Analysis

2016, April, 15, 21:40:00

2016: VERY UNCERTAIN PRICES

North Sea Brent crude oil prices averaged $38/barrel (b) in March, a $6/b increase from February. Both Brent and West Texas Intermediate (WTI) crude oil prices are forecast to average $35/b in 2016 and $41/b in 2017. However, the current values of futures and options contracts suggest high uncertainty in the price outlook.

2016, April, 15, 21:35:00

RUSSIA OPENS INDIA

"Everybody is trying to get a big stake in India--it is the biggest growing market in Asia," said Amrita Sen, chief oil analyst at London-based consultancy Energy Aspects.

2016, April, 15, 21:25:00

CHINA'S OIL IMPORTS UP

The world’s biggest energy user increased inbound shipments to 91.1 million metric tons in the first three months of the year, data from the Beijing-based General Administration of Customs showed on Wednesday. That’s equivalent to about 7.34 million barrels a day, 6 percent higher than the previous quarter and 13 percent up from the same period last year. Imports last month fell about 4 percent from February’s record to 7.71 million barrels a day, the third-highest ever.

2016, April, 15, 21:15:00

U.S. LOSSES

Lenders including JPMorgan Chase & Co., Wells Fargo & Co. and Bank of America Corp. are setting aside more money to cover potential loan losses after crude prices fell 61 percent in less than two years.

2016, April, 15, 21:10:00

U.S. GAS DOWN

Gas output from the top seven shale deposits will fall by 1.1 percent to 45.93 billion cubic feet a day from April, the biggest percentage decline since March 2013. The retreat is led by the oil-rich Eagle Ford deposit in Texas and the Niobrara shale in Colorado and neighboring states, where gas is pumped as a byproduct of crude extraction.

2016, April, 12, 20:40:00

БОЛЬШЕ РУССКОЙ НЕФТИ

В нефтяной отрасли, в прошлом году отмечался прирост добычи нефти и газового конденсата (+1,4 % по сравнению с 2014 г.), был установлен новый национальный рекорд по добыче – 534,1 млн тонн. Благодаря задействованным механизмам льготирования, выросла добыча в Восточной Сибири и на Дальнем Востоке – на 7,8% до 63,5 млн тонн, на континентальном шельфе – на 17,3% до 19 млн тонн, на месторождениях с трудноизвлекаемыми запасами – на 1,2% до 33 млн тонн.

2016, April, 12, 20:25:00

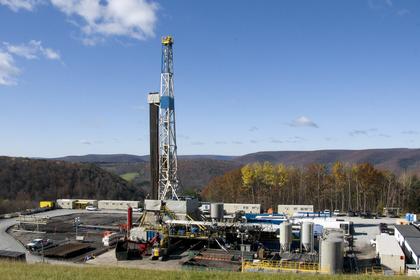

U.S. OIL DOWN 114,000

Crude oil production in May from the seven major US shale regions is expected to fall 114,000 b/d month-over-month to 4.84 million b/d, according to the US Energy Information Administration’s latest Drilling Productivity Report (DPR).

2016, April, 12, 20:15:00

U.S. SHALE PRESSURE

The squeeze puts further pressure on the shale industry to sell assets, cut jobs and drilling and shrink capital spending. It also raises the risk that more companies will tip into bankruptcy.

2016, April, 10, 13:45:00

U.S. RIGS DOWN 7

U.S. Rig Count is down 7 rigs from last week to 443, with oil rigs down 8 to 354, and gas rigs up 1 to 89.

Canadian Rig Count is down 8 rigs from last week to 41, with oil rigs down 3 to 8, and gas rigs down 5 to 33.

2016, April, 8, 21:35:00

GLOBAL LNG UP 2.5%

Europe became a low-priced ‘market of last resort’ for the global LNG trade, with most world supply growth absorbed by the region -- up 16% at 83.15mn mt, as net imports recovered thanks in part to a 31% fall in re-exports – but imports by the Middle East also grew.

2016, April, 8, 21:25:00

RUSSIAN OIL PRICE: $45 - $50

"The level of $45-50 (per barrel) is acceptable from the point of view of market balance: if prices go higher shale oil production could start to recover."

2016, April, 8, 21:20:00

IRAN ISN'T NEEDED

Oil-producing countries can come to an agreement capping crude production at January levels even if Iran doesn’t join the move to help shore up prices.

2016, April, 8, 21:10:00

U.S. GOOD PRICE - 2

Oil at $35 a barrel is neither too high nor too low but just right to make shares of U.S. explorers worth buying, according to Goldman Sachs Group Inc.

2016, April, 8, 21:05:00

U.S. GOOD PRICE

The cumulative effect suggests that for U.S. growth over the next three years, there's no difference between oil at $30 or $70 per barrel. How the trade balance responds to swings in crude will dictate which path is more desirable.

2016, April, 8, 20:35:00

SAUDI RAISES PRICES

State-run Saudi Arabian Oil Co. increased its official selling price for May Light, Medium and Heavy sales to U.S. buyers by 40 cents a barrel, the company said in an e-mailed statement Tuesday. Extra Light crude will sell at a premium of $2.60 a barrel to the regional benchmark, 75 cents higher than the differential in April. For the U.S., the benchmark is the Argus Sour Crude Index.