All publications by tag «»

2017, November, 13, 10:10:00

TRANSCANADA NET INCOME $2.136 BLN

TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for third quarter 2017 of $612 million or $0.70 per share compared to a net loss of $135 million or $0.17 per share for the same period in 2016. Comparable earnings for third quarter 2017 were $614 million or $0.70 per share compared to $622 million or $0.78 per share for the same period in 2016. TransCanada's Board of Directors also declared a quarterly dividend of $0.625 per common share for the quarter ending December 31, 2017, equivalent to $2.50 per common share on an annualized basis.

2017, November, 13, 10:05:00

TOTAL ACQUIRES ENGIE'S LNG $2 BLN

Total SA has agreed to acquire LNG assets from Engie SA for as much as $2.04 billion. The deal includes interests in liquefaction plants, long-term LNG sales and purchase agreements, an LNG tanker fleet, and access to regasification capacities.

2017, November, 13, 10:00:00

U.S. RIGS UP 9 TO 907

U.S. Rig Count is up 339 rigs from last year's count of 568, with oil rigs up 286, gas rigs up 54, and miscellaneous rigs down 1 to 1.

Canada Rig Count is up 27 rigs from last year's count of 176, with oil rigs up 19 and gas rigs up 8.

2017, November, 11, 08:56:00

VIETNAM & GAZPROM: KEY PARTNERS

Vietnam is one of Gazprom’s key partners in Southeast Asia. Together with PetroVietnam, we successfully conduct geological exploration and produce hydrocarbons, as well as make preparations to develop the country’s NGV market.

2017, November, 9, 14:05:00

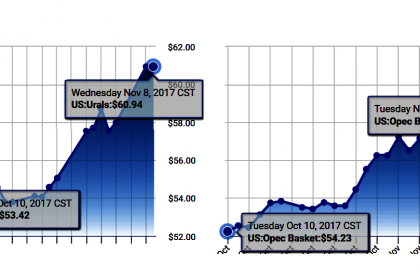

OIL PRICE: ABOVE $63

Benchmark Brent crude oil LCOc1 was unchanged at $63.49 a barrel by 0840 GMT. On Tuesday, Brent reached an intra-day high of $64.65, its highest since June 2015.

U.S. light crude CLc1 was steady at $56.81, not too far off this week’s more than two-year high of $57.69 a barrel.

2017, November, 9, 14:00:00

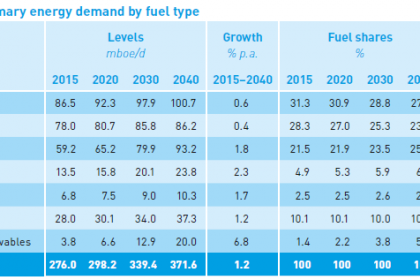

OPEC: 2040 GLOBAL ENERGY CHANGES

Within the grouping of Developing countries, India and China are the two nations with the largest additional energy demand over the forecast period, both in the range of 22–23 mboe/d.

2017, November, 9, 13:55:00

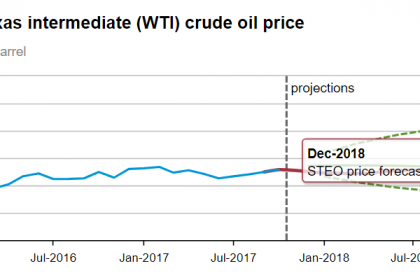

EIA: OIL PRICE $53 - $56

North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

2017, November, 9, 13:50:00

EIA: NUCLEAR ENERGY WILL UP

EIA projects that global nuclear capacity will grow at an average annual rate of 1.6% from 2016 through 2040, led predominantly by countries outside of the Organization for Economic Cooperation and Development (OECD). EIA expects China to continue leading world nuclear growth, followed by India. This growth is expected to offset declines in nuclear capacity in the United States, Japan, and countries in Europe.

2017, November, 9, 13:45:00

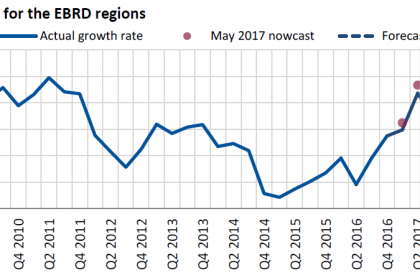

EUROPEAN ECONOMY UP 3.3%

Average growth across the EBRD region is seen at 3.3 per cent this year, a rise of 0.9 percentage points against the previous forecast from May, and compared with growth of just 1.9 per cent in 2016.

The economy in Russia, the largest in the EBRD region and a major influence on output in many other EBRD countries of operations, has now pulled out of recession after a cumulative contraction of 3 per cent over the last two years. Russia is expected to see GDP growth of 1.8 and 1.7 per cent in 2017 and 2018, respectively.

2017, November, 9, 13:40:00

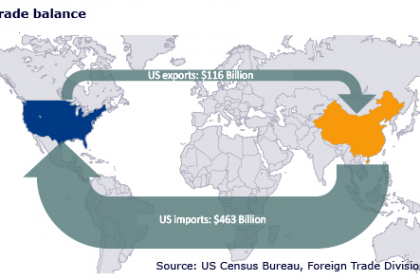

CHINA'S INVESTMENT TO U.S.

President Donald Trump can return to the United States claiming to have snagged over $250 billion in deals from his maiden trip to Beijing. Whether those deals live up to the lofty price tag is another question altogether.

Some huge deals were announced. Among them is a 20-year $83.7 billion investment by China Energy Investment Corp in shale gas developments and chemical manufacturing projects in West Virginia, a major energy producing state that voted heavily for Trump in the 2016 election.