All publications by tag «U.S»

2017, October, 6, 12:35:00

U.S. DEFICIT DOWN TO $42.4 BLN

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $42.4 billion in August, down $1.2 billion from $43.6 billion in July, revised. August exports were $195.3 billion, $0.8 billion more than July exports. August imports were $237.7 billion, $0.4 billion less than July imports.

2017, September, 29, 12:20:00

RUSSIA INFLUENCES U.S.

“In light of Facebook’s disclosure of over $100,000 in social media advertising associated with Russian accounts focused on the disruption and influence of US politics through social media, it is likely that Russia undertook a similar effort using social media to influence the US energy market,”

2017, September, 8, 09:00:00

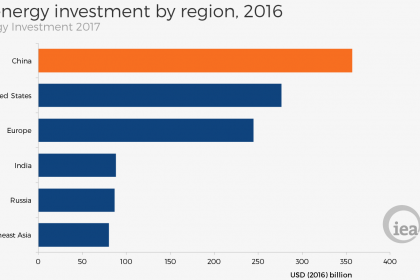

U.S. ENERGY INVESTMENT: $1.3 TLN

“We welcome the President’s commitment to pro-growth tax reform, and look forward to working with the administration and Congress on continuing our nation’s energy leadership. Pro-growth tax reform and economic policies can further strengthen our energy infrastructure and benefit consumers. As an industry that invests billions in the U.S. economy each year, pro-growth policies would allow us to accelerate these economic investments while keeping energy affordable. Private investment in our nation’s energy infrastructure could exceed $1.3 trillion and support 1 million jobs annually through 2035.”

2017, September, 8, 08:40:00

U.S. DEFICIT $43.7 BLN

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.7 billion in July, up $0.1 billion from $43.5 billion in June, revised. July exports were $194.4 billion, $0.6 billion less than June exports. July imports were $238.1 billion, $0.4 billion less than June imports.

2017, September, 4, 12:10:00

U.S. - RUSSIA BLOCK IN VENEZUELA

The Trump administration is ready to block a Russian state-owned oil giant from gaining control of critical energy assets in the U.S. owned by Venezuela, senior American officials say, a move that likely would feed tensions between Washington and Moscow.

2016, November, 2, 18:40:00

U.S. OIL WILL DOWN 800 TBD

Output in the U.S. will fall 800,000 barrels a day this year, Adam Sieminski, administrator for the EIA, said in an interview in Riyadh. That would be the first drop since 2008, data compiled by Bloomberg show. OPEC’s attempts to carry out an agreement on limiting production are still “very much up in the air,” he said.

2016, October, 27, 18:55:00

AMERICA'S HEALTH PRICE: $50

The North American market has continued to "grind slowly upwards" as the rig count, particularly in the US, ticks ahead from troughs seen six months ago, Martin Craighead said during a quarterly conference call with analysts. But "customers need to be more confident of the durability of those prices before making any significant change to their spending patterns," Craighead said.

2016, October, 18, 18:35:00

U.S. OIL PRODUCTION DOWN 30 TBD

USA oil production down 30 tbd, gas production down 178 mcfd.

2016, October, 18, 18:30:00

U.S. RIGS UP 15

USA Rig Count is down 248 rigs from last year's count of 787, with oil rigs down 163, gas rigs down 87, and miscellaneous rigs up 2.

Canadian Rig Count is down 16 rigs from last year's count of 181, with oil rigs up 14, and gas rigs down 30.

2015, September, 21, 18:50:00

U.S. OIL DEBT UP

Results from second-quarter 2015 financial statements of a number of U.S. companies with onshore oil operations suggest continued financial strain for some companies. Low oil prices have significantly reduced cash flow for U.S. oil producers, and to adjust to lower cash flows, companies have reduced capital expenditures and raised more cash from debt and equity.