All publications by tag «»

2018, February, 2, 12:25:00

OIL PRICE WILL BE $80

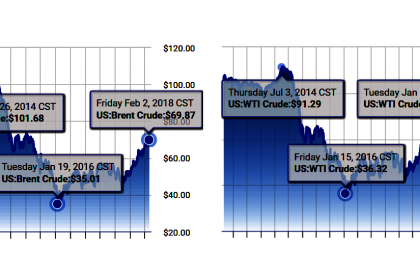

BLOOMBERG - Brent will reach $75 a barrel over the next three months and will climb to $82.50 within six months, analysts including Damien Courvalin wrote in an emailed report. Their previous estimate for both time periods was $62 a barrel.

2018, February, 2, 12:22:00

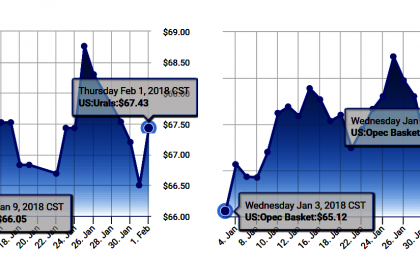

ЦЕНА URALS: $ 68,46

МИНФИН РОССИИ - Средняя цена на нефть марки Urals в январе 2018 года сложилась в размере $ 68,46 за баррель, что в 1,29 раза выше, чем в январе 2017 года ($53,16 за баррель).

2018, February, 2, 12:20:00

HEAVY ASIAN DEMAND

PLATTS - Asian demand for oil products will outweigh current and upcoming refinery capacity by 2025, Tushar Tarun Bansal, Director at McKinsey, told attendees at S&P Global Platts annual Middle Distillates Conference in Antwerp Thursday.

2018, February, 2, 12:17:00

U.S. ENERGY WAR

PLATTS - President Donald Trump said Tuesday that the "war" on American energy is over in a State of the Union speech given as US crude oil output is set to reach levels not seen in more than 47 years.

2018, February, 2, 12:15:00

CHINA'S OIL INVESTMENT UP

BLOOMBERG - The Beijing-based explorer sees capital expenditures at 70 billion to 80 billion yuan ($11.1 billion to $12.7 billion) for 2018, it said in a statement to the Hong Kong stock exchange Thursday. That’s an increase of as much as 60 percent from the previous year, which came in under target. It also raised its production estimate to between 470 million and 480 million barrels of oil equivalent, poised for the the first increase in three years.

2018, February, 2, 12:12:00

CHINA GOES NUCLEAR

REUTERS - China National Nuclear Corp (CNNC), China’s No. 2 nuclear power producer, will take over the country’s top nuclear power plant builder to create a company worth almost $100 billion, the latest state-orchestrated marriage in the nation’s vast power sector.

2018, February, 2, 12:10:00

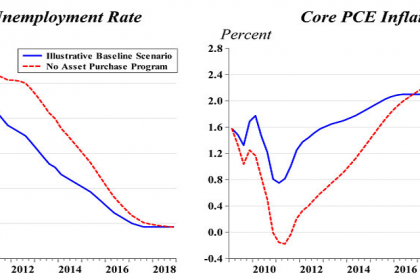

U.S. FEDERAL FUNDS RATE 1.25 - 1.5%

U.S. FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

2018, February, 2, 12:08:00

ZOHR INCREASES OUTPUT

BLOOMBERG - Zohr, the largest undersea gas discovery in the Mediterranean, will pump 1.7 billion cubic feet per day before the end of 2018, el-Molla said in a televised ceremony to inaugurate the field. Egypt is talking with Rome-based Eni to increase output to reach the 2019 production target this year instead, he said.

2018, February, 2, 12:05:00

SOUTH AFRICA'S GAS UP

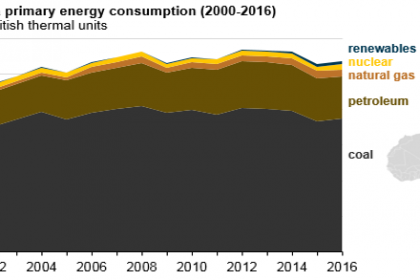

EIA - South Africa is one of the world’s leading emitters of energy-related carbon dioxide (CO2), ranking fifteenth globally in 2015 and accounting for more than any other country in Africa. In an effort to reduce CO2 emissions, South Africa is planning to diversify its energy portfolio, replacing coal with lower CO2-emitting fuels such as natural gas and renewable sources. The country’s Intended National Determined Contribution, submitted as part of the Paris Agreement, plans for CO2 emissions to peak by 2025, remain flat for a decade, and begin to decline around 2035.

2018, February, 2, 12:03:00

SHELL EARNINGS $15.8 BLN

SHELL - CCS earnings attributable to shareholders excluding identified items were $4.3 billion for the fourth quarter 2017 and $15.8 billion for the full year 2017, reflecting increased contributions from all businesses, compared with 2016. Full year earnings benefited mainly from higher realised oil, gas and LNG prices, improved refining performance and higher production from new fields, which offset the impact of field declines and divestments.