News

2019, August, 2, 11:15:00

TC ENERGY NET INCOME $1.1 BLN

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) announced net income attributable to common shares for second quarter 2019 of $1.1 billion or $1.21 per share compared to net income of $785 million or $0.88 per share for the same period in 2018.

2019, August, 1, 12:15:00

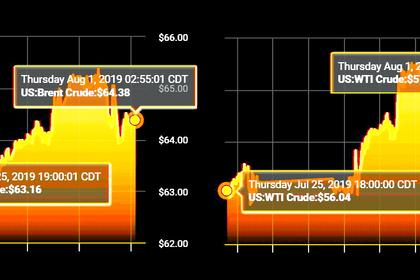

OIL PRICE: BELOW $65

Brent crude futures, LCOc1 the international benchmark, fell 68 cents, or 1%, to $64.37 a barrel by 0709 GMT, having fallen more than $1 earlier in the session. U.S. West Texas Intermediate (WTI) CLc1 crude was down 72 cents, or 1.2%, at $57.86 a barrel, also having dropped more than a $1 earlier.

2019, August, 1, 12:10:00

RUSSIAN STREAMS: NEW SANCTIONS

The bill would sanction vessels that lay Russian energy export pipelines at least 100 feet below sea level.

2019, August, 1, 12:05:00

ADNOC, ENI DEAL $3.24 BLN

Eni and ADNOC announced that they have closed their strategic partnership, announced in January, through which Eni acquired a 20% equity interest in ADNOC refining. The final cash price is approximately $3.24bn. The partners, which include Austria’s OMV, also set up a new trading joint venture.

2019, August, 1, 12:00:00

SHELL INCOME $3 BLN

“We have delivered good cash flow performance, despite earnings volatility, in a quarter that has seen challenging macroeconomic conditions in refining and chemicals as well as lower gas prices. This quarter we achieved some key milestones, such as the start-up of Appomattox and the first LNG cargo from Prelude. These add to our competitive portfolio, which is expected to generate additional cash in the coming quarters.

The resilience of our Upstream and customer-facing businesses and their ability to generate cash support the delivery of our 2020 outlook, which remains unchanged.”

2019, August, 1, 11:55:00

SHELL BUYBACK PROGRAMME $2.75 BLN

Royal Dutch Shell plc (the ‘company’) today announces the commencement of trading in the next tranche of its share buyback programme previously announced on July 26, 2018. In the next tranche, the company has entered into an irrevocable, non-discretionary arrangement with a broker to enable the purchase of A ordinary shares and/or B ordinary shares for a period up to and including October 28, 2019. The aggregate maximum consideration for the purchase of A ordinary shares and/or B ordinary shares under the next tranche is $2.75 billion. The company’s intention is to buy back at least $25 billion of its shares by the end of 2020, subject to further progress with debt reduction and oil price conditions.

2019, August, 1, 11:50:00

SHELL SELLS $1.9 BLN

Royal Dutch Shell plc (Shell), through its affiliate Shell Overseas Holdings Limited, has completed the sale of its shares in Shell Olie-og Gasudvinding Danmark B.V. (SOGU), holding a 36.8% non-operating interest in the Danish Underground Consortium (DUC), to Norwegian Energy Company ASA (Noreco) for a consideration amount of $1.9 billion.

2019, August, 1, 11:45:00

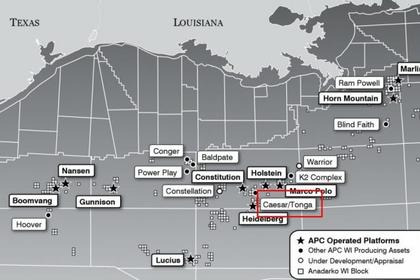

SHELL SELLS $0.965 BLN

Shell Offshore Inc. (Shell), a subsidiary of Royal Dutch Shell plc, has completed the sale of 22.45% non-operated interest in the Caesar-Tonga asset in the US Gulf of Mexico to Equinor Gulf of Mexico LLC (Equinor), a subsidiary of Equinor ASA, subject to approval of the lease assignments by the regulator. The total cash consideration was $965 million.

2019, August, 1, 11:40:00

BAKER HUGHES A GE NET LOSS $9 MLN

BAKER HUGHES, A GE COMPANY ANNOUNCES SECOND QUARTER 2019 RESULTS

2019, August, 1, 11:35:00

TANAP IS READY

The Trans Anatolian Natural Gas Pipeline (TANAP), the major segment of the Southern Gas Corridor is ready to supply Azerbaijani gas directly to Europe.

2019, August, 1, 11:30:00

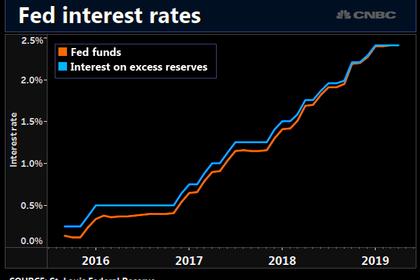

U.S. FEDERAL FUNDS RATE 2 - 2.25%

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent.

2019, July, 31, 14:00:00

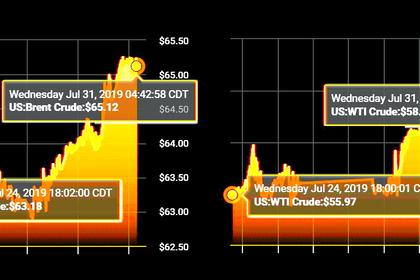

OIL PRICE: NEAR $65

Brent crude futures LCOc1, the international benchmark for oil prices, were up 40 cents, or 0.6%, at $65.12 a barrel by 0842 GMT. U.S. West Texas Intermediate crude CLc1 gained 20 cents, or 0.3%, to $58.25 a barrel.

2019, July, 31, 13:55:00

U.S., HORMUZ: HIGH PRICE

"I think Iran will look at it as a successful cost imposition to the adversary," "They're making all of the adversaries now rally forces, move them into the theater, put them at risk in the theater and pay for that presence at a very hefty price."

2019, July, 31, 13:45:00

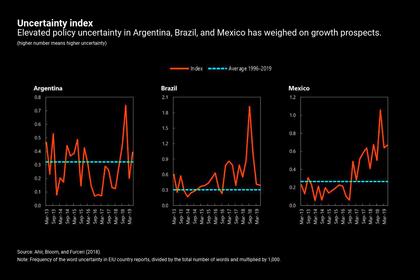

LATIN AMERICA, CARRIBEAN GDP UP 0.6%

Economic activity in Latin America and the Caribbean remains sluggish. Real GDP is expected to grow by 0.6 percent in 2019—the slowest rate since 2016—before rising to 2.3 percent in 2020.

2019, July, 31, 13:40:00

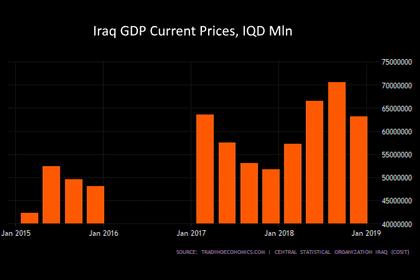

IRAQ'S GDP UP 4.6%

The fiscal and external positions are expected to continue to deteriorate over the medium term absent policy changes—with reserves falling below adequate levels and fiscal buffers eroded. Although the level of public debt will remain sustainable, gross fiscal financing needs will increase. Non-oil GDP growth is projected to reach 5½ in 2019 but subside over the medium term.