Oil&Gas

2017, April, 27, 20:00:00

TOTAL NET INCOME $2.8 BLN

"Supported by the OPEC/non-OPEC agreement, Brent prices remained volatile in the context of high inventories and averaged 54 $/b this quarter. In this environment, Total's adjusted net income increased by 56% to $2.6 billion in the first quarter 2017, in line with the strong recent quarterly results of 2016, due to good operational performance and a steadily decreasing breakeven. Excluding acquisitions and asset sales, the Group generated $1.7 billion of cash flow after investments, mainly due to a 63% increase in operating cash flow before working capital changes from the Exploration & Production segment and investment discipline."

2017, April, 27, 18:45:00

OIL PRICE: $40

“If OPEC and the coalition don’t extend the agreement to continue cuts, that price floor will go,” he said. “Without it, prices would fall, and there’s nothing to stop oil going below $40 a barrel.”

2017, April, 27, 18:35:00

BAKER HUGHES NET LOSS $129 MLN

Revenue for the quarter was $2.3 billion, a decrease of $148 million, or 6%, sequentially. Compared to the same quarter last year, revenue declined $408 million, or 15%. The sequential decrease in revenue was driven primarily by the deconsolidation of the North America onshore pressure pumping business, lower revenue internationally, mainly related to non-recurring year-end product sales, seasonality and price deterioration, and reduced activity in the Gulf of Mexico. This decline was partially offset by activity growth in our North America onshore business, primarily in our well construction product lines.

2017, April, 27, 18:30:00

NOV VARCO NET LOSS $122 MLN

Revenues for the first quarter of 2017 were $1.74 billion, an increase of three percent compared to the fourth quarter of 2016 and a decrease of 20 percent from the first quarter of 2016. Operating loss for the first quarter was $97 million, or 5.6 percent of sales. Excluding other items, operating loss was $70 million, or 4.0 percent of sales. Adjusted EBITDA (operating profit excluding other items before depreciation and amortization) for the first quarter was $105 million, or 6.0 percent of sales, an increase of $3 million from the fourth quarter of 2016. Cash flow from operations for the first quarter was $111 million.

2017, April, 25, 21:58:00

HALLIBURTON NET LOSS $32 MLN

Halliburton Company (NYSE:HAL) announced a loss from continuing operations of $32 million, or $0.04 per diluted share, for the first quarter of 2017.

2017, April, 25, 18:50:00

OIL PRICE: ABOVE $51

The June crude oil contract on the New York Mercantile Exchange dropped 39¢ on Apr. 24 to close at $49.23/bbl. The July contract decreased 39¢ to $49.58/bbl.

The natural gas price for May fell 3.5¢ to a rounded $3.07/MMbtu. The Henry Hub cash gas price was $2.98, down 6¢.

The Brent crude contract for June on London’s ICE fell 36¢ to settle at $51.60/bbl. The July contract was down 31¢ to $52.13/bbl. The May gas oil contract declined $1.75 to $465.75/tonne.

OPEC’s basket of crudes closed Apr. 24 at $49.64/bbl, down 35¢.

2017, April, 25, 18:30:00

U.S. RIGS UP 10

U.S. Rig Count is up 426 rigs from last year's count of 431, with oil rigs up 345, gas rigs up 79, and miscellaneous rigs up 2.

Canadian Rig Count is up 59 rigs from last year's count of 40, with oil rigs up 21, gas rigs up 39, and miscellaneous rigs down 1.

2017, April, 22, 12:05:00

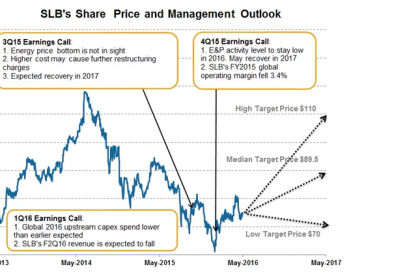

SCHLUMBERGER NET INCOME $279 MLN

Schlumberger Announces First-Quarter 2017 Results:

- Revenue of $6.9 billion decreased 3% sequentially

- GAAP EPS, including Cameron integration charges of $0.05 per share, was $0.20

- EPS, excluding Cameron integration charges, was $0.25

- Cash flow from operations was $656 million

- Quarterly cash dividend of $0.50 per share was approved

2017, April, 21, 20:40:00

U.S. PETROLEUM DELIVERIES UP 0.2%

Total petroleum deliveries in March moved up 0.2 percent from March 2016 to average nearly 19.7 million barrels per day. These were the highest March deliveries in nine years, since 2008. For the first quarter of 2017, total domestic petroleum deliveries, a measure of U.S. petroleum demand, were up 0.4 percent compared with the first quarter of 2016 to average 19.5 million barrels per day. These were the highest first quarter deliveries since 2008. According to the U.S. Bureau of Labor Statistics (BLS) April 7, 2017 report, the U.S. added 98,000 jobs in March. In addition, the unemployment rate (4.5 percent) and the number of unemployed persons (7.2 million) were down from prior month and the prior year.

2017, April, 21, 20:35:00

EXXON - ROSNEFT PERMISSION

Exxon Mobil is seeking permission from the U.S. government for approval to resume drilling around the Black Sea with a Russian partner, state-owned Rosneft, according to a person familiar with the matter.

2017, April, 14, 18:30:00

U.S. RIGS UP 8

U.S. Rig Count is up 407 rigs from last year's count of 440, with oil rigs up 332, gas rigs up 73, and miscellaneous rigs up 2.

Canadian Rig Count is up 78 rigs from last year's count of 40, with oil rigs up 30 and gas rigs up 48.

2017, April, 12, 18:30:00

KENYA'S GDP UP TO 5.5%

“Consistent with its robust performance in recent years, once again economic growth in Kenya was solid in 2016, coming in at an estimated 5.9%—a five-year high. This has been supported by a stable macroeconomic environment, low oil prices, earlier favorable harvest, rebound in tourism, strong remittance inflows, and an ambitious public investment drive,” said Diarietou Gaye, World Bank Country Director for Kenya. “Nonetheless, Kenya is currently facing headwinds that are likely to dampen GDP growth in 2017.”

2017, April, 10, 18:45:00

INDIA'S ENERGY TRANSFORMATION

Peak electricity demand has grown nearly 13% over the past two years as a growing middle class seeks new services, such as air conditioning, which continue to place higher demands on the system. Over the next 25 years, energy demand is expected to more than double as a result.

2017, April, 10, 18:30:00

U.S. RIGS UP 15 AGAIN

U.S. Rig Count is up 396 rigs from last year's count of 443, with oil rigs up 318, gas rigs up 76, and miscellaneous rigs up 2.

Canadian Rig Count is up 91 rigs from last year's count of 41, with oil rigs up 34 and gas rigs up 57.

2017, April, 7, 18:35:00

IRANIAN - INDIAN TIES

Speaking to reporters following a cabinet meeting on Wednesday, the official described India as one of Iran's good customers, but stressed that New Delhi cutting its oil purchase from Iran would not cause any trouble for Tehran as the country has more demand for its oil than can produce.