All publications by tag «RATE»

2018, August, 3, 09:25:00

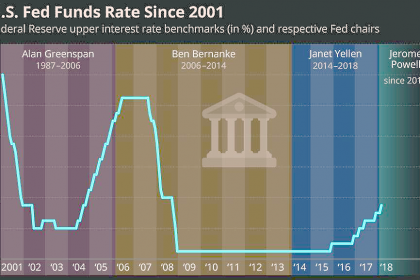

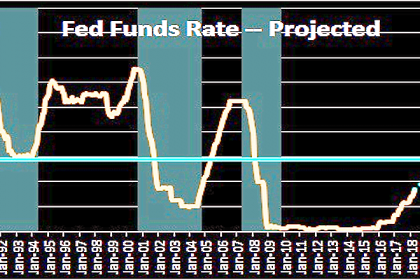

U.S. FEDERAL FUNDS RATE 1.75 - 2%

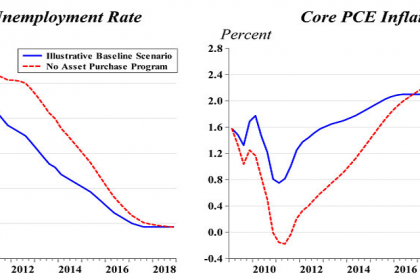

U.S. FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-3/4 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

2018, May, 4, 15:10:00

U.S. FEDERAL FUNDS RATE 1.5 - 1.75%

FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

2018, March, 28, 10:45:00

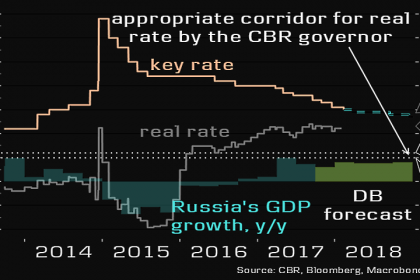

THE BANK OF RUSSIA KEY RATE 7.25%

CBRF - On 23 March 2018, the Bank of Russia Board of Directors decided to cut the key rate by 25 bp to 7.25% per annum. Annual inflation remains sustainably low. Inflation expectations are diminishing progressively. The Bank of Russia forecasts annual inflation to be 3-4% in late 2018 and remain close to 4% in 2019. In this environment the Bank of Russia will continue to reduce the key rate and will complete the transition to neutral monetary policy in 2018.

2018, February, 2, 12:10:00

U.S. FEDERAL FUNDS RATE 1.25 - 1.5%

U.S. FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

2017, November, 29, 09:45:00

ADNOC INVESTMENT $100 BLN

ADNOC - The SPC approved ADNOC’s plans for capital expenditure of over AED 400 billion, over the next five years, as it embarks on its Upstream and Downstream expansion and growth projects. The SPC also approved ADNOC’s plans to explore and appraise Abu Dhabi’s unconventional gas resources, as the company seeks to enable future value creation from its untapped gas resources. And, the SPC gave the green light to ADNOC to pursue international downstream investments that will position ADNOC as a global player in the downstream market.

2017, November, 3, 12:10:00

U.S. FEDERAL FUNDS RATE 1 - 1.25%

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

2017, June, 21, 11:00:00

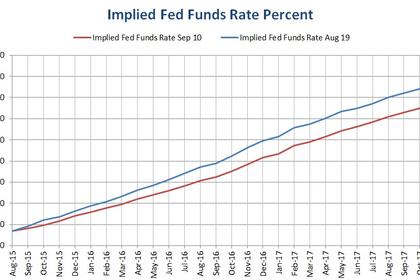

U.S. FEDERAL FUNDS RATE 1.25%

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

2017, May, 6, 17:05:00

U.S. FEDERAL FUNDS RATE TO 1%

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 3/4 to 1 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

2017, February, 2, 18:50:00

U.S. FEDERAL FUNDS RATE: 0.5 - 0.75%

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1/2 to 3/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a return to 2 percent inflation.

2017, January, 13, 18:45:00

EMIRATES URGE TO CUT

Suhail Al Mazrouei said on Wednesday that Opec and non-Opec producers who have agreed to restrict their output over the next six months need to demonstrate that they are being implemented in order for their initiative to stabilise oil prices.