Companies

2017, March, 22, 18:35:00

TOTAL WANTS IRANIAN GAS

Total is seeking a 50 percent stake in a $4 billion project in Iran's giant South Pars gas field, the French energy firm said in a regulatory filing on Friday detailing talks held with Iranian officials on several projects in 2016.

2017, March, 22, 18:30:00

TOTAL NET INCOME $8.3 BLN

In this difficult environment, the Group demonstrated its resilience by generating adjusted net income of $8.3 billion and had the highest profitability among the majors due to the strength of its integrated model and commitment of its teams to reduce the breakeven.

2017, March, 21, 18:35:00

NABORS NET LOSS $1 BLN

Nabors Industries Ltd. ("Nabors") (NYSE: NBR) reported full-year 2016 operating revenue of $2.2 billion, compared to operating revenue of $3.9 billion in the prior year, which included $366 million in revenue from the Completion and Production Services segment (NCPS), a business line that merged with C&J Energy Services, Inc. (CJES) on March 24, 2015 and ceased to be consolidated with Nabors on that date. Net income from continuing operations for the year was a loss of $1.0 billion, or $3.58 per share, compared to a loss of $330 million, or $1.14 per share, in FY 2015. Included in the net loss from continuing operations for full year 2016 were total after-tax impairments and other charges of $487 million, or $1.71 per share, as well as $0.80 per share in Nabors' proportional share of CJES' net loss for the period. This compares to prior year impairments and other charges of $380 million, or $1.31 per share, and $0.29 per diluted share for the company's proportional share of CJES' net loss.

2017, March, 16, 18:30:00

TESCO NET LOSS $117.9 MLN

TESCO reported a U.S. GAAP net loss of $20.1 million, or $(0.43) per diluted share, for the fourth quarter ended December 31, 2016. Adjusted net loss for the quarter was $13.3 million, or $(0.28) per share, excluding special items, consisting primarily of several charges related to receivables and restructuring costs. This compares to a U.S. GAAP net loss of $22.1 million, or $(0.48) per diluted share in the third quarter of 2016, and a U.S. GAAP net loss of $78.1 million, or $(2.00) per diluted share, for the fourth quarter of 2015. Adjusted net loss in the third quarter of 2016 was $17.3 million, or $(0.37) per diluted share, and in the fourth quarter of 2015 was $13.4 million, or $(0.33) per diluted share.

2017, March, 14, 18:45:00

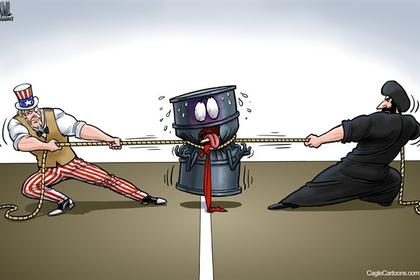

OIL PRICE WAR

"It became evident that U.S. shale oil output has become and will remain a new global oil price regulator for the foreseeable future," Rosneft said.

2017, March, 14, 18:30:00

SAUDI - JAPAN TALKS

Trade between the countries fell overall last year as oil prices dropped. Japan's 2.1 trillion yen ($18.6 billion) in imports from Saudi Arabia in 2016, mostly oil and gas, dwarfed its exports of 546.3 billion yen ($4.8 billion).

2017, March, 13, 18:40:00

ROSNEFT INCREASES TO TURKEY

Rosneft and Demiroren Group Companies signed an Agreement on petroleum product supplies during 2018-2020.

2017, March, 10, 18:30:00

SHELL DIVESTS CANADA $7.25 BLN

Shell will sell to a subsidiary of Canadian Natural Resources Limited (“Canadian Natural”) its entire 60 percent interest in AOSP, its 100 percent interest in the Peace River Complex in-situ assets, including Carmon Creek, and a number of undeveloped oil sands leases in Alberta, Canada. The consideration to Shell from Canadian Natural is approximately $8.5 billion (C$11.1 billion), comprised of $5.4 billion in cash plus around 98 million Canadian Natural shares currently valued at $3.1 billion. Canadian Natural is one of Canada’s largest energy companies and a leader in the oil sands, with a market capitalisation of approximately $35 billion (C$46 billion).

Separately and under the second agreement, Shell and Canadian Natural will jointly acquire and own equally Marathon Oil Canada Corporation (“MOCC”), which holds a 20 percent interest in AOSP, from an affiliate of Marathon Oil Corporation for $1.25 billion each, to be settled in cash.

The combination of these transactions will result in a net consideration of $7.25 billion to Shell.

2017, March, 7, 18:35:00

SHELL & SAUDI AGREEMENT

Royal Dutch Shell plc ("Shell") today announces the signing of binding definitive agreements between SOPC Holdings East LLC (a U.S. downstream subsidiary of Shell) and Saudi Refining Inc. ("SRI") (a wholly owned subsidiary of Saudi Arabian Oil Company (“Saudi Aramco”)) on the separation of assets, liabilities and businesses of Motiva Enterprises LLC (“Motiva”), a 50/50 refining and marketing joint venture.

2017, March, 6, 18:55:00

SAUDI'S RENEWABLE ENERGY

Saudi Arabian Oil Co., as it is formally called, is considering investments of as much as $5 billion in renewable energy, part of the kingdom’s effort to reduce the amount of oil feeding domestic energy needs.

2017, March, 6, 18:50:00

INDIA & MYANMAR OIL

Myanmar, one of the oldest oil and gas industries in the region and a country which exported its first crude oil centuries ago, is again emerging as a bright spot for overseas investors after sanctions, which were imposed on the country during a long period of military rule and political unrest, were lifted in 2012.

2017, March, 6, 18:45:00

KASHAGAN'S OIL EXPORTS

Kazakhstan has for the first time shipped Kashagan crude in the form of Siberian Light blend from the Russian port of Novorossiisk, the Kazakh state pipeline company has said, amid a surge in Siberian Light exports.

2017, March, 6, 18:40:00

UKRAINE PAYS MORE

Ukrainian state monopoly supplier Naftogaz Ukrainy has issued letters of credit under the loan agreement with Citi and Deutsche Bank secured by the World Bank. They total €220mn ($231mn) and will be used this month to buy gas from European suppliers selected through the World Bank’s auctions, it said March 1. It is planned to buy up to 1.1bn m³, with payment due in April upon completion of the relevant gas deliveries to Ukraine.

2017, March, 6, 18:35:00

EXXON'S SHALE OIL UP

The company plans to spend nearly $5.5 billion drilling in Texas, New Mexico and North Dakota. Exxon is hoping to take advantage of technological advancements and lower costs of doing business in the shale.

2017, March, 3, 18:55:00

GAZPROM'S $11 BLN

The group was forced in August to abandon plans to split the cost of the 1,200km Nord Stream 2 pipeline under the Baltic Sea with the project’s European partners Engie, OMV, Wintershall, Shell and Uniper.