News

2018, November, 22, 11:20:00

SAUDIS OIL RECORD: 10.9 MBD

BLOOMBERG - Saudi Arabian oil production surged to a record near 11 million barrels a day this month after the kingdom received stronger-than-usual demand from clients preparing for a disruption in Iranian supplies, according to industry executives who track Saudi output.

2018, November, 22, 11:15:00

U.S. - CHINA OIL

PLATTS - Recent activity in the US Gulf Coast shipping market signals that Chinese buyers have returned to buying US crudes oil after halting all imports of US grades in August and September.

2018, November, 22, 11:00:00

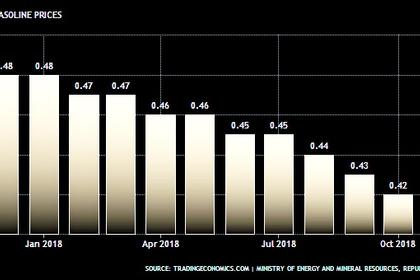

INDONESIA'S GASOLINE IMPORTS 11 MBD

PLATTS - Indonesia's state-owned Pertamina is estimated to import around 10-11 million barrels of gasoline in December, steady from November.

2018, November, 22, 10:55:00

GAZPROM NEFT PROFIT: +58%

GAZPROM NEFT - RUB298.7 billion — Gazprom Neft’s net profit for 9M 2018, a 58-percent increase on 9M 2017;

RUB614.5 billion adjusted EBITDA* for the first nine months of 2018 — up 53.9 percent on 9M 2017;

Free cash flow (FCF) for 9M 2018, standing at RUB134.8 billion, a 62.4-percent increase year-on-year.

2018, November, 22, 10:50:00

NORWAY'S PETROLEUM PRODUCTION 1.9 MBD

NPD - Preliminary production figures for October 2018 show an average daily production of 1 874 000 barrels of oil, NGL and condensate, which is an increase of 271 000 barrels per day compared to September.

2018, November, 22, 10:45:00

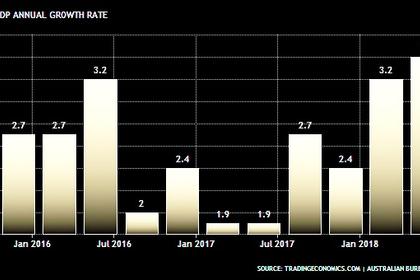

CONTINUED AUSTRALIA'S GROWTH

IMF - Australia’s recent strong growth is expected to continue in the near term, further reducing slack in the economy and leading the way to gradual upward pressure on wages and prices.

2018, November, 22, 10:40:00

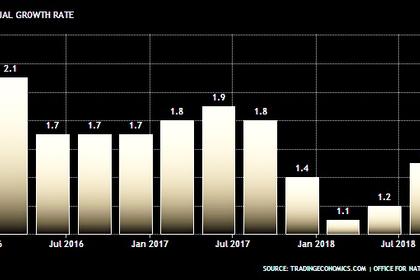

BRITAIN'S GROWTH 1.5%

IMF - Britain's growth is projected to remain around 1½ percent going forward, under a baseline scenario that assumes a smooth transition to a broad free trade agreement with the EU.

2018, November, 22, 10:35:00

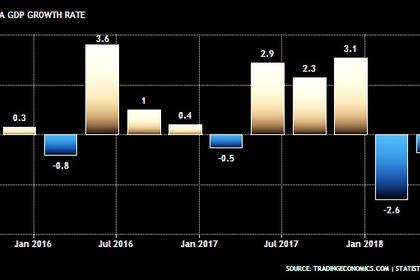

SOUTH AFRICA'S LAGGING

IMF - Some of the negative effects of the changing external environment are already being felt in South Africa despite its economic resilience.

2018, November, 22, 10:30:00

U.S. RIGS DOWN 3 TO 1,079

BHGE - U.S. Rig Count is down 3 rigs from last week to 1,079, with oil rigs down 3 to 885 and gas rigs unchanged at 194. Canada Rig Count is up 7 rigs from last week to 204, with oil rigs up 6 to 124 and gas rigs up 1 to 80.

