All publications by tag «FINANCIAL»

2019, June, 13, 16:15:00

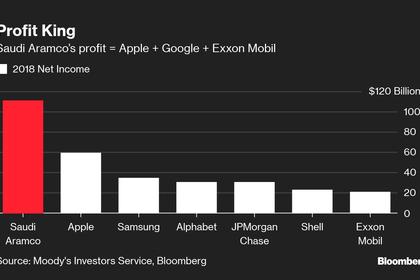

SAUDI ARAMCO NET INCOME $111 BLN

Saudi Aramco is the world’s largest integrated oil and gas company; its upstream operations are based in the Kingdom of Saudi Arabia and it also operates a global downstream business. Headquartered in the city of Dhahran, the company operates in eight locations within the Kingdom and 20 locations overseas, and employs around 76,000 people.

2016, July, 29, 18:40:00

CONOCO NET LOSS $2.54 BLN

ConocoPhillips (NYSE: COP) reported a second-quarter 2016net loss of $1.1 billion,or ($0.86) per share, compared with a second-quarter 2015 net loss of $179 million, or ($0.15) per share. Excluding special items, second-quarter 2016 adjusted earnings were anet loss of $985 million, or ($0.79) per share, compared with second-quarter 2015 adjusted earnings of $81 million, or $0.07 per share. Special items for the current quarter were related to non-cashimpairments in the Lower 48, primarily in the Gulf of Mexico; pension settlement expense; deferred tax adjustments; and a gain onan asset sale.

2016, July, 28, 18:50:00

ANADARKO NET LOSS $1.7 BLN

"Our portfolio continues to perform exceptionally well, and we've continued to significantly reduce our cost structure throughout the year," said Al Walker, Anadarko Chairman, President and CEO.

2016, May, 16, 20:45:00

RUSSIA'S POSITIVE SIGNALS

Russia’s economy is closer to growth than at any time since it slid into recession and central bank Governor Elvira Nabiullina is focusing on what she says are “positive signals.”

2016, May, 5, 18:15:00

WEATHERFORD NET LOSS $498 MLN

Revenue for the first quarter of 2016 was $1.59 billion compared with $2.01 billion in the fourth quarter of 2015 and $2.79 billion in the first quarter of 2015. First quarter revenues declined 21% sequentially and 43% from the prior year. The sequential decline was 22% in North America and 21% for International operations. Product sales declined 30% sequentially, while service and rental revenue decreased by 16%. The product sales decline was as much seasonal as cyclical and most impacted the Eastern Hemisphere.

2016, April, 21, 13:50:00

U.S. LOSSES $67 BLN

A high debt-to-equity ratio can present challenges in the face of falling revenue, which most U.S. oil producers experienced in 2015 because of lower oil prices. A company agrees to the terms of a bank loan or bond issuance to fund projects with the expectation that its activities will generate sufficient revenue to service the debt and eventually repay it. Debt on the balance sheet implies future cash outflows. The need to service large amounts of debt as revenues declined made companies with high debt-to-equity ratios more vulnerable to losses than companies with less leverage in their capital structures.

2016, March, 22, 19:15:00

2015: U.S. DEFICIT UP

Goods exports decreased to $1,513.5 billion from $1,632.6 billion, the first decrease since 2009. The largest decrease—which accounted for more than two-thirds of the total decrease in goods exports—was in industrial supplies and materials. The decrease was mainly due to a decrease in petroleum and products.

2016, March, 3, 18:55:00

ANADARKO SELLS MORE

One of the world’s biggest independent oil and natural gas exploration and production companies, Anadarko said Tuesday it will cut capital expenditures this year to between $2.6 billion and $2.8 billion, from about $5.5 billion last year.

2016, February, 7, 17:10:00

SUNCOR NET LOSS $2 BLN

Net loss of $2.007 billion ($1.38 per common share), due to non-cash asset writedowns, which were a result of the depressed commodity cycle, and a foreign exchange loss on U.S. dollar denominated debt.

2016, February, 7, 17:05:00

CONOCO NET LOSS $4.4 BLN

Full-year 2015 earnings were a net loss of $4.4 billion, or ($3.58) per share, compared with full-year 2014 earnings of $6.9 billion, or $5.51 per share. Excluding special items, full-year 2015 adjusted earnings were a net loss of $1.7 billion, or ($1.40) per share, compared with full-year 2014 adjusted earnings of $6.6 billion, or $5.30 per share.