Trends

2017, September, 20, 08:45:00

RENEWABLE'S FUTURE

The falling cost of renewable energy will increasingly allow wind and solar projects to make money without subsidies, say the top executives in Europe’s power industry.

2017, September, 20, 08:40:00

TOTAL BUYS RENEWABLE

Total has picked up a 23 per cent stake in renewable energy company Eren for €237.5m as the the French oil group looks to expand its capacity in the sector.

2017, September, 20, 08:30:00

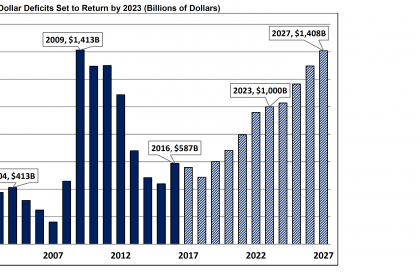

U.S. DEFICIT UP TO $123.1 BLN

The U.S. current-account deficit increased to $123.1 billion (preliminary) in the second quarter of 2017 from $113.5 billion (revised) in the first quarter of 2017, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit increased to 2.6 percent of current-dollar gross domestic product (GDP) from 2.4 percent in the first quarter.

2017, September, 18, 12:35:00

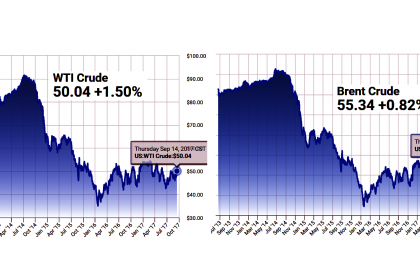

OIL PRICE: ABOVE $55

U.S. West Texas Intermediate (WTI) crude futures CLc1 were trading up 41 cents, or 0.8 percent, at $50.30 by 0852 GMT, near the three-month high of $50.50 it reached last Thursday.

Brent crude futures LCOc1, the benchmark for oil prices outside the United States, were at $55.91 a barrel, up 29 cents, and also not far from the near five-month high of $55.99 touched on Thursday.

2017, September, 18, 12:30:00

RUSSIA - CHINA - VENEZUELA OIL

“The principal risk regarding Russian and Chinese activities in Venezuela in the near term is that they will exploit the unfolding crisis, including the effect of US sanctions, to deepen their control over Venezuela’s resources, and their [financial] leverage over the country as an anti-US political and military partner,” observed R. Evan Ellis, a senior associate in the Center for Strategic and International Studies’ Americas Program.

2017, September, 18, 12:10:00

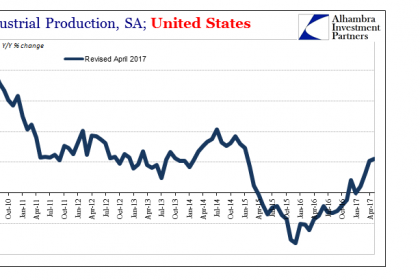

U.S. INDUSTRIAL PRODUCTION DOWN 0.9%

Industrial production declined 0.9 percent in August following six consecutive monthly gains. Hurricane Harvey, which hit the Gulf Coast of Texas in late August, is estimated to have reduced the rate of change in total output by roughly 3/4 percentage point. The index for manufacturing decreased 0.3 percent; storm-related effects appear to have reduced the rate of change in factory output in August about 3/4 percentage point. The manufacturing industries with the largest estimated storm-related effects were petroleum refining, organic chemicals, and plastics materials and resins.

2017, September, 18, 12:05:00

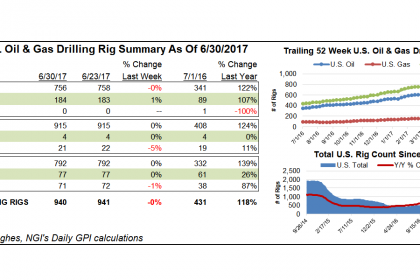

U.S. RIGS DOWN 8 TO 936

U.S. Rig Count is up 430 rigs from last year's count of 506, with oil rigs up 333, gas rigs up 97, and miscellaneous rigs unchanged at 1.

Canada Rig Count is up 80 rigs from last year's count of 132, with oil rigs up 37, gas rigs up 44, and miscellaneous rigs down 1.

2017, September, 15, 09:05:00

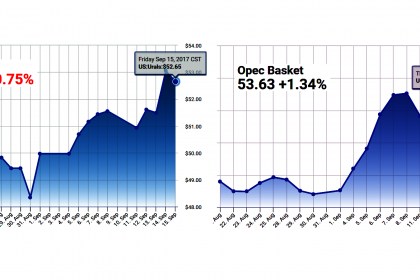

OIL PRICE: NOT ABOVE $56

U.S. West Texas Intermediate crude CLc1 was down 21 cents, or 0.4 percent, at $49.68 a barrel at 0302 GMT. It briefly broke above $50 on Thursday, hitting a four-month high, and finished 1.2 percent higher at $49.89, its highest close since July 31.

Brent crude LCOc1 futures were down 29 cents, or 0.5 percent, at $55.18 a barrel. They gained 0.6 percent to settle at $55.47 the previous session, the highest close since April 13.

