Analysis

2017, September, 22, 09:20:00

OIL PRICE: NOT ABOVE $57

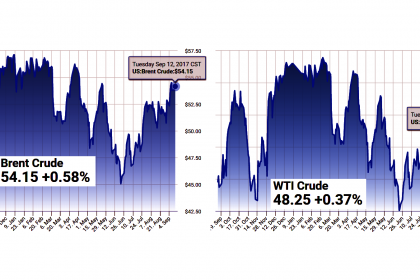

International benchmark Brent crude futures were at $56.51 a barrel at 0644 GMT, up 8 cents, or 0.14 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures were up 12 cents, or 0.24 percent, at $50.67 per barrel.

2017, September, 22, 08:55:00

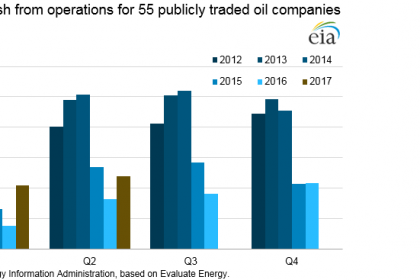

U.S. OIL & CASH FLOW UP

Second-quarter 2017 financial statements for 55 U.S. oil companies indicate that aggregate liquids production grew year over year for the first time since the fourth quarter of 2015. Cash flow from operating activities also increased year over year, the third consecutive quarter of year-over-year growth, reaching the highest level in nearly two years.

2017, September, 22, 08:35:00

QATAR - TURKEY LNG

Qatargas has agreed to sell 1.5 million tpy of LNG to Turkey’s BOTAŞ Petroleum Pipeline Corporation (BOTAŞ) over a period of three years

2017, September, 22, 08:30:00

U.S. FEDERAL FUNDS RATE: 1 - 1.25%

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

2017, September, 20, 09:05:00

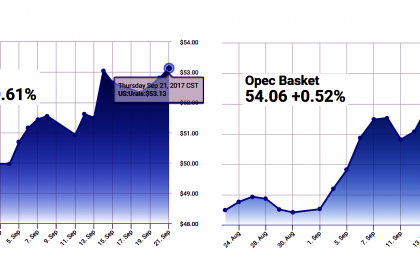

OIL PRICE: ABOVE $55 YET

The October light, sweet crude contract on the New York Mercantile Exchange gained 2¢ to settle at $49.91/bbl on Sept. 18. The November contract dropped 9¢ to settle at $50.35/bbl.

The NYMEX natural gas price for October rose 12¢ to $3.14/MMbtu. The Henry Hub cash gas price climbed by 11¢ to $3.10/MMbtu.

Heating oil for October fell nearly 2¢ to a rounded $1.78/gal. The NYMEX reformulated gasoline blendstock for October was up less than 1¢ to $1.67/gal on Sept. 18.

The Brent crude contract for November on London’s ICE fell 14¢ to $55.48/bbl. The December contract declined 17¢ to $55.25/bbl. The gas oil contract for October was $525/tonne, down $9.75.

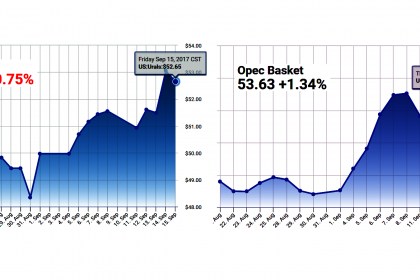

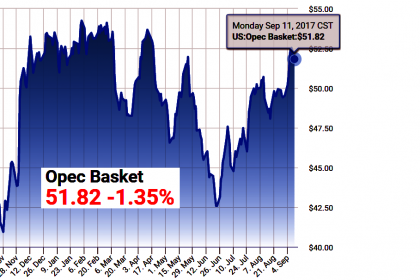

OPEC’s basket of crudes for Sept. 18 was $53.78/bbl, up 14¢.

