Gas

2017, November, 24, 09:30:00

ГАЗПРОМ УСПЕШЕН

ГАЗПРОМ - 2017 год — особенно успешен с точки зрения расширения присутствия «Газпрома» на мировом энергетическом рынке. В прошлом году компания установила рекорд экспорта в дальнее зарубежье — 179,3 млрд куб. м. В 2017 году потребление российского газа продолжило уверенный рост — по состоянию на 22 ноября «Газпром» поставил потребителям 170 млрд куб. м газа — на 13,3 млрд куб. м газа больше, чем за аналогичный период 2016 года.

2017, November, 24, 09:25:00

ПЛОДОТВОРНЫЙ ГАЗПРОМ В БОЛИВИИ

МИНЭНЕРГО РОССИИ - Александр Новак отметил плодотворное взаимодействие между компаниями «Газпром» и боливийской государственной нефтегазовой компанией «ЯПФБ». «Убежден, что участие ПАО «Газпром» совместно с «ЯПФБ» в освоении лицензионных блоков «Асеро», «Ипати» и «Акио» будет коммерчески успешным для наших стран», - сказал Министр.

2017, November, 22, 11:30:00

РОССИЯ ИСПОЛНЯЕТ ОБЯЗАТЕЛЬСТВА

МИНЭНЕРГО РОССИИ - Российская нефтяная отрасль обеспечивает потребности внутреннего рынка и исполнение международных обязательств: за три квартала текущего года объём добычи нефти и газового конденсата составил почти 410 млн т., объём поставок на внутренний рынок достиг 213 млн т, экспорт в страны ближнего и дальнего зарубежья – чуть меньше 200 млн т.

2017, November, 22, 11:25:00

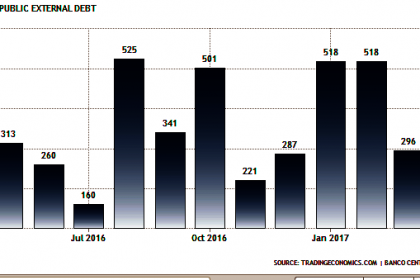

РУССКИЙ ДОЛГ ВЕНЕСУЭЛЫ: $3.15 МЛРД.

МИНФИН РОССИИ - Сумма консолидированного долга Венесуэлы составила 3,15 млрд. долл. США, новый график погашения задолженности предусматривает платежи в течение 10 лет, объем которых в первые 6 лет минимален.

2017, November, 22, 11:20:00

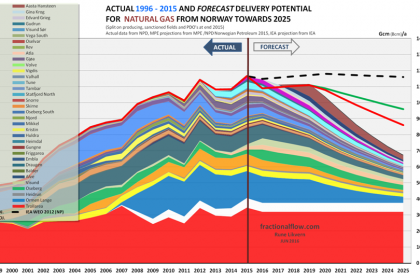

NORWAY'S PRODUCTION UP TO 1.9 MBD

NPD - Preliminary production figures for October 2017 show an average daily production of 1 901 000 barrels of oil, NGL and condensate, which is an increase of 141 000 barrels per day compared to September.

2017, November, 22, 11:15:00

TRANSCANADA'S CONSTRUCTION $8 BLN

TransCanada Corporation (TSX:TRP) (NYSE:TRP) (TransCanada) confirmed that the Nebraska Public Service Commission (PSC) has approved an alternative route for the proposed Keystone XL Pipeline project through the state. TransCanada is evaluating the PSC's decision.

2017, November, 22, 11:05:00

NIGERIA & CHEVRON PROJECT &1.7 BLN

Nigerian National Petroleum Corporation (NNPC) and Chevron Nigeria Limited (CNL) have executed the second and final phase of an Alternative Financing Agreement that would increase crude oil production in the country by about 39,000 barrels per day.

2017, November, 20, 09:20:00

RUSSIA'S GAS FOR EUROPE UP

Gazprom's natural gas supplies to western Europe edged up by 3% year on year in the third quarter of 2017, according to an S&P Global Platts analysis of Gazprom data, as Russian gas deliveries to its core markets continue to outpace last year's levels.

2017, November, 20, 09:05:00

INDIA'S GAS WILL UP

REUTERS - India’s natural gas consumption is expected to rise to 70 billion cubic metres (bcm) by 2022 and 100 bcm by 2030, according to a government think tank and the Oxford Institute of Energy Studies, up from 50 bcm now. India burns just 7 percent of what top user the United States consumes in a year with about a quarter of India’s population.

2017, November, 20, 08:50:00

U.S. RIGS UP 8 TO 915

U.S. Rig Count is up 327 rigs from last year's count of 588, with oil rigs up 267, gas rigs up 61, and miscellaneous rigs down 1 to 1.

Canada Rig Count is up 24 rigs from last year's count of 184, with oil rigs up 9 and gas rigs up 15.

2017, November, 17, 19:40:00

ADNOC OUTPUT UP

OGJ - ADNOC is increasing its total production capacity to 3.5 million b/d next year from about 3.1 million b/d at present.

2017, November, 17, 19:35:00

ADNOC & CNPC COLLABORATION

OGJ - Abu Dhabi National Oil Co. (ADNOC) and China National Petroleum Corp. (CNPC) signed an agreement covering potential collaboration, including potential offshore opportunities and the sour gas development projects.

2017, November, 15, 15:15:00

IEA: GLOBAL ENERGY DEMAND UP BY 30%

Global energy needs rise more slowly than in the past but still expand by 30% between today and 2040. This is the equivalent of adding another China and India to today’s global demand.

2017, November, 14, 18:00:00

NIGERIA NEED INVESTMENT $5.5 BLN

REUTERS - Nigeria will move ahead with plans to borrow $5.5 billion from foreign investors after the Senate on Tuesday approved President Muhammadu Buhari request for the move.

2017, November, 14, 17:55:00

VENEZUELA'S SELECTIVE DEFAULT

REUTERS - Further complicating the situation, S&P Global Ratings declared Venezuela in selective default after it failed to make coupon payments on bonds due in 2019 and 2024 within a 30-day grace period. The agency warned there was a strong chance it would miss further payments within three months.