2017, September, 15, 09:00:00

OIL PRICES: $50 - $60

Oil prices are expected to hold between $50 and $60 a barrel as bloated global stocks fall after a deal between OPEC and other producers to trim output, BP Chief Executive Bob Dudley said on Thursday.

2017, September, 15, 08:55:00

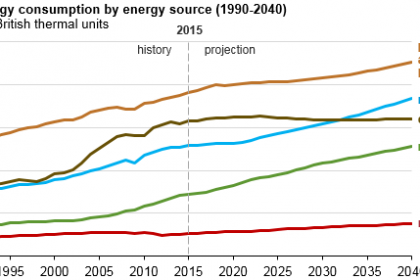

WORLD ENERGY CONSUMPTION UP TO 28%

The U.S. Energy Information Administration projects that world energy consumption will grow by 28% between 2015 and 2040. Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development (OECD), and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia (which includes China and India) accounts for more than 60% of the world's total increase in energy consumption from 2015 through 2040.

2017, September, 15, 08:50:00

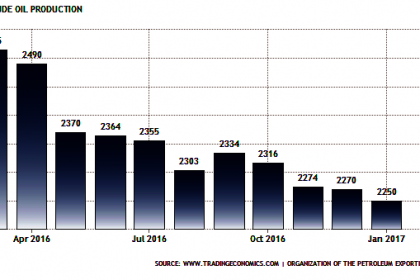

NIGERIA NEEDS TIME

Emmanuel Kachikwu, Nigeria’s minister of state for petroleum resources, told the Financial Times that the west African nation’s energy sector was still suffering from years of violent disruptions and needed more “recovery time” before joining a supply deal agreed last year between some of the world’s biggest oil producers.

2017, September, 15, 08:45:00

SEADRILL'S BANKRUPTCY

Seadrill, one of the world’s largest offshore drilling companies, filed for bankruptcy after it secured agreement from nearly all of its banks to support a plan to inject $1bn in new capital and all but wipe out existing shareholders.

2017, September, 15, 08:40:00

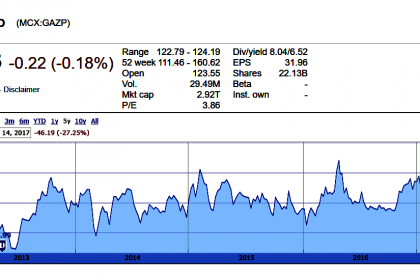

ИНВЕСТИЦИИ ГАЗПРОМА: 1 128,6 МЛРД. РУБ.

В соответствии с проектом инвестиционной программы на 2017 год в новой редакции, общий объем освоения инвестиций предусмотрен на уровне 1 трлн 128,576 млрд руб., что на 217,341 млрд руб. больше по сравнению с инвестиционной программой, утвержденной в декабре 2016 года. В том числе объем капитальных вложений составит 738,538 млрд руб. (рост на 112,518 млрд руб.), расходы на приобретение в собственность ПАО «Газпром» внеоборотных активов — 11,310 млрд руб. (рост на 11,185 млрд руб.). Объем долгосрочных финансовых вложений — 378,728 млрд руб. (рост на 93,637 млрд руб.).

2017, September, 15, 08:30:00

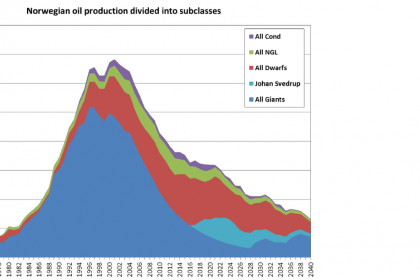

NORWAY'S OIL PRODUCTION DOWN 41 TBD

Preliminary production figures for August 2017 show an average daily production of 1 918 000 barrels of oil, NGL and condensate, which is a decrease of 41 000 barrels per day compared to July.

Total gas sales were 10.4 billion Sm3 (GSm3), which is a decrease of 0.1 GSM3 from the previous month.

2017, September, 13, 15:25:00

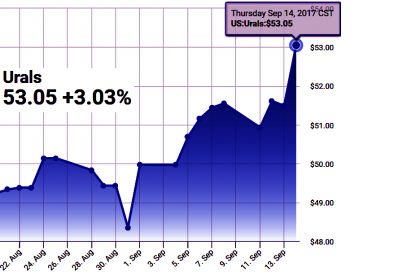

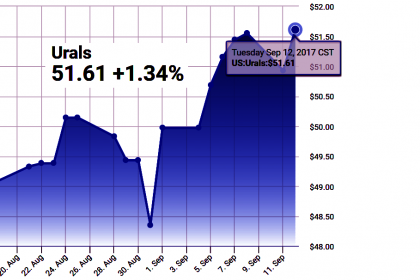

OIL PRICE: NOT ABOVE $55

By 1021 GMT, international benchmark Brent crude LCOc1 was up 27 cents, or 0.5 percent, at $54.54 a barrel.

U.S. West Texas Intermediate (WTI) CLc1 was up 38 cents, or 0.8 percent, at $48.61 a barrel.