Companies

2019, February, 1, 10:40:00

SHELL THIRD BUYBACK

SHELL - Royal Dutch Shell plc (the ‘company’) announces the commencement of trading in the third tranche of its share buyback programme previously announced on July 26, 2018. In the third tranche, the company has entered into an irrevocable, non-discretionary arrangement with a broker to enable the purchase of A ordinary shares and/or B ordinary shares for a period up to and including April 29, 2019.

2019, February, 1, 10:35:00

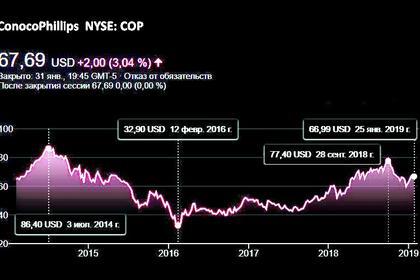

CONOCO EARNINGS $5.3 BLN

CONOCOPHILLIPS - Full-year 2018 earnings were $6.3 billion, or $5.32 per share, compared with a full-year 2017 net loss of $0.9 billion, or ($0.70) per share. Excluding special items, full-year 2018 adjusted earnings were $5.3 billion, or $4.54 per share, compared with full-year 2017 adjusted earnings of $0.7 billion, or $0.60 per share.

2019, February, 1, 10:30:00

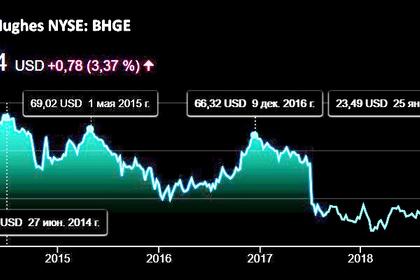

BHGE NET INCOME $131 MLN

BHGE - “2018 marked BHGE’s first full year as a combined company and it was a year of significant change and progress for us. We moved beyond the initial integration phase into the next chapter for BHGE. In November, our majority shareholder, GE, reduced their ownership from approximately 62.5% to approximately 50.4%, and we reached critical commercial agreements with GE that position our company for the future. The market environment changed significantly as we progressed through the year. ” said Lorenzo Simonelli, BHGE Chairman, President and Chief Executive Officer.

2019, January, 30, 11:35:00

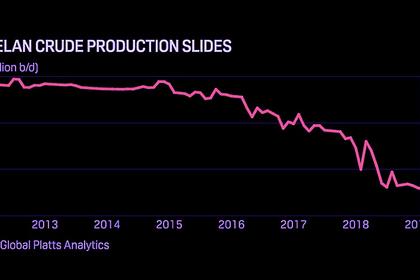

WEAK VENEZUELA SANCTIONS

OGJ - “The sanctions will affect refinery margins in the US. Now they will have to import heavy crude from the Middle East at a premium. US refiners will be amongst the biggest losers, as we have noted earlier,” Rodriguez-Masiu said.

2019, January, 30, 11:30:00

U.S., VENEZUELA SANCTIONS ALWAYS

PLATTS - The Trump administration announced Monday that it will sanction PDVSA, Venezuela's state-owned oil company, a move that could suspend roughly 500,000 b/d of Venezuelan crude exports to US Gulf Coast refineries and shut down US exports of diluents to the South American nation.

2019, January, 30, 11:25:00

MORE RUSSIAN GAS FOR AUSTRIA

GAZPROM - Particular attention at the meeting was paid to the growing demand for gas supplied by Gazprom to Austria. In the period from January 1 through January 27, 2019, gas exports totaled an estimated 1.2 billion cubic meters, an increase of 35 per cent from the same period of last year.

2019, January, 30, 11:20:00

RUSSIAN GAS FOR EUROPE: 200 BCM

PLATTS - Russia's Gazprom Export believes that the record high gas sales of 200 Bcm in Europe and Turkey last year represented a "new reality" for Russian gas exports. Speaking Tuesday at the European Gas Conference in Vienna, CEO Elena Burmistrova also said she expected gas sales to remain at current levels over the next few years.

