Finance

2023, March, 31, 07:45:00

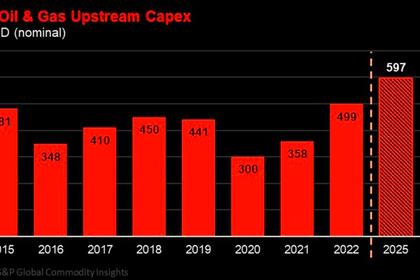

GLOBAL OIL GAS LIMITS $11 TLN

The stricter guidelines come as the outlook darkens for limiting global temperature increases to around 1.5C, with a lack of financing for greener projects a key hurdle.

2023, March, 31, 07:30:00

INFLATION ; A MOVING TARGET

Banking crisis seems to be a regulatory issue not a monetary policy issue. Dollar may get a leg up higher soon despite the fluid situation. Natural credit tightening by banks being a factor to consider, also remembering the Core PCE Data during the week.

2023, March, 15, 06:40:00

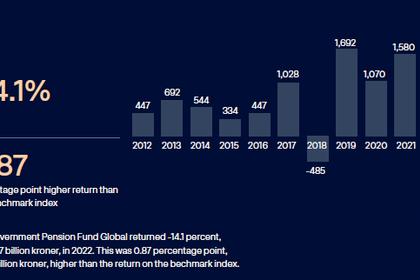

NORWAY PENSION FUND RETURNED -14.1% YET

The fund returned -14.1 percent, or -1,637 billion kroner, in a year of rising interest rates, high inflation and war in Europe. However, the market value of the fund increased by 90 million kroner in 2022.

2023, March, 1, 11:05:00

INDIA'S HYDROGEN INVESTMENT $3.6 BLN

The Indian conglomerate Essar has announced that it will invest US$3.6bn in the United Kingdom and in India over the next five years through a new entity, named Essar Energy Transition (EET), with the goal to drive decarbonisation.

2023, February, 27, 09:55:00

U.S. CARBON MANAGEMENT INVESTMENT $2.52 BLN

The Biden-Harris Administration, through the U.S. Department of Energy (DOE), announced $2.52 billion in funding for two carbon management programs to catalyze investments in transformative carbon capture systems and carbon transport and storage technologies.

2023, February, 27, 09:35:00

CANADA'S NUCLEAR SMR INVESTMENT

The programme aims to support projects that will help to develop supply chains for SMR manufacturing and fuel supply and security to support Canada’s SMR industry, and to fund research on waste management solutions to ensure that SMRs, and the waste they generate, will be safe now and into the future.

2023, February, 27, 09:25:00

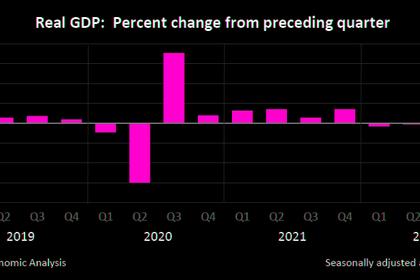

U.S. GDP UP BY 2.7%

Real gross domestic product (GDP) increased at an annual rate of 2.7 percent in the fourth quarter of 2022, according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.

2023, February, 17, 10:40:00

AUSTRALIAN WIND PROJECT 10 GW

The wind project is currently under development near the Port of Newcastle and will be situated in proximity of energy transmission infrastructure.

2023, February, 10, 12:15:00

U.S. FOUNDATION FOR ENERGY SECURITY AND INNOVATION (FESI)

The Foundation for Energy Security and Innovation (FESI) will support DOE to carry out its critical mission to ensure America's continued security and prosperity through transformative science and technology solutions.

2023, February, 8, 12:30:00

ФИНАНСОВЫЕ ПРИОРИТЕТЫ БРИКС

Ряд стран отметили важность укрепления сотрудничества в рамках Нового банка развития, который является флагманским проектом БРИКС.

2023, February, 8, 12:25:00

ФНБ РОССИИ $155,3 МЛРД.

По состоянию на 1 февраля 2023 г. объем ФНБ составил 10 807 595,0 млн рублей , что эквивалентно 155 297,8 млн долл. США.

2023, February, 6, 12:50:00

ДОХОДЫ РОССИИ МИНУС 108,0 МЛРД. РУБ.

Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета прогнозируется в феврале 2023 года в размере -108,0 млрд руб.

2023, February, 6, 12:45:00

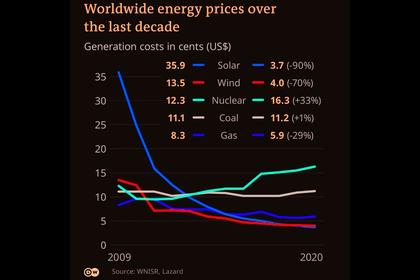

EXPENSIVE NUCLEAR POWER

An Institute for Energy Economics and Financial Analysis (IEEFA) analysis of the five projects that have been built or are under construction found the only common elements of the next-generation design are unanticipated issues that have led to costly delays and soaring price tags.

2023, February, 3, 11:05:00

INDIA GREEN TRANSITION $8 BLN

India plans to spend US$4.3bn on energy transition through the Ministry of Petroleum and Gas, including programs for green fuel, green energy, green farming, green mobility, green buildings, and green equipment and policies for efficient use of energy across various economic sectors.

2023, February, 3, 11:00:00

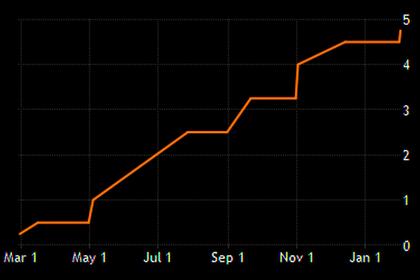

U.S. FEDERAL FUNDS RATE 4.5 - 4.75%

The Committee decided to raise the target range for the federal funds rate to 4-1/2 to 4-3/4 percent.