Oil

2019, December, 18, 13:35:00

ЭНЕРГЕТИКА РОССИИ, ИРАНА

“Отношения между Россией и Ираном планомерно развиваются, следуя курсу руководства наших стран. Наши лидеры находятся в постоянном контакте. Благодаря выстроенному конструктивному диалогу мы достигли существенного расширения взаимовыгодного российско-иранского взаимодействия в различных областях торгово-экономического сотрудничества, включая энергетику”,

2019, December, 18, 13:30:00

СОТРУДНИЧЕСТВО РОССИИ, РЕСПУБЛИКИ КОНГО

Особое внимание было уделено сотрудничеству в сфере энергетики, в том числе проекту нефтепродуктопровода «Пуэнт-Нуар – Лутете – Малуко-Трешо», работе российских нефтегазовых компаний АО «Зарубежнефть» и ПАО «ЛУКОЙЛ», перспективам взаимодействия в области электроэнергетики, а также сотрудничеству в области атомной энергетики.

2019, December, 18, 13:10:00

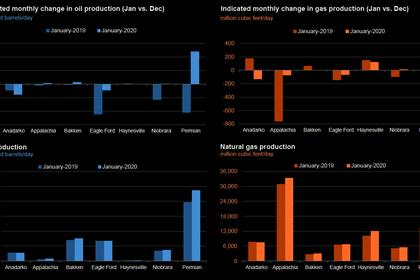

U.S. PRODUCTION: OIL + 30 TBD, GAS + 77 MCFD

Crude oil production from the major US onshore regions is forecast to increase 30,000 b/d month-over-month in December from 9,105 to 9,135 thousand barrels/day, gas production to increase 77 million cubic feet/day from 85,521 to 85,598 million cubic feet/day .

2019, December, 18, 12:50:00

BP, RELIANCE NETWORK IN INDIA

BP and Reliance Industries Limited (RIL) signed a definitive agreement relating to the formation of their new Indian fuels and mobility joint venture. This follows the initial heads of agreement signed in August this year.

2019, December, 16, 14:00:00

OIL PRICE: ABOVE $65

Brent 17 cents or 0.3% to $65.39 a barrel, WTI was up 10 cents or 0.2% to $60.17 a barrel.

2019, December, 16, 13:50:00

БАНК РОССИИ: КЛЮЧЕВАЯ СТАВКА 6.25%

Мы ожидаем, что темпы роста ВВП в этом году сложатся ближе к верхней границе нашего прогнозного интервала 0,8–1,3%. По итогам III квартала темпы роста экономики ускорились до 1,7%. Продолжается рост выпуска в промышленности. В октябре после длительного периода замедления увеличился годовой темп роста оборота розничной торговли. Этому способствовало ускорение роста реальных зарплат, что во многом происходит благодаря замедлению инфляции при сравнительно неизменных темпах роста номинальных зарплат.

2019, December, 16, 13:30:00

IEA: OIL DEMAND UP 0.9 MBD

Global oil demand increased by 900 kb/d y-o-y in 3Q19, the strongest annual growth in a year. Nearly three-quarters of the growth occurred in China.

2019, December, 16, 13:25:00

UAE, EGYPT RELATIONS

Commenting on the strategic cooperation between ECI and ECGE, Massimo Falcioni, CEO of ECI, said, "Taking into account the very strong non-oil trade relations between Egypt and the United Arab Emirates, this agreement will pave the way for the identification and development of more business opportunities. ECI’s partnership with ECGC will not only reinforce the existing partnership between the two countries but will also boost the regional and global competitiveness of local businesses."

2019, December, 16, 13:10:00

SAUDI ARAMCO $2 TLN

Saudi Aramco (2222.SE) hit the $2 trillion target sought by de-facto Saudi leader Crown Prince Mohammed bin Salman on Thursday as its shares racked up a second day of gains, despite some scepticism about the state-owned oil firm’s value.

2019, December, 16, 13:05:00

SHELL CREDIT FACILITY $10 BLN

Royal Dutch Shell plc (“Shell”) announces that it has signed a $10 billion revolving credit facility. The new facility replaces Shell’s existing $8.84 billion revolving credit facility and is provided by a syndicate of 25 banks.

2019, December, 16, 13:00:00

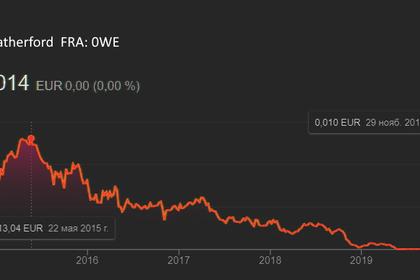

WEATHERFORD FINANCIAL RESTRUCTURING

Weatherford International plc announced that it has completed its financial restructuring and emerged from chapter 11 protection.

2019, December, 16, 12:55:00

U.S. RIGS UP 0 TO 799

U.S. Rig Count is unchanged from last week at 799, Canada Rig Count is up 15 rigs from last week to 153,

2019, December, 13, 11:10:00

OIL PRICE: ABOVE $64

Brent climbed 47 cents, or 0.7%, to $64.67 a barrel, WTI was up 34 cents, or 0.6%, to $59.52 a barrel,

2019, December, 13, 11:05:00

ПАРТНЕРСТВО РОССИИ, ВЬЕТНАМА

“Наиболее активно энергетическое взаимодействие России и Вьетнама традиционно развивается в нефтегазовой, электроэнергетической сферах и, в особенности, в угольном сегменте - экспорт угля из России во Вьетнам за прошедшие 9 месяцев 2019 года увеличился сразу на 172%, до 4,52 млн тонн. В то же время поставки нефтепродуктов выросли на более, чем 35% до 87,5 тыс тонн”, - сказал Александр Новак.

2019, December, 13, 10:55:00

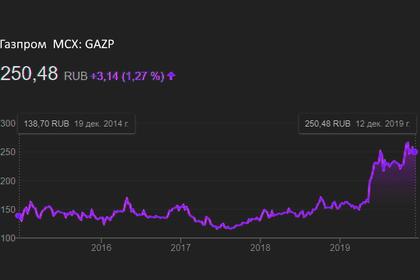

GAZPROM'S INVESTMENT 2020: RUB 1,104.7 BLN

Gazprom's overall amount of investments for 2020: RUB 1,104.7 billion.

Gazprom's borrowings for 2020: RUB 557.8 billion.

Final investment program and budget to be approved by Gazprom Board of Directors.