2017, September, 20, 08:50:00

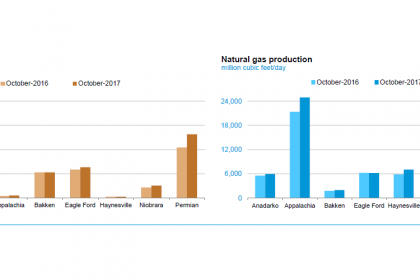

U.S. OIL + 79 TBD, GAS + 788 MCFD

Crude oil output from the seven major US onshore producing regions is forecast to increase 79,000 b/d month-over-month in October to 6.083 million b/d. Natural gas production from the seven regions is expected to climb 788 MMcfd month-over-month in October to 59.745 bcfd.

2017, September, 20, 08:30:00

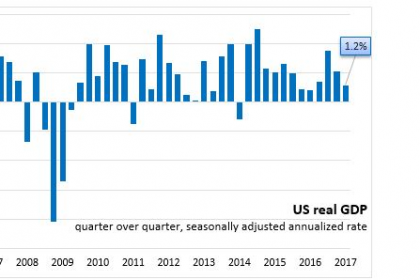

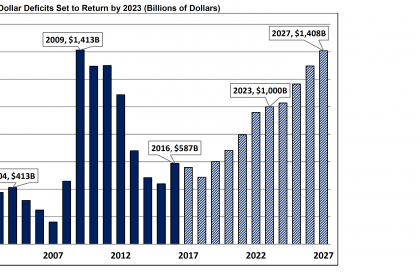

U.S. DEFICIT UP TO $123.1 BLN

The U.S. current-account deficit increased to $123.1 billion (preliminary) in the second quarter of 2017 from $113.5 billion (revised) in the first quarter of 2017, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit increased to 2.6 percent of current-dollar gross domestic product (GDP) from 2.4 percent in the first quarter.

2017, September, 18, 12:35:00

OIL PRICE: ABOVE $55

U.S. West Texas Intermediate (WTI) crude futures CLc1 were trading up 41 cents, or 0.8 percent, at $50.30 by 0852 GMT, near the three-month high of $50.50 it reached last Thursday.

Brent crude futures LCOc1, the benchmark for oil prices outside the United States, were at $55.91 a barrel, up 29 cents, and also not far from the near five-month high of $55.99 touched on Thursday.

2017, September, 18, 12:30:00

RUSSIA - CHINA - VENEZUELA OIL

“The principal risk regarding Russian and Chinese activities in Venezuela in the near term is that they will exploit the unfolding crisis, including the effect of US sanctions, to deepen their control over Venezuela’s resources, and their [financial] leverage over the country as an anti-US political and military partner,” observed R. Evan Ellis, a senior associate in the Center for Strategic and International Studies’ Americas Program.

2017, September, 18, 12:05:00

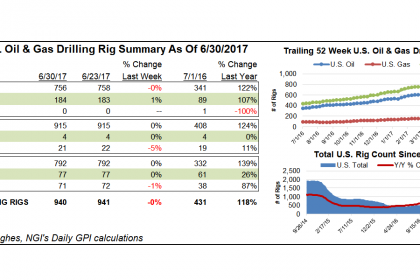

U.S. RIGS DOWN 8 TO 936

U.S. Rig Count is up 430 rigs from last year's count of 506, with oil rigs up 333, gas rigs up 97, and miscellaneous rigs unchanged at 1.

Canada Rig Count is up 80 rigs from last year's count of 132, with oil rigs up 37, gas rigs up 44, and miscellaneous rigs down 1.

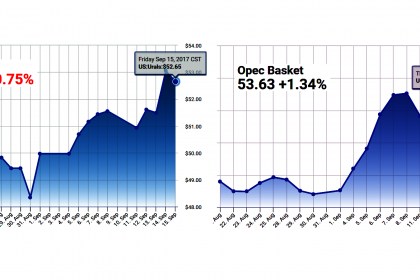

2017, September, 15, 09:05:00

OIL PRICE: NOT ABOVE $56

U.S. West Texas Intermediate crude CLc1 was down 21 cents, or 0.4 percent, at $49.68 a barrel at 0302 GMT. It briefly broke above $50 on Thursday, hitting a four-month high, and finished 1.2 percent higher at $49.89, its highest close since July 31.

