Analysis

2020, September, 30, 13:10:00

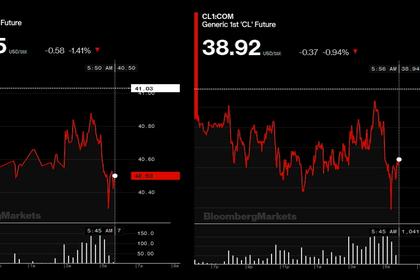

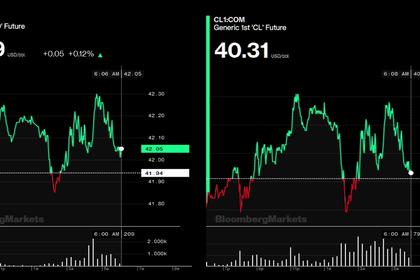

OIL PRICE: NOT BELOW $40 AGAIN

Brent dropped 40 cents, or 1%, to $40.63 per barrel, WTI fell 32 cents, or 0.8%, to $38.97.

2020, September, 30, 13:05:00

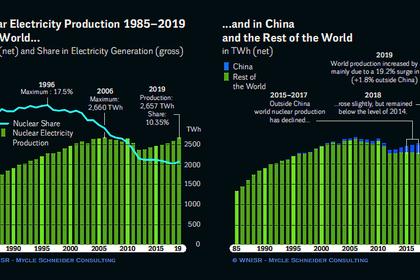

GLOBAL NUCLEAR ENERGY UPDOWN

The World Nuclear Industry Status Report 2020 (WNISR2020) provides a comprehensive overview of nuclear power plant data, including information on age, operation, production, and construction of reactors.

2020, September, 30, 12:55:00

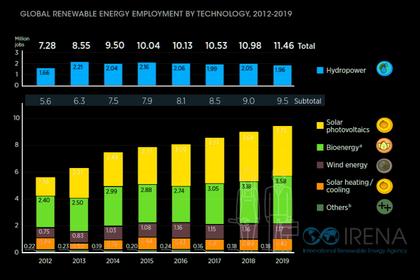

RENEWABLE EMPLOYMENT UP TO 11.5 MLN

Employment in renewable energy worldwide was estimated at 11.5 million in 2019, up from 11 million in 2018. Women hold 32% of these jobs.

2020, September, 30, 12:45:00

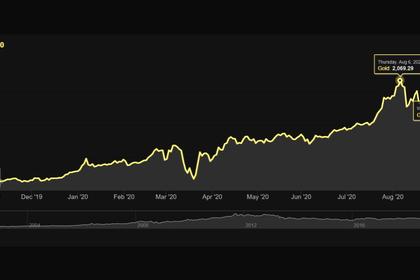

GOLD PRICE DOWN AGAIN

Spot gold fell 0.6% to $1,886.78 per ounce, U.S. gold futures were down 0.5% at $1,893.40.

2020, September, 30, 12:40:00

SHELL WILL CUT 9,000 JOBS

Shell job reductions of 7,000 to 9,000 are expected (including around 1,500 people who have agreed to take voluntary redundancy this year) by the end of 2022.

2020, September, 30, 12:35:00

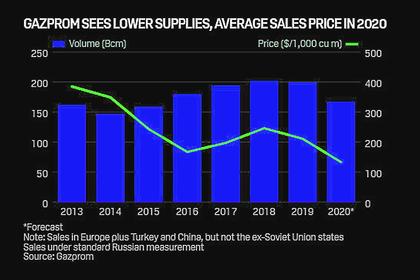

GAZPROM SALES WILL DOWN

Gazprom reported a 6.8% drop in its revenues and a 17% fall in its net profit in 2019

2020, September, 29, 13:00:00

OIL PRICE: NOT BELOW $42 AGAIN

Brent fell 32 cents, or 0.8%, to $42.55 a barrel, WTI dropped 34 cents, or 0.8%, to $40.26 a barrel

2020, September, 29, 12:25:00

EUROPE'S INDEX DOWN

The pan-European STOXX 600 was down 0.5% after recording its biggest single-day gain in three months on Monday.

2020, September, 28, 12:10:00

OIL PRICE: NOT BELOW $41 AGAIN

Brent fell 37 cents, or 0.9%, to $41.55 a barrel, WTI was at $39.86 a barrel

2020, September, 28, 11:55:00

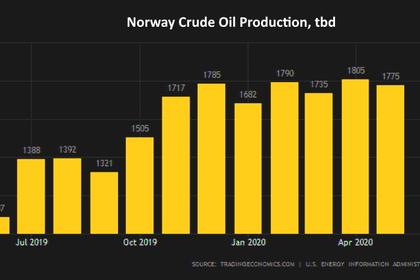

NORWAY'S OIL & GAS PRODUCTION 1.722 MBD

The production figures for oil in August include this cut of 134 000 barrels per day in the second half of 2020.

2020, September, 28, 11:50:00

CHINA'S INDEX UP

The blue-chip CSI300 index rose 0.3%, to 4,581.91, while the Shanghai Composite Index slipped 0.1% to 3,217.53.

2020, September, 28, 11:30:00

U.S. RIGS UP 6 TO 261

U.S. Rig Count is up 6 from last week to 261, Canada Rig Count is up 7 from last week to 71

2020, September, 25, 13:20:00

OIL PRICE: NEAR $42

Brent was up 30 cents at $42.24 a barrel, WTI rose 23 cents to $40.54 a barrel.

2020, September, 25, 13:15:00

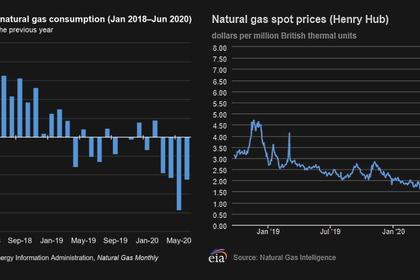

U.S. GAS CONSUMPTION DOWN

Natural gas consumption in the U.S. industrial sector declined from 25.4 billion cubic feet per day (Bcf/d) in January 2020 to 20.1 Bcf/d in June 2020,

2020, September, 25, 13:10:00

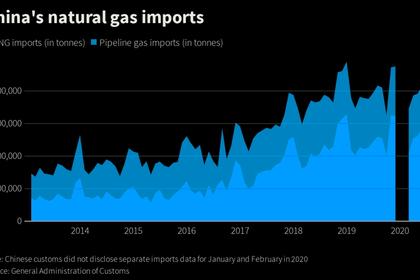

CHINA LNG IMPORTS UP

China LNG imports are set to hit a record 65-67 million tonnes this year