Oil

2018, July, 23, 13:40:00

КООПЕРАЦИЯ РОССИИ И КИТАЯ

МИНЭНЕРГО РОССИИ - «Последовательно реализуются ключевые проекты двустороннего взаимодействия, включая поставки природного газа по «восточному» маршруту и «Ямал СПГ». Ведется кооперация в нефтяной сфере в рамках организации поставок по нефтепроводу «Сковородино-Мохэ». Заинтересованы в участии китайских компаний и в других перспективных проектах, включая Арктик СПГ 2».

2018, July, 23, 13:25:00

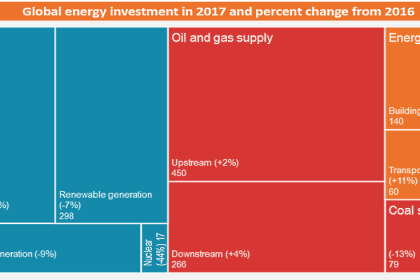

GLOBAL ENERGY INVESTMENT DOWN 2%

IEA - For the third consecutive year, global energy investment declined, to USD 1.8 trillion (United States dollars) in 2017 – a fall of 2% in real terms. The power generation sector accounted for most of this decline, due to fewer additions of coal, hydro and nuclear power capacity, which more than offset increased investment in solar photovoltaics.

2018, July, 23, 13:25:00

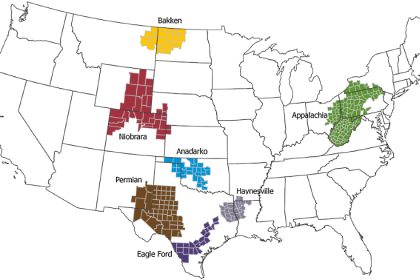

U.S. OIL PRODUCTION + 143 TBD, GAS PRODUCTION + 1,066 MCFD

EIA - Crude oil production from the major US onshore regions is forecast to increase 143,000 b/d month-over-month in July from 7,327 to 7,470 thousand barrels/day , gas production to increase 1,066 million cubic feet/day from 69,466 to 70,532 million cubic feet/day .

2018, July, 23, 13:05:00

BAKER HUGHES NET LOSS $19 MLN

BAKER HUGHES A GE - Orders of $6.0 billion for the quarter, up 15% sequentially and up 9% year-over-year on a combined business basis.

Revenue of $5.5 billion for the quarter, up 3% sequentially and up 2% year-over-year on a combined business basis.

GAAP operating income of $78 million for the quarter, increased $119 million sequentially and increased $223 million year-over-year on a combined business basis.

2018, July, 16, 11:05:00

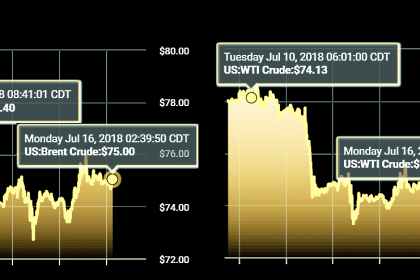

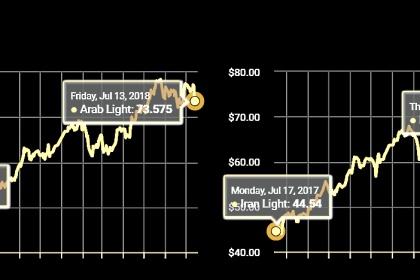

OIL PRICE: NEAR $75

REUTERS - Brent crude futures were down 66 cents, or 0.9 percent, at $74.67 a barrel at 0645 GMT. U.S. West Texas Intermediate (WTI) crude was down 57 cents, or 0.8 percent, at $70.43 a barrel.

2018, July, 16, 11:00:00

IEA: OIL SUPPLY ISSUES

IEA - The re-emergence of Libya as a risk factor in global supply follows a series of attacks on key infrastructure that saw production plummet to around 500 kb/d in July from close to the 1 mb/d level seen for about a year.

2018, July, 16, 10:55:00

SAUDI ARABIA - IRAN RESOLUTION

PLATTS - "The shift from reporting individual country conformity to reporting overall conformity will be adopted to reflect the June 23 decision of the 4th OPEC and non-OPEC Ministerial Meeting that countries will strive to adhere to the overall conformity level, voluntarily adjusted to 100%, as of July 2018," Saudi energy minister Khalid al-Falih wrote to his counterparts Thursday in a letter.