2018, November, 19, 11:50:00

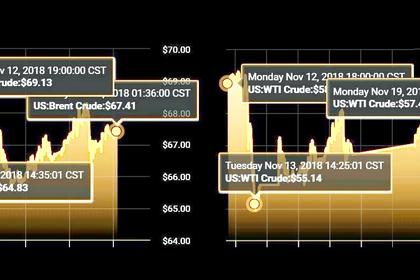

OIL PRICE: ABOVE $67

REUTERS - Front-month Brent crude oil futures were at $67.41 per barrel at 0746 GMT, up 65 cents, or 1 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures, were up 76 cents, or 1.4 percent, at $57.22 per barrel.

2018, November, 19, 11:40:00

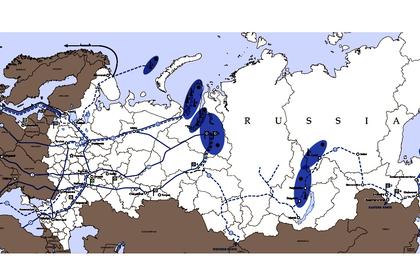

RUSSIAN GAS FOR EVERYONE

BLOOMBERG - The $11 billion pipeline is one of three giant projects helping the world’s biggest gas producer strengthen its grip on Europe and Asia. Thousands of miles to the east, the Power of Siberia pipeline will connect with China, and a project under the Black Sea will deliver fuel to Turkey and southeast Europe.

2018, November, 19, 11:35:00

IRAN, RUSSIA OPPORTUNITIES

NGW - Although US secondary sanctions against Iran’s petroleum sector resumed on November 5, Russia will most likely defy them by continuing to invest in Iran’s natural gas sector. Russia may also seek to influence the flow of Iran’s natural gas into the European market, where it could undermine Russia’s political-economic interests if not coordinated with Moscow.

2018, November, 19, 11:30:00

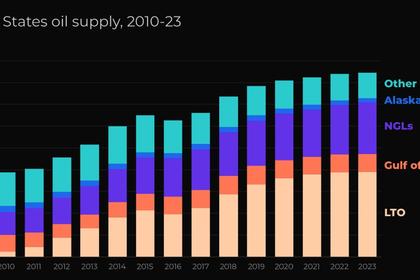

U.S. PETROLEUM DEMAND 20.8 MBD

U.S. API - U.S. petroleum demand in October of 20.8 million barrels per day (mb/d) was the strongest for the month since 2006 and a continued reflection of solid economic activity.

2018, November, 19, 11:25:00

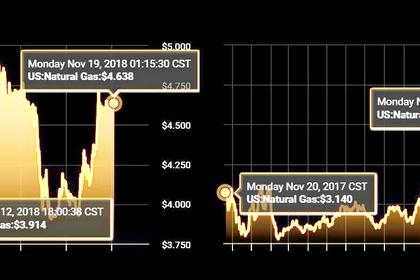

U.S. GAS PRICES UP

REUTERS - Next-day natural gas prices for Friday at the Sumas hub on the border between Washington state and British Columbia quadrupled to a record high on forecasts for cooler, near-normal weather in the Pacific Northwest and declining pipeline flows from Canada.

2018, November, 19, 11:20:00

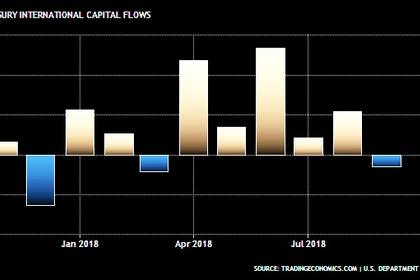

U.S. SECURITIES OUTFLOW $29.1 BLN

U.S. DT - The sum total in September of all net foreign acquisitions of long-term securities, short-term U.S. securities, and banking flows was a net TIC outflow of $29.1 billion. Of this, net foreign private inflows were $23.5 billion, and net foreign official outflows were $52.7 billion.