Analysis

2021, April, 14, 12:15:00

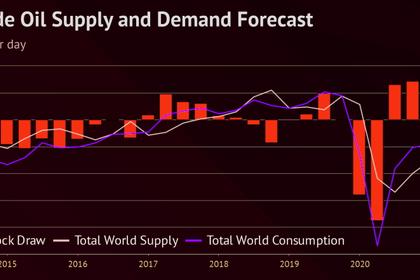

GLOBAL OIL DEMAND WILL UP BY 6 MBD

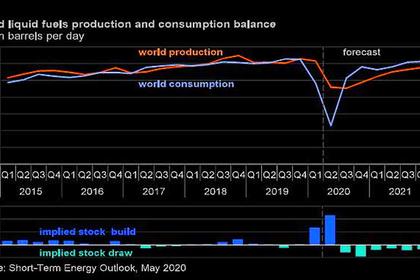

In 2021, world oil demand growth is expected to increase by about 6.0 mb/d y-o-y, representing an upward revision of about 0.1 mb/d from last month’s report.

2021, April, 14, 12:10:00

U.S. OIL PRODUCTION WILL UP

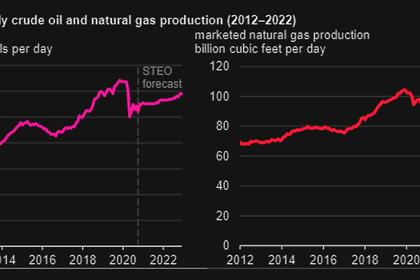

Higher prices are buoying drillers’ confidence. Benchmark Nymex oil gained nearly 35% in the past four months after OPEC and its alliance cut production to strike a balance between demand and supply. The fossil fuel is also getting a bump as Covid-19 vaccinations progress and Americans travel again, boosting gasoline consumption.

2021, April, 14, 12:00:00

EUROPEAN WIND INVESTMENT $51 BLN

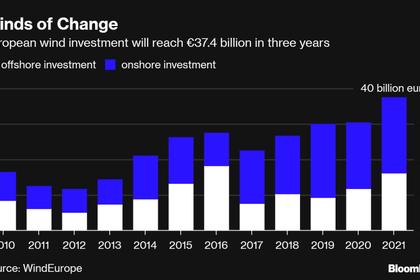

The investments financed 19.6 GW of capacity that will be constructed in the coming years. Around 13 GW of this will be in the EU.

2021, April, 13, 13:40:00

OIL PRICE: ABOVE $63 STILL

Brent were up 37 cents, or 0.6%, at $63.65 a barrel. WTI gained 32 cents, or 0.5%, to $60.02 a barrel.

2021, April, 13, 13:10:00

GLOBAL INDEXES UP

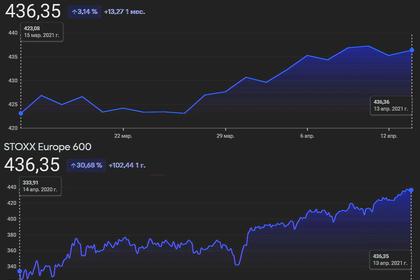

The broad Euro STOXX 600 gained 0.3% to near record highs, with export-heavy German shares up 0.2%. Indexes in Paris and London shares fell 0.1%.

2021, April, 13, 13:00:00

ФНБ РОССИИ $182,3 МЛРД.

По состоянию на 1 апреля 2021 г. объем ФНБ составил 13 802 118,5 млн. рублей или 11,9% ВВП, что эквивалентно 182 321,0 млн. долл. США,

2021, April, 13, 12:55:00

ДОХОДЫ РОССИИ +212,6 МЛРД.РУБ.

Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета, связанный с превышением фактически сложившейся цены на нефть над базовым уровнем, прогнозируется в апреле 2021 года в размере +212,6 млрд руб.

2021, April, 12, 10:38:47

OIL PRICE: NEAR $63 STILL

Brent was up 2 cents at $62.97 a barrel. WTI gained 1 cent to $59.49 a barrel.

2021, April, 12, 10:20:00

OPEC+ OIL PRODUCTION UP 450 TBD

With the production gains, OPEC+ compliance with its quotas slipped to 111% in March, compared with 113.5% in February, juiced by Saudi Arabia voluntarily cutting an additional 1 million b/d since January.

2021, April, 12, 10:10:00

U.S. DIGITAL ENERGY INVESTMENT $2 TLN

President Biden’s American Jobs Plan proposes pumping $2.3 trillion into a slew of sectors over the next eight years.

2021, April, 12, 10:05:00

INDIA'S INDEXES DOWN

The NSE Nifty 50 index was down 2.44% at 14,474.10 by 0440 GMT, while the S&P BSE Sensex was 2.42% lower at 48,374.94. The two indexes have now retreated 6%-8% from their mid-February record highs.

2021, April, 12, 09:55:00

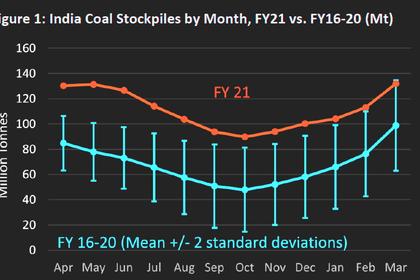

INDIA'S COAL RECORD

India has stockpiled a record 132 million tonnes of coal – enough to run India’s power plants for two months – greatly exceeding the average of the previous five years,

2021, April, 12, 09:40:00

U.S. GRID MODERNIZATION

The answer lies, at least in part, in focusing on grid modernization, including the expansion of transmission capacity, increased use of energy storage systems, microgrids and digital solutions, and the adoption of a more coordinated national policy to make this possible.

2021, April, 12, 09:30:00

U.S. RIGS UP 2 TO 432

U.S. Rig Count is up 2 from last week at 432, Canada Rig Count is down 11 from last week to 58

2021, April, 9, 11:25:00

OIL PRICE: NEAR $63 YET

Brent edged down 12 cents, or 0.2%, to $63.08 a barrel. WTI was at $59.59 a barrel.