2018, July, 16, 10:50:00

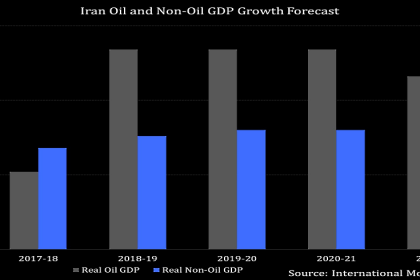

IRAN'S ECONOMIC COOPERATION

SHANA - Dr. Hassan Rouhani, following a meeting of the heads of the three powers, stated that the vast majority of countries do not undergo US domestic laws, saying: “In the fields of energy, transportation, production and staple commodities, the country will not encounter any trouble, and we have always been victorious every time the administration and people stayed together.”

2018, July, 16, 10:45:00

RUSSIA'S INVESTMENT FOR IRAN: $50 BLN

BLOOMBERG - Iran said Russia is ready to invest as much as $50 billion in its oil industry even as Western majors are pulling out of deals with the republic amid the threat of U.S. sanctions.

2018, July, 16, 10:35:00

CHINA'S INVESTMENT FOR NIGERIA: $14+3 BLN

AN - China National Offshore Oil Corp. (CNOOC) is willing to invest $3 billion in its existing oil and gas operation in Nigeria, the Nigerian National Petroleum Corporation (NNPC) said on Sunday following a meeting with the Chinese in Abuja.

2018, July, 16, 10:30:00

LIBYA'S OIL DOWN 160 TBD

REUTERS - Production at Libya’s giant Sharara oil field was expected to fall by at least 160,000 barrels per day (bpd) on Saturday after two staff were abducted in an attack by an unknown group, the National Oil Corporation (NOC) said.

2018, July, 16, 10:25:00

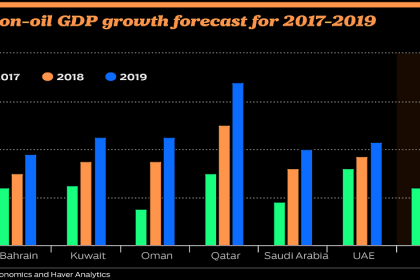

BAHRAIN'S GDP UP 3.2%

IMF - Output grew by 3.8 percent in 2017, underpinned by a resilient non-hydrocarbon sector, with robust implementation of GCC-funded projects as well as strong activity in the financial, hospitality, and education sectors. The banking system remains stable with large capital buffers. Growth is projected to decelerate over the medium term.

2018, July, 16, 10:20:00

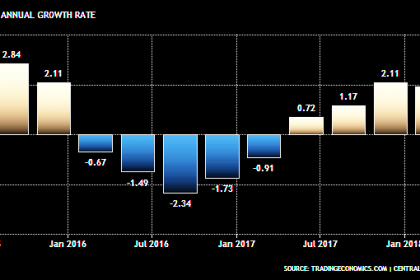

NIGERIA'S GDP UP 2%

IMF - Higher oil prices and short-term portfolio inflows have provided relief from external and fiscal pressures but the recovery remains challenging. Inflation declined to its lowest level in more than two years. Real GDP expanded by 2 percent in the first quarter of 2018 compared to the first quarter of last year. However, activity in the non-oil non-agricultural sector remains weak as lower purchasing power weighs on consumer demand and as credit risk continues to limit bank lending.

2018, July, 12, 10:55:00

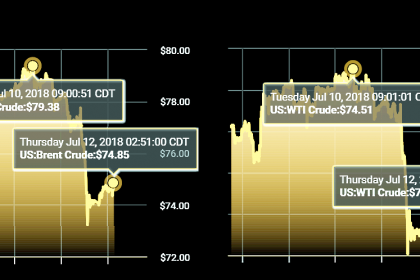

OIL PRICE: ABOVE $74

REUTERS - Brent crude LCOc1 rose $1.23, or 1.7 percent, to $74.63 a barrel by 0544 GMT after slumping 6.9 percent on Wednesday. U.S. West Texas Intermediate (WTI) CLc1 added 46 cents, or 0.7 percent, to $70.84 a barrel, after falling 5 percent the previous session.

2018, July, 12, 10:45:00

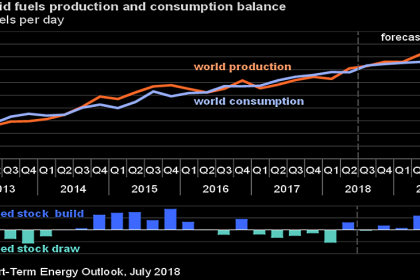

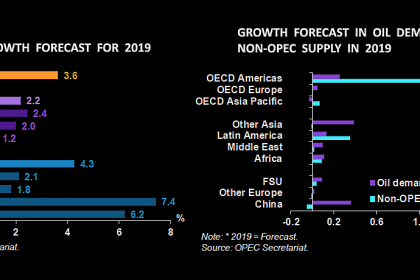

OPEC: OIL DEMAND UP BY 1.65 MBD

OPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East.