News

2024, November, 19, 06:34:00

4th World Conference on Climate Change & Sustainability Milan, Italy 22-24 October, 2025

Climate Week 2025 following the success of first, second and third edition, held in 2022, 2023 and 2024 in Frankfurt, Rome, Barcelona respectively.

2024, November, 19, 06:30:00

RUSSIAN URANIUM LIMITS

The latest move targets a particularly vulnerable US link in the nuclear fuel cycle. Russia controls almost half the world’s capacity to separate the uranium isotopes needed in reactors, and last year supplied more than a quarter of the US’s enriched fuel.

2024, November, 19, 06:25:00

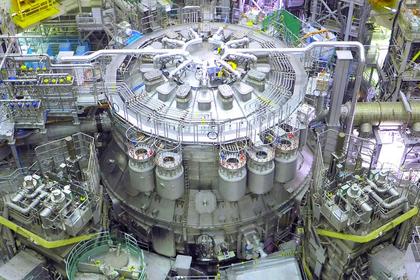

VIETNAM NUCLEAR RESTARTING

Over the longer term, the Government had proposed to the relevant authorities to restart nuclear power projects and robust development of offshore wind energy.

2024, November, 19, 06:20:00

MALAYSIA NUCLEAR IMPLEMENTATION

“Since the decision has been made by the National Energy Council and endorsed by the Cabinet, nuclear energy is likely to be included in the 13th Malaysia Plan (RMK-13) as one of the country’s official energy sources,” Rafizi told reporters after the National OGSE (Oil & Gas, Services & Equipment) Blueprint Forum 2024 in Kuala Lumpur.

2024, November, 19, 06:15:00

GAS ENERGY FOR AFRICA

Natural gas is not only a cleaner alternative to coal but also a reliable energy source that can support various sectors, including manufacturing, agriculture, and transportation.

2024, November, 19, 06:10:00

U.S. ENERGY SHORTAGE

An electricity shortage is bearing down on the nation and there are no easy fixes. Trump has laid out an energy policy that would emphasize oil and gas drilling and environmental controls and curbs on the rate of wind generation deployment. None of that will get us through the impending crisis as the demand for more electricity is surging.

2024, November, 19, 06:05:00

BRITAIN RENEWABLES 9.6 GW

The UK awarded significantly more capacity in this CfD round than in the previous. In 2023, the UK awarded only 3.7 GW of renewable capacity, including 1.9 GW of solar capacity and 1.5 GW of onshore wind.

2024, November, 19, 06:00:00

EGYPT RENEWABLES 5.2 GW

The first agreement was signed between Egypt’s Ministry of Electricity and a consortium of the UAE’s TAQA and France’s Voltalia for the development of a 3.2 GW renewable energy project, which will feature 2.1 GW of solar and 1.1 GW of wind capacity. The project would be located around 130 kilometers south-east of Cairo, near the 545 MW Zarafana wind project, and could be commissioned by 2028.

2024, November, 14, 07:00:00

OIL PRICE: BRENT NEAR $72, WTI NEAR $68

Brent fell 35 cents, or 0.5%, to $71.93 a barrel, WTI declined 42 cents, or 0.6%, to $68.01.

2024, November, 14, 06:55:00

СОТРУДНИЧЕСТВО РОССИИ, ИНДИИ

Особое внимание уделяется инициативам в сфере энергетики: развитие потенциала атомного сектора, производство турбин большой мощности, оборудования для солнечной и ветрогенерации, совершенствование СПГ-технологий.

2024, November, 14, 06:50:00

INDIA, RUSSIA TRADE: UP 5 TIMES

Trade between the traditional allies have shot up five times in the past three years, according to trade ministry data, as India lapped up Russian crude oil while most others shunned its barrels following the invasion of Ukraine.

2024, November, 14, 06:45:00

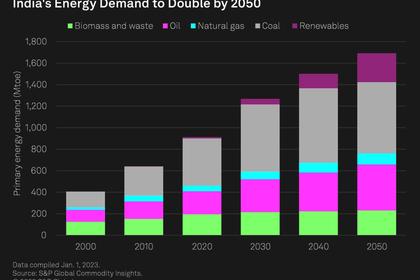

INDIA ENERGY TRANSFORMATION

Since gaining independence in 1947, India's power sector has achieved remarkable growth, with the installed capacity soaring from a mere 1,300 MW to an impressive 400 GW by 2023. This growth trajectory has been propelled by strategic investments in thermal, hydro, and renewable energy, underlining the sector's resilience, adaptability, and alignment with global sustainability goals.

2024, November, 14, 06:40:00

CHINA, INDONESIA GREEN DEAL $10 BLN

In a joint statement after the leaders' meeting, the countries agreed to enhance collaboration in sectors such as new energy vehicles, lithium batteries, photovoltaics, and the digital economy.

2024, November, 14, 06:35:00

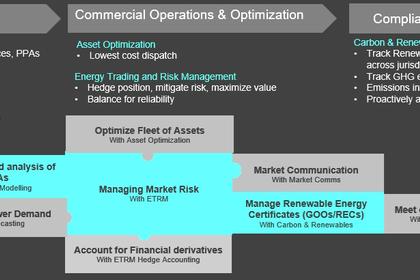

SOLAR, WIND UNPREDICTABILITY

As renewable energy sources like solar and wind become more widespread, their inherent unpredictability introduces new challenges. Unlike traditional fossil fuel power plants, renewable generation is intermittent, making it harder to forecast production and balance the grid.

2024, November, 14, 06:30:00

GIS FOR ENERGY NETWORKS

Geographic Information Systems (GIS) offer a transformative approach to managing these networks, providing a comprehensive, real-world model of assets and enabling better decision-making and operational efficiency.