All publications by tag «RATE»

2019, November, 1, 13:30:00

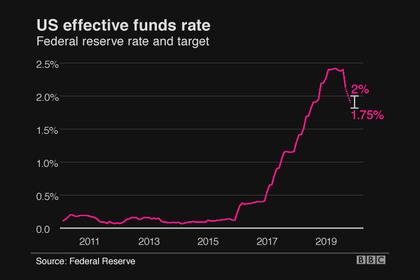

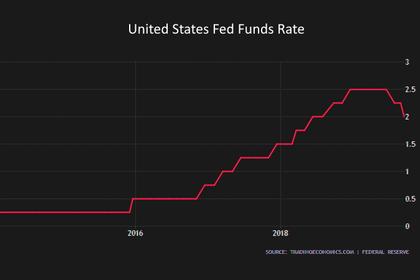

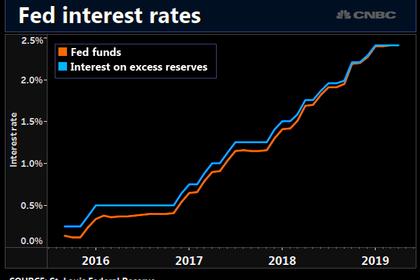

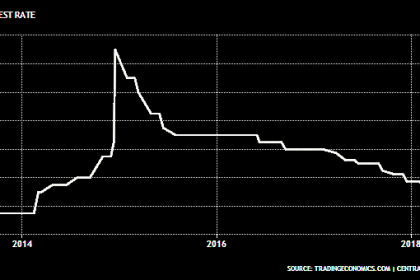

U.S. FEDERAL FUNDS RATE 1.5 - 1.75%

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 1-1/2 to 1-3/4 percent.

2019, September, 19, 13:35:00

U.S. FEDERAL FUNDS RATE 1.75 - 2%

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 1-3/4 to 2 percent.

2019, August, 1, 11:30:00

U.S. FEDERAL FUNDS RATE 2 - 2.25%

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent.

2019, June, 20, 17:15:00

U.S. FEDERAL FUNDS RATE 2.25 - 2.5%

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

2019, May, 2, 16:25:00

U.S. FEDERAL FUNDS RATE 2.25 - 2.5%

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

2019, March, 22, 10:05:00

U.S. FEDERAL FUNDS RATE 2.25-2.5%

U.S. FRB - Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

2019, February, 1, 10:55:00

U.S. FEDERAL FUNDS RATE 2.25-2.5%

U.S. FRB - Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

2019, January, 21, 11:15:00

EMIRATES RENEWABLE INVESTMENT AED4.4 BLN

ENA - Mohammed Saif Al Suwaidi, Director-General of ADFD, said, "The Abu Dhabi Fund for Development believes in the vital role the renewable energy sector plays in attaining the sustainable development goals in developing countries. This important sector stimulates economic growth, creates employment opportunities, drives innovation, supports the advancement of other key sectors, and optimises the use of natural resources – all crucial factors in improving people’s lives."

2018, September, 28, 09:35:00

U.S. FEDERAL FUNDS RATE 2.25%

FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 2 to 2-1/4 percent.

2018, August, 3, 09:30:00

THE BANK OF RUSSIA KEY RATE 7.25%

BANK OF RUSSIA - On 27 July 2018, the Bank of Russia Board of Directors decided to keep the key rate at 7.25% per annum. Though annual inflation remains below the target, it is tending to return to 4%. The Bank of Russia forecasts that consumer prices will grow by 3.5–4% year-on-year at the end of 2018 and annual inflation will temporarily overshoot 4% in 2019 due to the planned increase of the value added tax. The annual consumer price growth rate will return to 4% in early 2020.