Trends

2016, September, 19, 18:30:00

HIGH RISK FOREVER

“We see 2017-2020 as still having the potential for much higher prices. After 2020, there is a high risk that electric vehicle penetration will change the oil market forever.”

2016, September, 15, 18:40:00

UNSTABLE OIL PRICES

The collapse of oil prices has forced Canadian and global producers to slash costs and curtail investment over the past two years. Even after a rebound from a 12-year low earlier this year, oil futures in New York are still about 60 percent down from their 2014 peak. Prices have been mostly stuck in the $40-$50 range for the past four months.

2016, September, 14, 15:20:00

GROWTH IS SLOWING

Global oil demand growth is slowing at a faster pace than initially predicted.

2016, September, 14, 15:15:00

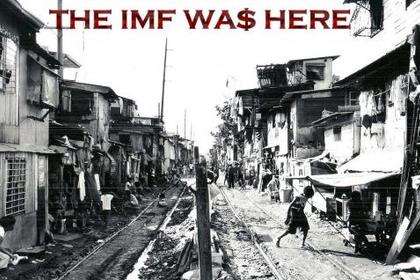

IMF WANTS WHOLE WORLD

Growth has also been unequal: in major advanced economies, incomes for the top 10 percent increased by 40 percent in the past two decades, while growing only modestly at the bottom.

2016, September, 13, 14:50:00

MARKET IS OWERSUPPLIED

The producer cartel revised higher for this year and next oil supply forecasts from non-member countries, implying that demand for its crude will remain far lower than current near record output of more than 33m barrels a day.

2016, September, 9, 14:05:00

REFINING PROFITS DOWN

The decline in earnings was driven largely by the decline in crack spreads (the price difference between crude oil and petroleum products) in the second quarter. In addition to changes in crack spreads, which serve as an indicator of refinery profits, earnings per barrel reflect transportation costs and other operating expenses. Also, refiners use different crude oil blends and produce different yields of refined products, which changes the per barrel earnings among refiners.

2016, September, 8, 18:55:00

OIL PRICES: $42 - $52

Brent crude oil prices are forecast to average $43/b in 2016 and $52/b in 2017. West Texas Intermediate (WTI) crude oil prices are forecast to average $1/b less than Brent in 2016 and 2017.

2016, September, 8, 18:45:00

E&P WILL UP BY 5%

Oil and gas companies are poised to increase spending on exploration and production globally by 5% in 2017, while offshore spending may continue to fall next year, based on Barclays’ midyear global spending survey of more than 200 companies.

2016, September, 8, 18:35:00

INTERNATIONAL RIG COUNT DOWN 200

The international rig count for August 2016 was 937 down 1 from the 938 counted in July 2016, and down 200 from the 1,137 counted in August 2015. The international offshore rig count for August 2016 was 228, up 2 from the 226 counted in July 2016, and down 42 from the 270 counted in August 2015.

2016, September, 7, 19:00:00

IRAN SUPPORTS PRICE $50 - $60

“Iran wants a stable market and therefore any measure that helps the stabilisation of the oil market is supported by Iran,” Mr Zanganeh said. “We support oil prices between $50 and $60 per barrel.”

2016, September, 5, 18:55:00

OPEC PRODUCTION UP TO 33.7 MBD

Supplies from the Organization of Petroleum Exporting Countries rose by 120,000 barrels a day to average 33.69 million a day in August amid increases by Iran, Iraq and Kuwait, the survey of analysts, oil companies and ship-tracking data showed. The group is due to hold informal talks in three weeks in Algiers, where Russian President Vladimir Putin says an agreement can be reached to limit output.

2016, September, 5, 18:50:00

ASIA'S OIL PRODUCTION DOWN

Asia's net oil imports surpassed the total amount of oil consumed in North America in 2015 and are set to rise after producers slashed spending on exploration and production on low oil prices, leaving oilfields at risk of sharp production declines in the next decade.

2016, August, 31, 18:50:00

EUROPEAN ENERGY MARKET BALANCE

“There are no easy buttons to push. It’s not simply about the oil price, the Paris Agreement or the still incomplete single market. It’s about the interdependencies and how these factors amplify each other. At the end of the day, economic as well as social and ecological interests must be in balance with supply security in Europe.”

2016, August, 31, 18:45:00

CHEVRON'S LNG FOR CHINA

Chevron Corporation (NYSE: CVX) announced that its wholly-owned subsidiary, Chevron U.S.A. Inc., has signed a binding LNG Sales and Purchase Agreement (SPA) with ENN LNG Trading Company Limited (ENN) for the delivery of liquefied natural gas (LNG) to China from Chevron’s global supply portfolio. Under the terms of the SPA, ENN will receive up to 0.65 million metric tons per annum (MTPA) of LNG over 10 years, with the first delivery expected to start in 2018 or the first half of 2019.

2016, August, 31, 18:40:00

MALAYSIAN - INDONESIAN LNG

In recent years, given the huge potential in Indonesia LNG market, JSK has ventured into the LNG supply chain. Recently, it was awarded the LNG re-gasification and storage contracts to support a gas-fired power plant in Bali, Indonesia. Following the successful completion of the deal, Coastal Contracts would have joint control over JSK Gas’s operating subsidiaries and assets. JSK Gas, through its 99% owned subsidiary Benoa Gas Terminal (BGT), would be engaged in the operations and transfer of a floating LNG regasification unit over a five-year contract period.