Brent crude LCOc1 futures were down 29 cents, or 0.5 percent, at $55.18 a barrel. They gained 0.6 percent to settle at $55.47 the previous session, the highest close since April 13.

2017, September, 15, 08:55:00

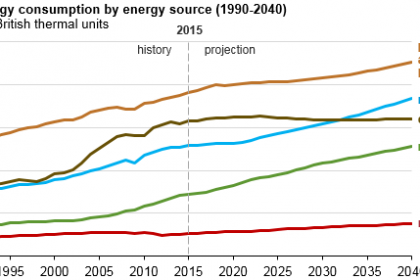

WORLD ENERGY CONSUMPTION UP TO 28%

The U.S. Energy Information Administration projects that world energy consumption will grow by 28% between 2015 and 2040. Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development (OECD), and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia (which includes China and India) accounts for more than 60% of the world's total increase in energy consumption from 2015 through 2040.

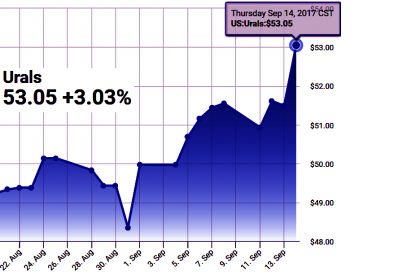

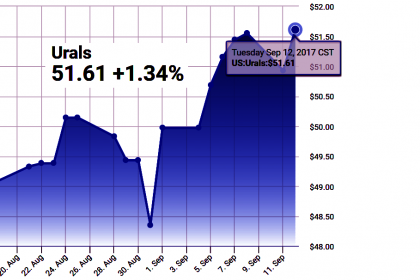

2017, September, 13, 15:25:00

OIL PRICE: NOT ABOVE $55

By 1021 GMT, international benchmark Brent crude LCOc1 was up 27 cents, or 0.5 percent, at $54.54 a barrel.

U.S. West Texas Intermediate (WTI) CLc1 was up 38 cents, or 0.8 percent, at $48.61 a barrel.

2017, September, 13, 15:20:00

OIL PRICES: $51 - $52, GAS PRICES: $3.05 - $3.29

EIA forecasts Brent spot prices to average $51/b in 2017 and $52/b in 2018.

Expected growth in natural gas exports and domestic natural gas consumption in 2018 contribute to the forecast Henry Hub natural gas spot price rising from an annual average of $3.05/MMBtu in 2017 to $3.29/MMBtu in 2018.

2017, September, 13, 15:15:00

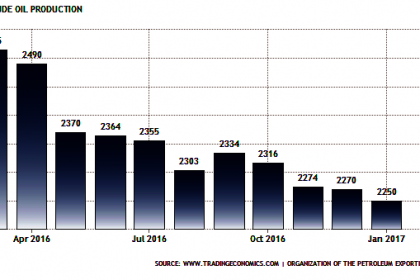

OPEC OIL PRICE UP 6% TO $49.6

The OPEC Reference Basket rose for the second-consecutive month in August to average $49.60/b, representing a gain of $2.67/b or 6%. Year-to-date, the Basket was 30.9% higher at $49.73/b. Crude futures prices also saw gains with ICE Brent increasing 5.5% to $51.87/b and NYMEX WTI up 3.0% at $48.06/b. Year-to-date, crude futures prices were more than 20% higher. During the week of 29 August money

managers cut WTI futures and options net long positions by 105,671 contracts to 147,303 lots, the US Commodity Futures Trading Commission (CFTC) said. Money managers slightly reduced Brent futures and options net length contracts by 1,296 to 416,551 lots during the same week.