag «»

2017, July, 14, 09:35:00

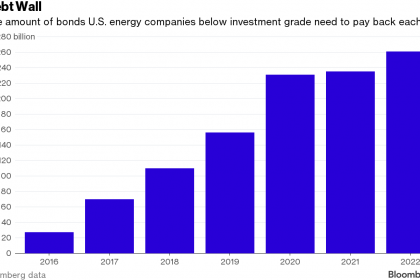

U.S. OIL DEBT

From 2012 through the end of 2015, debt was a significant source of capital for the producers included in the analysis, with the addition of a cumulative $55.3 billion in net debt. Since the beginning of 2016, however, these producers have reduced debt by $1.4 billion. The combination of higher equity and lower debt has resulted in the long-term debt-to-equity ratio, a measure of financial leverage, declining from 88% to 80% for the group of companies as a whole between the first quarter of 2016 and the first quarter of 2017.

2017, July, 14, 09:30:00

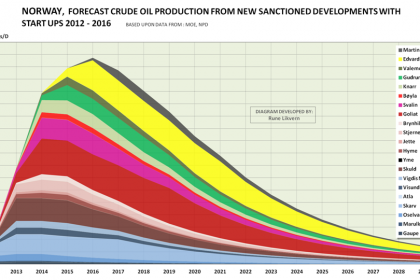

NORWAY'S PRODUCTION DOWN 116 TBD

Preliminary production figures for June 2017 show an average daily production of 1 884 000 barrels of oil, NGL and condensate, which is a decrease of 116 000 barrels per day compared to May.

2017, July, 12, 14:35:00

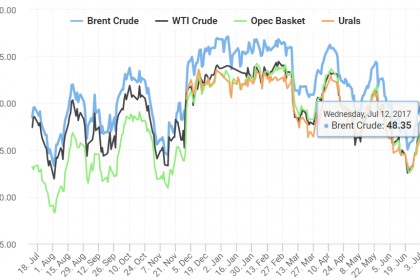

OIL PRICES: ABOVE $48

Oil prices rose more than 1 percent on Wednesday, extending gains from the previous day as the U.S. government cut its crude production outlook for next year and as fuel inventories plunged.

Brent crude futures were up 60 cents, or 1.3 percent, at $48.12 per barrel by 0657 GMT, while U.S. West Texas Intermediate (WTI) crude futures were at $45.72 per barrel, up 68 cents, or 1.5 percent.

2017, July, 12, 14:30:00

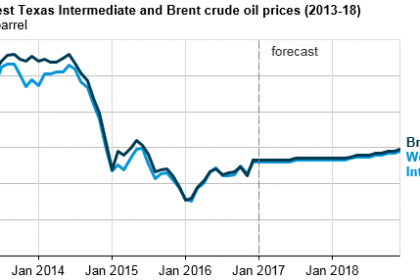

OIL&GAS PRICES FORECAST: $51-$52; $3.1-$3.4

Brent crude oil prices are forecast to average $51/b in 2017 and $52/b in 2018. Average West Texas Intermediate (WTI) crude oil prices are forecast to be $2/b lower than the Brent price in both 2017 and 2018.

Henry Hub natural gas spot prices are forecast to average $3.10 per million British thermal units (MMBtu) in 2017 and $3.40/MMBtu in 2018.

2017, July, 12, 14:25:00

РОСТ ПОТРЕБЛЕНИЯ ЭНЕРГИИ

«Будет происходить глубинное переформатирование географической структуры рынка – так, при ожидаемой стагнации или уменьшении объемов энергопотребления в странах ОЭСР, центр роста потребления сместится в страны Азии, Ближнего Востока, Африки, где потребление вырастет не менее чем в 1,5 раза»

2017, July, 12, 14:20:00

СНИЖЕНИЕ ЗАПАСОВ НЕФТИ

«Мы должны выйти на балансировку рынка и снижение запасов до среднего пятилетнего уровня к 1 апреля следующего года»

2017, July, 12, 14:15:00

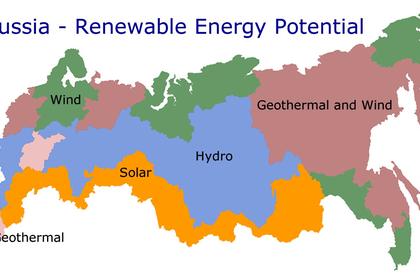

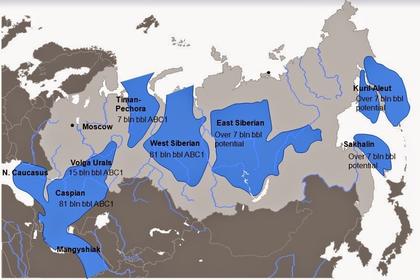

RUSSIA'S INVESTMENT POTENTIAL

"Russia is among the leading energy countries today. We see colossal unrealized potential for cooperation, for investment -- we will continue working on implementing it with all the interested parties," Novak said.

2017, July, 12, 14:10:00

IEA: ENERGY INVESTMENT UPDOWN

Total energy investment worldwide in 2016 was just over $1.7 trillion, accounting for 2.2% of global GDP. Investment was down by 12% compared to IEA’s revised 2015 energy investment estimate of $1.9 trillion.

2017, July, 12, 14:05:00

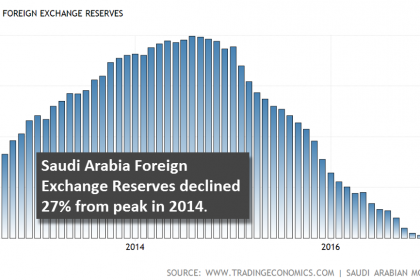

SAUDI ARAMCO INVESTMENT: $300 BLN

“Saudi Aramco plans to invest more than $300 billion over the coming decade to reinforce our preeminent position in oil, maintain our spare oil production capacity and pursue a large exploration and production program centered on conventional and unconventional gas resources.”

2017, July, 12, 14:00:00

SAUDIS WILL CUT

Saudi Arabia will cut crude oil shipments to its customers in August by more than 600,000 barrels per day to balance the rise in domestic consumption during the summer, while staying within its OPEC production commitment, a Saudi industry source said.