2019, January, 30, 10:50:00

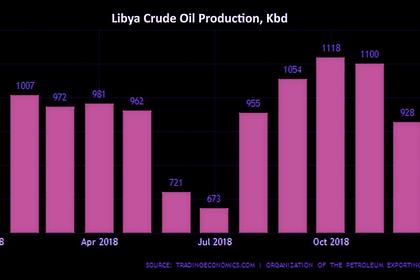

LIBYA NEED INVESTMENT $60 BLN

PLATTS - Libya's state National Oil Corp. is targeting a $60 billion overhaul of its oil and gas sector as it strives to reach a pre-civil war output level of around 1.6 million b/d by the end of this year.

2019, January, 28, 10:25:00

OIL UNDER SIEGE

REUTERS - “There is no doubt - and there is a consensus coming here in various meetings in Davos - that our industry is literally under siege and the future of oil is at stake,” said Mohammed Barkindo, secretary-general of oil producer group OPEC.

2019, January, 28, 09:50:00

ENI, OMV, ADNOC: $5.8 BLN

REUTERS - Italy’s Eni and Austria’s OMV have agreed to pay a combined $5.8 billion to take a stake in Abu Dhabi National Oil Company’s (ADNOC) refining business and establish a new trading operation owned by the three partners.

2019, January, 25, 08:15:00

SANTOS ANNUAL REVENUE UP 19%

SANTOS - Record quarterly sales revenue of $1,043 million, up 7% and including record quarterly LNG sales revenue of $449 million, up 11%. Record annual sales revenue of $3,696 million, up 19%

2019, January, 25, 08:05:00

NOVATEK RESERVES: +4%

NOVATEK - Total SEC proved reserves, including the Company’s proportionate share in joint ventures, aggregated 15,789 million barrels of oil equivalent (boe), including 2,177 billion cubic meters (bcm) of natural gas and 181 million metric tons (mmt) of liquid hydrocarbons. Total proved reserves increased by 4% compared to the year-end 2017, representing a reserve replacement rate of 222% for the year, addition of 1,218 million boe, inclusive of 2018 production.

2019, January, 25, 08:00:00

NOVATEK'S GAS PRODUCTION: +10%

PLATTS - "We're increasing gas production by up to 10% taking into account Yamal LNG, with liquids output, including crude and condensate, to grow by around 2%, I think," Mikhelson was quoted as saying on the sidelines of the World Economic Forum in Davos.

2019, January, 23, 11:05:00

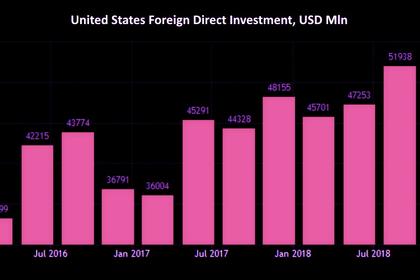

SAUDI'S INVESTMENT FOR U.S.

REUTERS - Saudi Aramco, the world’s top oil producer, is looking to acquire natural gas assets in the United States and is willing to spend “billions of dollars” there as it aims to become a global gas player, the company’s CEO said on Tuesday.

2019, January, 21, 11:05:00

SCHLUMBERGER NET INCOME $2.138 BLN

SCHLUMBERGER - Schlumberger Chairman and CEO Paal Kibsgaard commented, “Full-year 2018 revenue of $32.8 billion increased 8% year-on-year and grew for the second successive year. Performance was driven by North America where revenue of $12.0 billion increased 26% due to the results of our OneStim® business, which grew by 41%. Full-year international revenue of $20.4 billion was essentially flat compared with 2017. However, excluding Cameron, international revenue for the second half of 2018 showed year-over-year growth of 3%, marking the beginning of a positive activity trend after three consecutive years of declining revenues.