All publications by tag «PRICE»

2017, June, 21, 11:15:00

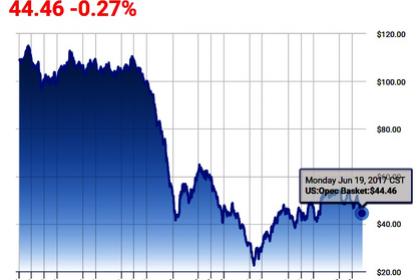

OIL PRICES DOWN 20%

Prices have fallen more than 20 per cent from their levels in early January, which they last touched in the summer of 2015. A decline of more than 20 per cent from a most recent high is typically considered a bear market.

2017, June, 21, 11:10:00

OIL PRICES MINIMUM

U.S. crude for July delivery lost 97 cents, or 2.2%, to $43.23 a barrel on the New York Mercantile Exchange, trading at prices it hasn't settled below since Aug. 10. A settlement at $43.56 a barrel or lower put oil into a bear market, which means it has lost 20% or more since the recent high, a nearly one-year high on Feb. 23.

2017, June, 21, 11:05:00

SAUDIS OIL RESOURCES UP

Saudi Arabia effectively grew its recoverable oil resources by 73 billion barrels this year after lower tax rates for state producer Saudi Aramco boosted the country's estimated prospective resources.

2017, June, 20, 14:40:00

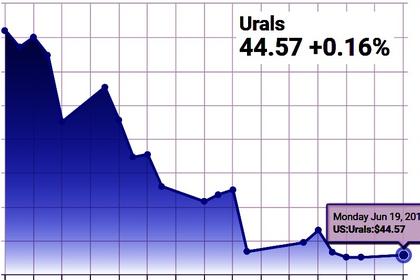

OIL PRICE: STILL ABOVE $47

Brent futures were up 4 cents at $46.95 at 0214 GMT. On Monday, they fell 46 cents, or 1 percent, to settle at $46.91 a barrel.

That was their lowest since Nov. 29, the day before the Organization of the Petroleum Exporting Countries (OPEC) and other producers agreed to cut output for six months from January.

U.S. West Texas Intermediate crude futures were down 1 cent at $44.19 a barrel. They declined 54 cents, or 1.2 percent in the previous session, to settle at $44.20 per barrel, the lowest close since Nov. 14. The July contract will expire on Tuesday and August will become the front-month.

2017, June, 20, 14:35:00

НЕФТЯНОЙ РЫНОК СТАБИЛИЗИРУЕТСЯ

По словам главы Минэнерго России, для стабилизации нефтяного рынка необходимо, чтобы запасы упали до среднего уровня за пять лет: «Мы уверены, что это произойдет в течение ближайших кварталов, возможно к концу первого квартала 2018 года. Мы мониторим текущую текущую ситуацию. На данный момент нет необходимости предпринимать какие-то дополнительные действия».

2017, June, 20, 14:30:00

OIL MARKET MOVEMENT

"In my opinion, market fundamentals are going in the right direction, but in light of the large surplus in stockpiles over the past years, the cut needs time to take effect," he told the newspaper, referring to a global deal to curb oil production.

2017, June, 9, 21:15:00

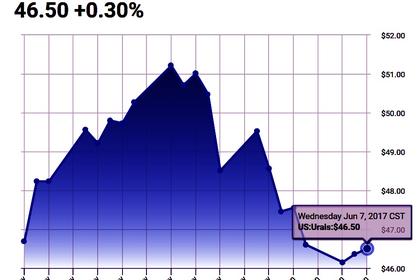

OIL PRICE: ABOVE $48

Brent crude oil LCOc1 was up 48 cents at $48.34 a barrel by 12:17 p.m. EDT. U.S. crude CLc1 was 39 cents higher at $46.04 a barrel. U.S. crude and Brent benchmarks remained on track for weekly declines of more than 3 percent, pressured by big U.S. inventories and heavy worldwide flows.

2017, June, 9, 21:10:00

GAS PRICE: $3.020

At the New York Mercantile Exchange (Nymex), the July 2017 contract price fell 5¢ from $3.071/MMBtu last Wednesday to $3.020/MMBtu yesterday.

2017, June, 8, 18:05:00

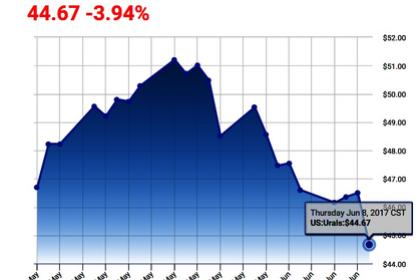

OIL PRICE: ABOVE $47

Brent crude LCOc1 was up 43 cents by 0900 GMT at $48.49 a barrel, having fallen 4 percent the day before, while U.S. crude futures CLc1 rose 38 cents to $46.10 a barrel.

2017, June, 8, 17:35:00

OIL PRODUCTION DOWN

The Organization of the Petroleum Exporting Countries (OPEC) met on May 25, 2017, and announced an extension to production cuts that were originally set to end this month. The agreed-upon OPEC crude oil production target remains at 32.5 million barrels per day (b/d) through the end of the first quarter of 2018. EIA now forecasts OPEC members’ crude oil production to average 32.3 million b/d in 2017 and 32.8 million b/d in 2018, about 0.2 million b/d and 0.4 million b/d, respectively, lower than previously forecast. However, continuing production growth in many non-OPEC countries is expected to moderate the pace of global liquid fuels inventory draws in 2017 and lead to a small inventory build in 2018.